Should You Worry About The Air T Inc’s (NASDAQ:AIRT) Shareholder Register?

A look at the shareholders of Air T Inc (NASDAQ:AIRT) can tell us which group is most powerful. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said ‘Show me the incentive and I will show you the outcome.’

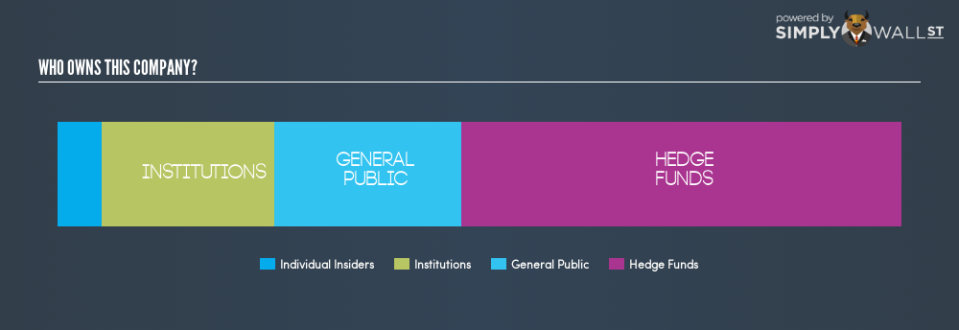

With a market capitalization of US$67.3m, Air T is a small cap stock, so it might not be well known by many institutional investors. Taking a look at the our data on the ownership groups (below), it’s seems that institutional investors have bought into the company. Let’s delve deeper into each type of owner, to discover more about AIRT.

Check out our latest analysis for Air T

What Does The Institutional Ownership Tell Us About Air T?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

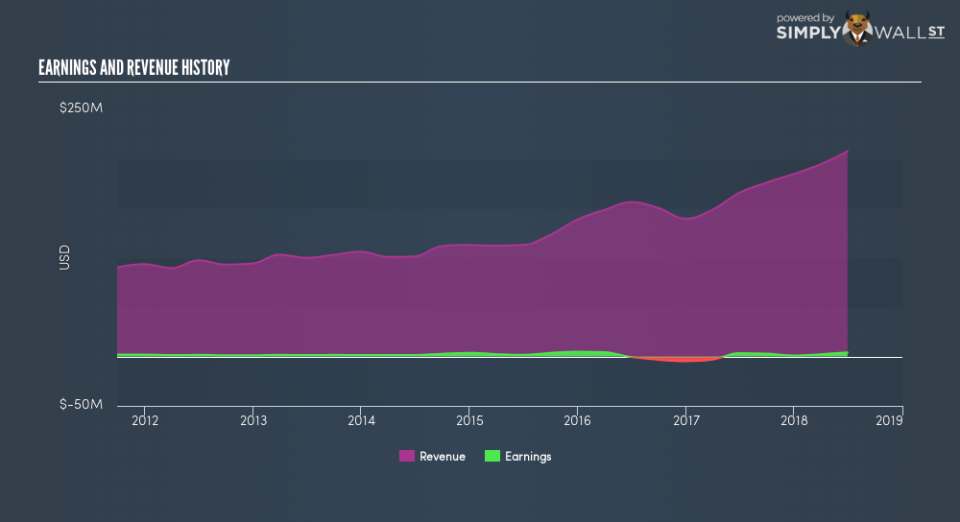

We can see that Air T does have institutional investors; and they hold 20.4% of the stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Air T, (below). Of course, keep in mind that there are other factors to consider, too.

It looks like hedge funds own 52.0% of Air T shares. That’s interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Air T

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Air T Inc. As individuals, the insiders collectively own US$3.6m worth of the US$67.3m company. This shows at least some alignment, but I usually like to see larger insider holdings. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public holds a 22.2% stake in AIRT. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.