Is WPX Energy's (NYSE:WPX) Share Price Gain Of 107% Well Earned?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the WPX Energy, Inc. (NYSE:WPX) share price is 107% higher than it was three years ago. How nice for those who held the stock! Also pleasing for shareholders was the 16% gain in the last three months. But this could be related to the strong market, which is up 14% in the last three months.

Check out our latest analysis for WPX Energy

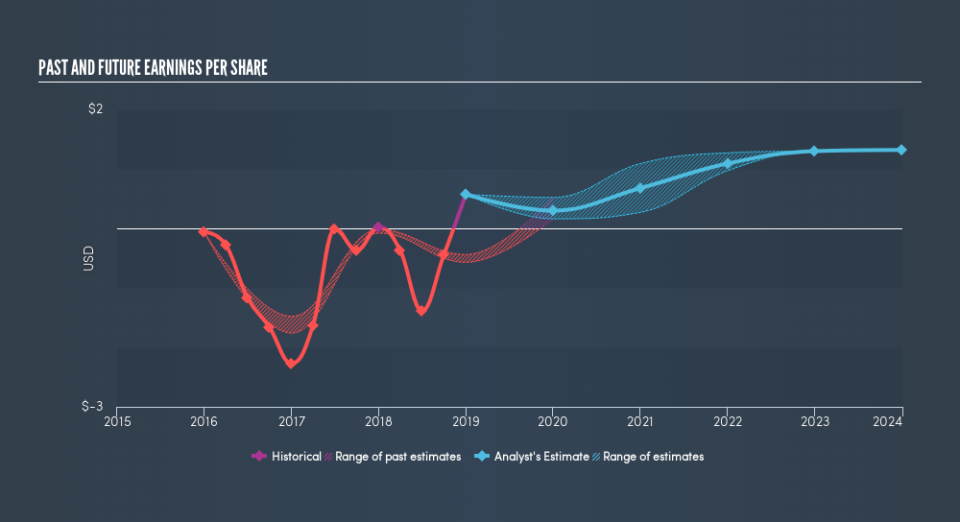

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, WPX Energy moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that WPX Energy has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on WPX Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in WPX Energy had a tough year, with a total loss of 3.6%, against a market gain of about 8.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 7.1% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: WPX Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.