Working Capital Advisors (UK) Ltd. Increases Stake in Funko Inc

On October 2, 2023, Working Capital Advisors (UK) Ltd. added 9,349 shares of Funko Inc (NASDAQ:FNKO) to its portfolio. The transaction saw the firm's total holdings in the company rise to 6,828,548 shares, representing a 0.14% change in shares. The shares were acquired at a price of $7.25 each, making the total value of the transaction approximately $67,780.25. This acquisition has increased the firm's position in Funko Inc to 34.83% of its portfolio and represents 13.18% of the company's total shares.

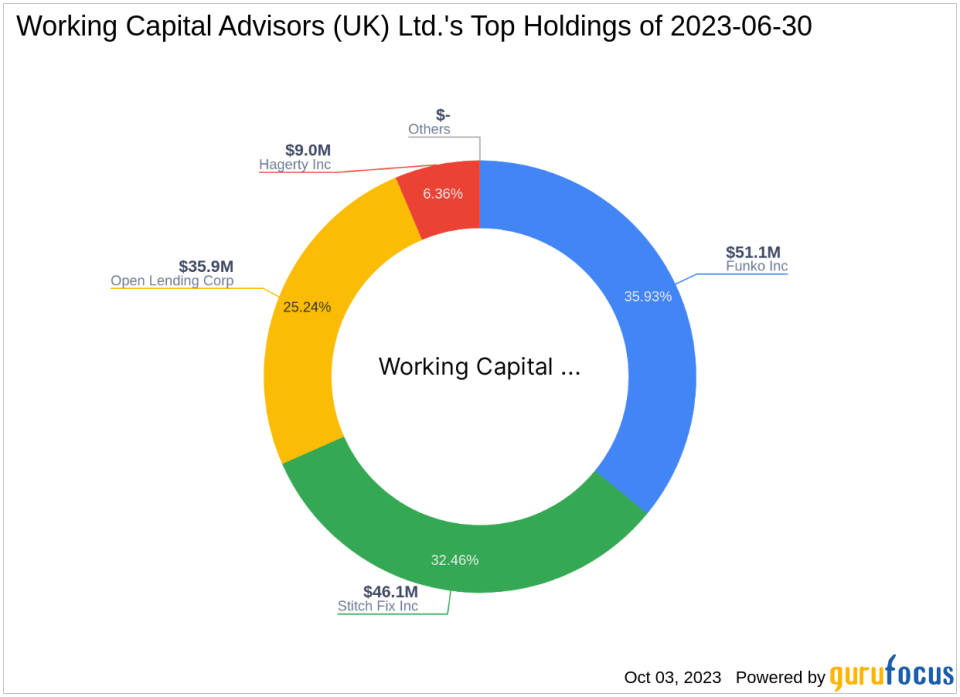

About Working Capital Advisors (UK) Ltd.

Working Capital Advisors (UK) Ltd. is a London-based investment firm. The firm's portfolio consists of four stocks, with a total equity of $142 million. Its top holdings include Funko Inc(NASDAQ:FNKO), Stitch Fix Inc(NASDAQ:SFIX), Open Lending Corp(NASDAQ:LPRO), and Hagerty Inc(NYSE:HGTY). The firm's investment philosophy is primarily focused on the Consumer Cyclical and Financial Services sectors.

Funko Inc: A Brief Overview

Funko Inc, a pop culture consumer products company based in the USA, creates unique and fun products that allow customers to express their affinity for their favorite movie, TV show, video game, musician, or sports team. The company holds licenses and rights to create tens of thousands of characters from popular franchises such as Game of Thrones, Walking Dead, Disney, Marvel, Harry Potter, Fallout, and others. Its products are sold through a diverse network of retail customers across multiple retail channels, including specialty retailers, mass-market retailers, and e-commerce sites. As of October 3, 2023, the company has a market capitalization of $376.594 million.

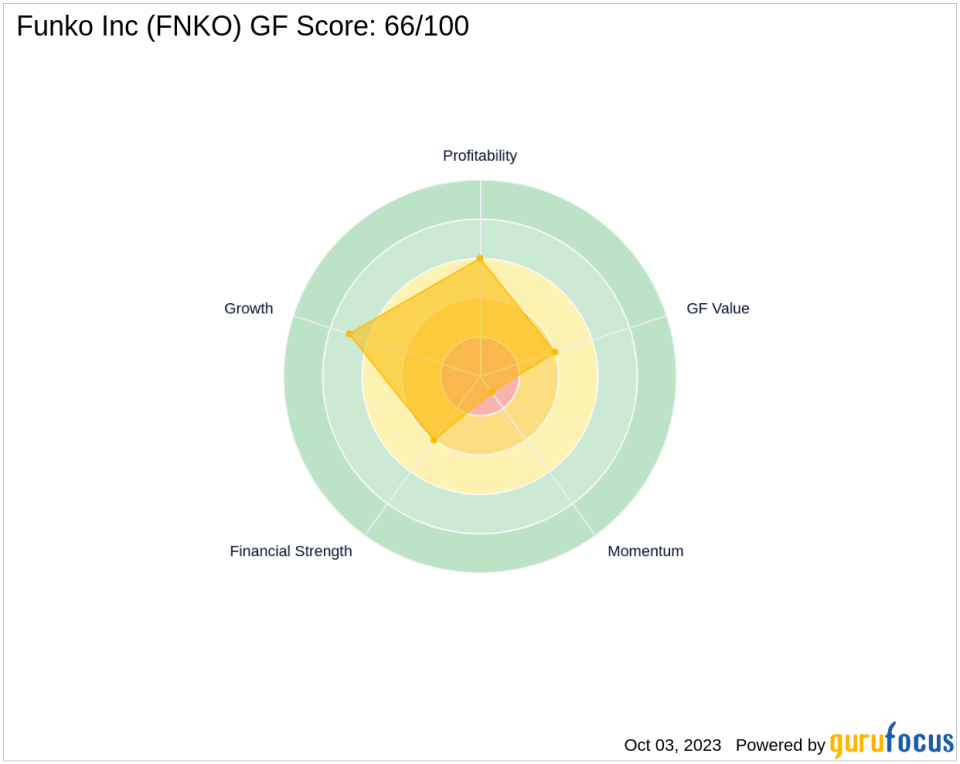

Financial Health and Performance of Funko Inc

Funko Inc's financial health and performance can be evaluated using various metrics. The company's balance sheet rank is 4/10, indicating a moderate level of financial stability. Its profitability rank is 6/10, suggesting a reasonable level of profitability. The company's growth rank is 7/10, indicating a good growth potential. However, its GF Value Rank is 4/10, suggesting that the stock may be overvalued. The company's momentum rank is 1/10, indicating a lack of momentum in the stock's price.

Growth and Momentum of Funko Inc

Funko Inc's growth and momentum can be evaluated using various metrics. The company's gross margin growth is -2.10%, and its operating margin growth is 0.00%. Its revenue growth over the past three years is 7.10%, and its EBITDA growth over the same period is -34.20%. The company's revenue growth rank over the past three years is 222. However, its predictability rank is not available, indicating a lack of consistent growth patterns.

Largest Guru Holding Funko Inc

The largest guru holding Funko Inc is Hotchkis & Wiley Capital Management LLC. However, the exact share percentage held by the firm is not available.

Conclusion

The recent acquisition by Working Capital Advisors (UK) Ltd. has increased its stake in Funko Inc, making it one of the firm's top holdings. This transaction could potentially influence the stock's performance and the firm's portfolio. However, investors should also consider the company's financial health, growth potential, and momentum before making investment decisions.

This article first appeared on GuruFocus.