Should You Be Worried When DSW Inc’s (NYSE:DSW) Insiders Sell?

DSW Inc., together with its subsidiaries, operates as a branded footwear and accessories retailer in the United States. DSW’s insiders have divested from 1.96k shares in the large-cap stock within the past three months. It is widely considered that insider selling stock in their own companies is potentially a bearish signal. The MIT Press (1998) published an article showing that stocks following insider selling underperformed the market by 2.7%. However, these signals may not be enough to gain conviction on whether to divest. I will be analysing whether these selling activities are supported by favourable future outlook and recent share price volatility.

View our latest analysis for DSW

Which Insiders Are Selling?

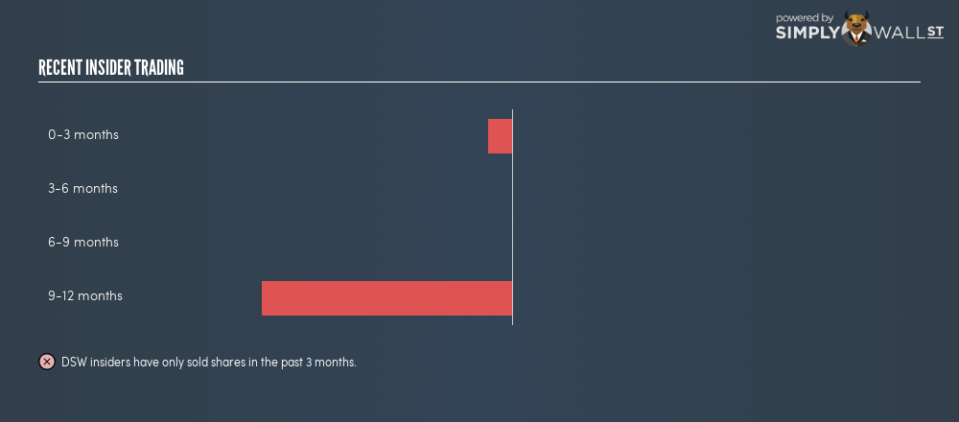

More shares have been sold than bought by DSW’s insiders in the past three months. In total, individual insiders own over 9.95 million shares in the business, which makes up around 12.4% of total shares outstanding. The insider that recently sold more shares is Jared Poff (management) .

Does Selling Activity Reflect Future Growth?

On the surface, analysts’ earnings growth projection of 109% over the next three years provides a fantastic outlook for the business. However, this is inconsistent with the signal company insiders are sending with their net selling activity. Digging deeper into the line items, DSW is expected to experience decline in top-line growth next year, which could imply some headwinds going forward. Although, expected high double-digit earnings growth could indicate the company’s cost controls will show meaningful results, offsetting the fall in revenue growth. Insiders may expect an inevitable decline in earnings growth given the strong short term outlook, and have divested based on a longer term outlook. Otherwise they may view, at the current share price, the stock has become overvalued relative to its intrinsic value.

Did Insiders Sell On Share Price Volatility?

Alternatively, the timing of these insider transactions may have been driven by share price volatility. This means, if insiders believe shares were heavily undervalued recently, this would provide a prime opportunity to buy more irrespective of its growth outlook. DSW’s shares ranged between $29.22 and $23.88 over the past three months. This indicates reasonable volatility with a change of 22.36%. Insiders’ purchases may not be driven by this movement but perhaps they may simply want to diversify their holdings, distribute stock to investors, or simply require the cash for personal reasons.

Next Steps:

DSW’s net selling activity tells us the stock has fallen out of favour with some insiders as of late, however, this is rather cautious relative to analysts’ earnings expectation, and the share price movement may be too trivial to cash in on any mispricing. But we must also be aware that insiders divesting may not actually be based their views on the company’s outlook. Furthermore, while insider transactions could be a helpful signal, it is definitely not sufficient on its own to make an investment decision. there are two essential factors you should further examine:

Financial Health: Does DSW have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Other High Quality Alternatives : Are there other high quality stocks you could be holding instead of DSW? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.