Workiva's (NYSE:WK) Q4: Beats On Revenue But Full-Year Guidance Underwhelms

Financial and compliance reporting software company Workiva (NYSE:WK) announced better-than-expected results in Q4 FY2023, with revenue up 15.9% year on year to $166.7 million. The company expects next quarter's revenue to be around $174 million, in line with analysts' estimates. It made a non-GAAP profit of $0.30 per share, improving from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Workiva? Find out by accessing our full research report, it's free.

Workiva (WK) Q4 FY2023 Highlights:

Revenue: $166.7 million vs analyst estimates of $164.3 million (1.5% beat)

EPS (non-GAAP): $0.30 vs analyst estimates of $0.21 (40.3% beat)

Revenue Guidance for Q1 2024 is $174 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $720 million at the midpoint, missing analyst estimates by 1.5% and implying 14.3% growth (vs 17.2% in FY2023)

Free Cash Flow of $23.95 million, up 69.9% from the previous quarter

Net Revenue Retention Rate: 110%, in line with the previous quarter

Customers: 6,034, up from 5,945 in the previous quarter

Gross Margin (GAAP): 77.3%, up from 76.1% in the same quarter last year

Market Capitalization: $5.07 billion

"Workiva closed out the year with another solid quarter," said Workiva CEO Julie Iskow.

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Compliance Software

The demand for software platforms that automate compliances processes is rising as keeping up with the latest financial reporting regulations and standards is difficult and expensive, especially as companies increasingly operate across several geographical regions with varying rules.

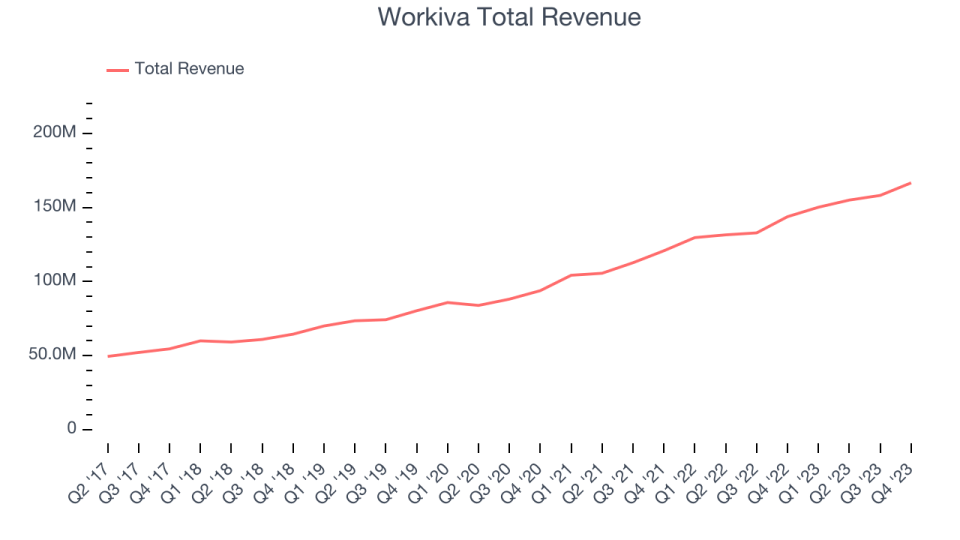

Sales Growth

As you can see below, Workiva's revenue growth has been solid over the last two years, growing from $120.8 million in Q4 FY2021 to $166.7 million this quarter.

This quarter, Workiva's quarterly revenue was once again up 15.9% year on year. We can see that Workiva's revenue increased by $8.48 million quarter on quarter, which is a solid improvement from the $3.15 million increase in Q3 2023. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that Workiva is expecting revenue to grow 15.9% year on year to $174 million, in line with the 15.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $720 million at the midpoint, growing 14.3% year on year compared to the 17.1% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

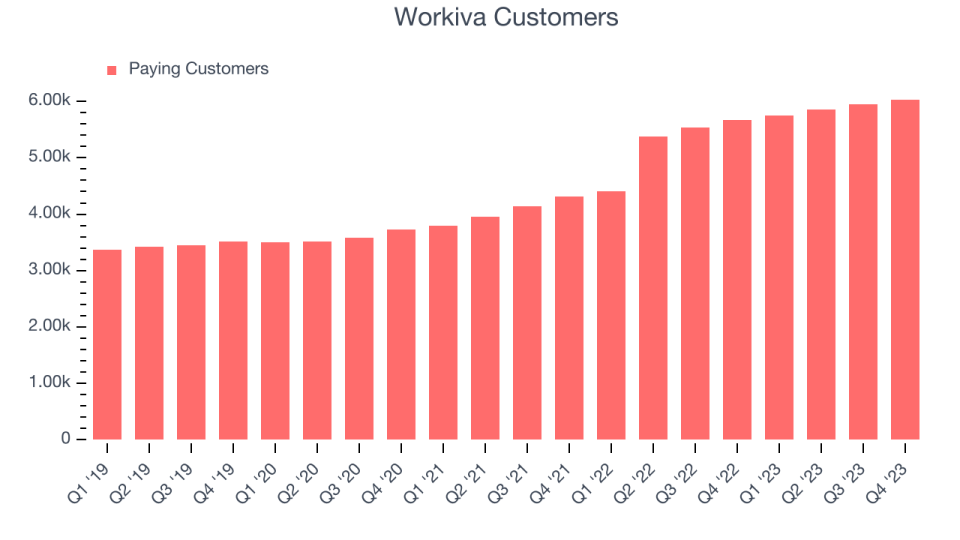

Customer Growth

Workiva reported 6,034 customers at the end of the quarter, an increase of 89 from the previous quarter. That's in line with the customer growth we've observed over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from Workiva's Q4 Results

It was great to see Workiva improve its gross margin this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its full-year revenue guidance was below expectations and its net revenue retention decreased. Overall, this was a mixed quarter for Workiva. The stock is flat after reporting and currently trades at $94.19 per share.

So should you invest in Workiva right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.