Worthington Enterprises Inc (WOR) Reports Adjusted Earnings of $0.80 Per Share in Q3 Fiscal 2024

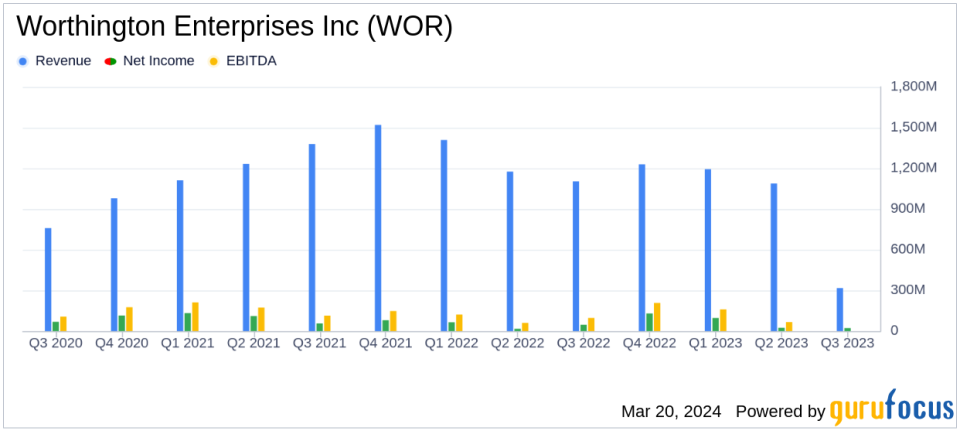

Net Sales: Decreased to $316.8 million in Q3 FY 2024 from $346.3 million in Q3 FY 2023.

Operating Income: Slight increase to $4.3 million in Q3 FY 2024 from $4.0 million in Q3 FY 2023.

Net Earnings from Continuing Operations: Dropped to $22.0 million in Q3 FY 2024 from $29.8 million in Q3 FY 2023.

Adjusted EPS from Continuing Operations: Reported at $0.80 in Q3 FY 2024, nearly steady compared to $0.81 in Q3 FY 2023.

Adjusted EBITDA: Decreased to $66.9 million in Q3 FY 2024 from $70.2 million in Q3 FY 2023.

Balance Sheet: Total debt reduced to $298.0 million, with cash reserves of $227.3 million as of Q3 FY 2024.

Dividend: Declared a quarterly dividend of $0.16 per common share payable on June 28, 2024.

On March 20, 2024, Worthington Enterprises Inc (NYSE:WOR) released its 8-K filing, detailing the financial results for the third quarter of fiscal year 2024. The company, a diversified metals manufacturing company, reported net sales of $316.8 million and net earnings from continuing operations of $22.0 million, or $0.44 per diluted share. This represents a decline from the previous year's net sales of $346.3 million and net earnings from continuing operations of $29.8 million, or $0.60 per diluted share.

However, on an adjusted basis, net earnings from continuing operations were $40.2 million, or $0.80 per diluted share, holding steady compared to the adjusted net earnings from continuing operations of $39.9 million, or $0.81 per share, in the prior year quarter. The company's performance was impacted by the final Separation costs and a one-time charge to income tax expense related to non-deductible transaction costs, as well as a non-cash charge to settle the unfunded benefit obligation of the company's last remaining pension plan.

Financial Performance and Challenges

Worthington Enterprises' third quarter was marked by a decrease in net sales, primarily due to unfavorable mix and slightly lower volumes within the Building Products segment. Despite these challenges, the company's Consumer Products business saw higher volume and margins, contributing to the stability of adjusted earnings. The Building Products and Sustainable Energy Solutions segments faced lower gross profit, which was partially offset by improvements within Consumer Products.

Net interest expense was significantly reduced due to higher interest income and lower average debt levels, following the redemption of the company's senior unsecured notes. Equity income increased, primarily due to higher contributions from WAVE, a joint venture. Income tax expense increased, driven by discrete tax adjustments primarily related to the Separation.

Segment Performance

Consumer Products generated net sales of $133.2 million, an increase over the prior year quarter, with adjusted EBITDA up to $25.6 million. Building Products saw a decrease in net sales and adjusted EBITDA, while Sustainable Energy Solutions experienced an increase in net sales but a loss in adjusted EBITDA.

Strategic Outlook and Dividend Announcement

President and CEO Andy Rose expressed confidence in the company's strategic positioning and balance sheet strength. He highlighted the company's business system of transformation, innovation, and acquisitions as key to future success. Additionally, the Board of Directors declared a quarterly dividend of $0.16 per common share, payable on June 28, 2024.

Worthington Enterprises' commitment to innovation and transformation is evident in its diverse product offerings and strategic initiatives. The company's ability to maintain steady adjusted earnings despite sales declines and various charges demonstrates resilience and operational efficiency. As the company moves into the fourth quarter, its strong balance sheet and strategic positioning are expected to support continued shareholder value creation.

For more detailed information on Worthington Enterprises Inc's financial performance, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Worthington Enterprises Inc for further details.

This article first appeared on GuruFocus.