World Wrestling Entertainment Inc: A Strong Contender in the Media Industry with Good ...

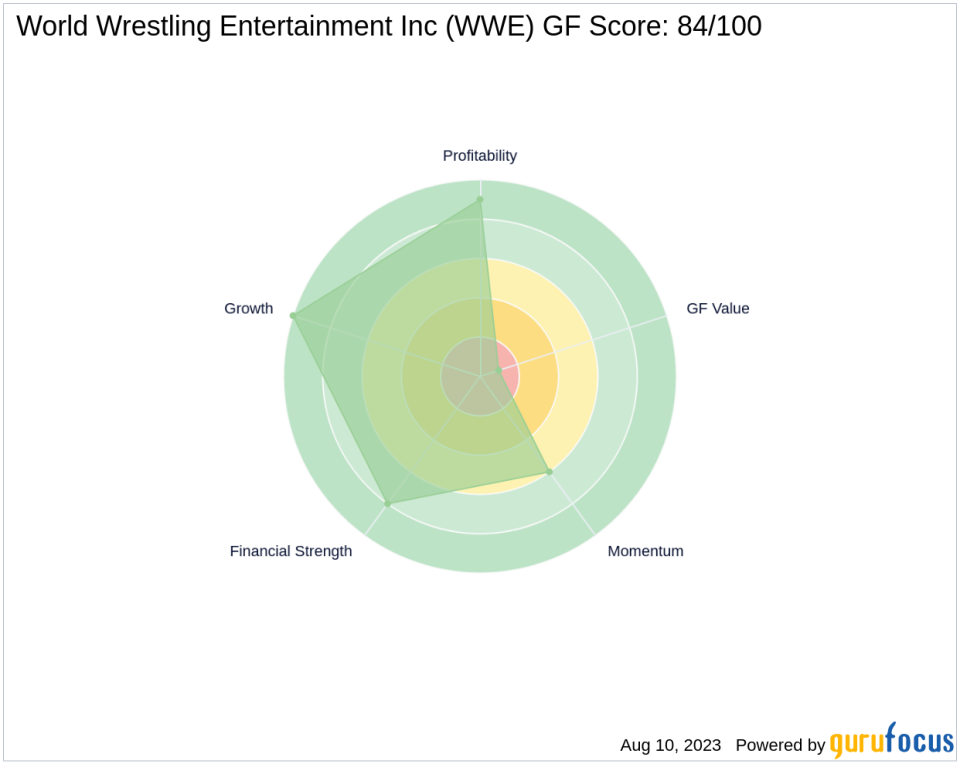

World Wrestling Entertainment Inc (NYSE:WWE) is a renowned name in the media industry, specializing in professional wrestling. The company has a market capitalization of $9.37 billion and a stock price of $112.72 as of August 10, 2023. The stock has seen a gain of 3.13% today and a 3.02% increase over the past four weeks. According to the GF Score, WWE has a score of 84 out of 100, indicating good outperformance potential.

Financial Strength Analysis

The Financial Strength of a company is a crucial factor in determining its long-term viability. WWE has a Financial Strength Rank of 8/10, indicating a robust financial situation. The company's interest coverage is 13.52, suggesting it can comfortably meet its interest obligations. The debt to revenue ratio is 0.31, which is relatively low, indicating a manageable debt burden. The Altman Z score is 10.99, further confirming the company's financial stability.

Profitability Rank Analysis

WWE's Profitability Rank is 9/10, indicating high profitability. The company's Operating Margin is 19.58%, and the Piotroski F-Score is 6, both of which are positive indicators of profitability. The trend of the Operating Margin over the past five years is 21.10%, suggesting consistent profitability. The company has been profitable for 9 out of the past 10 years, further confirming its strong profitability.

Growth Rank Analysis

The Growth Rank of WWE is 10/10, indicating strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 7.40%, and the 3-year revenue growth rate is 11.20%, both of which are impressive. The 5-year EBITDA growth rate is 19.10%, further confirming the company's strong growth.

GF Value Rank Analysis

The GF Value Rank of WWE is 1/10, suggesting that the stock is currently overvalued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

WWE's Momentum Rank is 6/10, indicating a moderate momentum in the stock's performance. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the same industry, WWE holds a strong position. Endeavor Group Holdings Inc (NYSE:EDR) has a GF Score of 33, Nexstar Media Group Inc (NASDAQ:NXST) has a GF Score of 93, and iQIYI Inc (NASDAQ:IQ) has a GF Score of 72. WWE's GF Score of 84 suggests that it has good outperformance potential compared to its competitors.

Conclusion

In conclusion, World Wrestling Entertainment Inc (NYSE:WWE) presents a promising investment opportunity with its strong financial strength, high profitability, robust growth, and good outperformance potential. However, investors should be cautious of the stock's current overvaluation. The company's future outlook based on its GF Score and ranks suggests potential for continued growth and profitability.

This article first appeared on GuruFocus.