Worthington (WOR) Expands Mexican Facility to Meet EV Demand

Worthington Industries, Inc. WOR, an industrial manufacturing company, has announced a substantial expansion of its Tempel Steel facility located in Apodaca, Mexico. Worthington's Steel Processing business segment operates this facility.

The expansion plan involves a comprehensive re-engineering of the existing production area at Tempel and new operations in an adjacent 185,000-square-foot facility. These strategic steps will significantly broaden Tempel's Focused Factory, specializing in producing highly advanced traction motor laminate cores designed for electric vehicles. The expanded production capacity is slated to commence operations in 2024, making Apodaca Tempel's largest production site for motor and transformer laminations catering to the electric vehicle market.

The acquisition of Tempel in 2021 marked a pivotal moment in establishing Worthington as a prominent leader in the rapidly expanding electrical steel market, which includes transformers, machine motors, and electric vehicle motors. The decision to expand the Apodaca facility is a clear testament to Worthington's dedication to this market and the exceptional workforce at Tempel.

This expansion will empower Tempel to harness the skills and knowledge of the Apodaca community, which includes over 500 members from the current Tempel Steel local workforce. As part of this growth initiative, Tempel anticipates creating up to 400 new positions within its Apodaca workforce over the next five years.

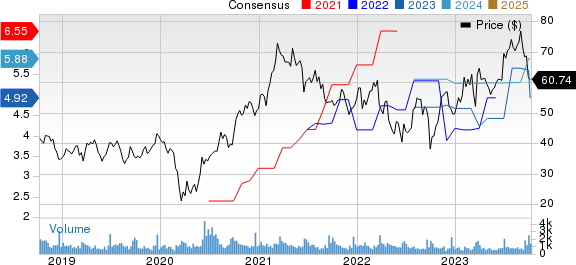

Worthington Industries, Inc. Price and Consensus

Worthington Industries, Inc. price-consensus-chart | Worthington Industries, Inc. Quote

Worthington reported adjusted earnings of $2.06 per share for the first quarter of fiscal 2024, surpassing the Zacks Consensus Estimate of $1.99. This is an improvement from payments of $1.61 per share in the year-ago quarter. However, its revenues for the quarter were roughly $1.19 billion, falling short of the Zacks Consensus Estimate by 11.81%. The top line fell 15% from revenues of around $1.41 billion in the corresponding quarter of the previous year, hurt by lower average selling prices in Steel Processing and reduced overall volumes.

Worthington’s shares have gained 43.8% in the past year against the industry’s rise of 17.9% in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Worthington currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are WestRock Company WRK sporting a Zacks Rank #1 (Strong Buy), and Air Products and Chemicals, Inc. APD and The Andersons Inc. ANDE, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Westrock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 15% in the past year.

The consensus estimate for Air Products’ current fiscal year earnings is pegged at $11.47, indicating year-over-year growth of 10.2%. APD beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 1.8%. The company’s shares have surged 21.3% in the past year.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 56.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report