World Wrestling Entertainment Inc: A Strong Contender in the Media Industry with Good ...

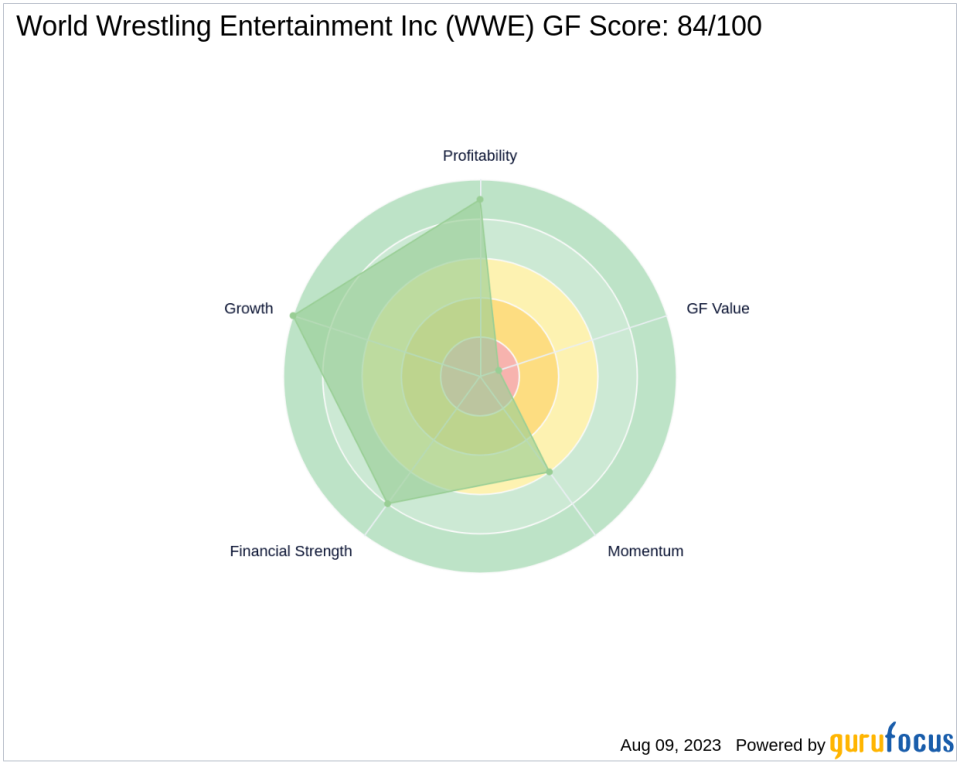

World Wrestling Entertainment Inc (NYSE:WWE) is a renowned name in the media industry, specializing in diversified entertainment. As of August 9, 2023, the company's stock price stands at $109.65, marking a 2.44% gain for the day and a 1.76% increase over the past four weeks. With a market capitalization of $9.17 billion, WWE's financial performance is impressive, as reflected in its GF Score of 84 out of 100, indicating good outperformance potential.

Financial Strength: A Solid Foundation

WWE's Financial Strength rank is 8 out of 10, demonstrating a robust financial situation. The company's interest coverage is 13.52, indicating its ability to cover its debt obligations. Furthermore, its debt to revenue ratio is 0.31, suggesting a manageable debt burden. The Altman Z score of 10.99 further confirms the company's financial stability.

Profitability Rank: Consistent and Promising

WWE's Profitability Rank is 9 out of 10, reflecting its consistent profitability. The company's Operating Margin is 19.58%, and its Piotroski F-Score is 6, indicating a healthy financial situation. The trend of the operating margin over the past five years averages at 21.10%, suggesting a steady profit margin. With nine profitable years over the past decade, WWE's profitability consistency is commendable.

Growth Rank: A Rising Star

With a perfect Growth Rank of 10 out of 10, WWE exhibits strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 7.40%, and its 3-year revenue growth rate is 11.20%. The 5-year EBITDA growth rate stands at an impressive 19.10%, indicating a promising growth trajectory.

GF Value Rank: A Cautionary Tale

Despite its strong financial performance and growth, WWE's GF Value Rank is 1 out of 10. This suggests that the stock may be overvalued, and investors should exercise caution when considering investment.

Momentum Rank: Steady Progress

WWE's Momentum Rank is 6 out of 10, indicating a steady performance. This suggests that the company's stock price has been relatively stable, providing a reliable investment option for those seeking steady returns.

Competitor Analysis: A Comparative Perspective

When compared to its competitors, WWE holds a strong position. Endeavor Group Holdings Inc (NYSE:EDR) has a GF Score of 33, Nexstar Media Group Inc (NASDAQ:NXST) scores 93, and iQIYI Inc (NASDAQ:IQ) has a GF Score of 72. This comparative analysis further highlights WWE's strong performance in the media industry.

Conclusion: A Strong Contender with Good Outperformance Potential

In conclusion, World Wrestling Entertainment Inc's strong financial strength, consistent profitability, and impressive growth make it a strong contender in the media industry. Despite its low GF Value Rank, the company's overall GF Score of 84 out of 100 suggests good outperformance potential. Investors should, however, exercise caution due to the stock's current valuation. As always, it is recommended to conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.