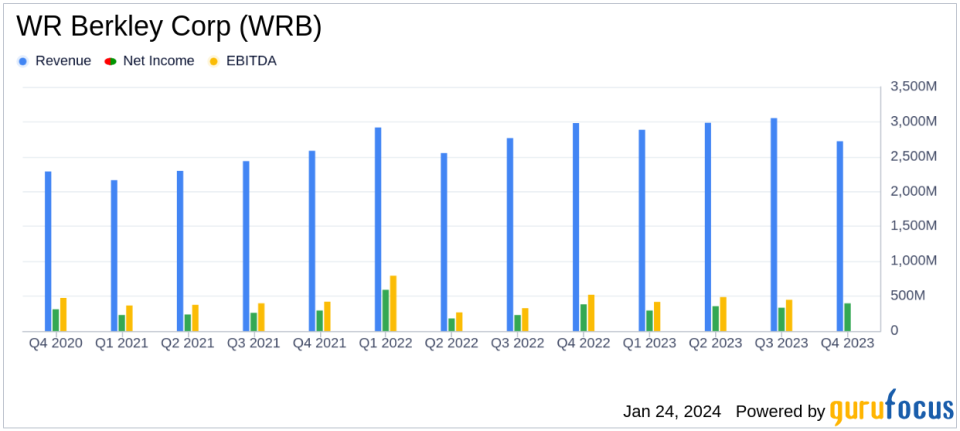

WR Berkley Corp Reports Record Underwriting and Investment Income for Q4 and Full Year 2023

Gross Premiums Written: Increased to $3.23 billion in Q4 and $12.97 billion for the full year.

Net Income: Reached $397.3 million in Q4 and $1.38 billion for the full year.

Operating Income: Grew to $391.8 million in Q4, with an annual total of $1.34 billion.

Return on Equity: Stood at 23.6% for Q4 and 20.5% for the full year.

Book Value Per Share: Increased by 11.6% in Q4, before dividends and share repurchases.

Net Investment Income: Hit a record $313.3 million in Q4, a 52.9% increase in the core portfolio.

Combined Ratio: Reported at 88.4% for Q4, including current accident year catastrophe losses.

On January 24, 2024, WR Berkley Corp (NYSE:WRB) released its 8-K filing, detailing a robust financial performance for both the fourth quarter and the full year of 2023. The insurance holding company, which specializes in commercial casualty insurance and operates worldwide, reported record quarterly and annual pre-tax underwriting income and net investment income, signaling a strong year despite the challenges faced by the industry.

Financial Performance and Challenges

WR Berkley Corp's performance in the fourth quarter was marked by a significant return on equity of 23.6% and an operating return on equity of 23.2%. The company's book value per share grew by 11.6% before dividends and share repurchases, reflecting a solid increase in shareholder equity. Net premiums written saw a growth of 12.0%, indicating a successful strategy in capital deployment. However, the company faced challenges, including the impact of current accident year catastrophe losses, which amounted to $32.0 million and contributed to a reported combined ratio of 88.4%. Despite these challenges, the company's decentralized structure and ability to navigate risks have positioned it well for future growth.

Financial Achievements

The insurance industry is characterized by its cyclical nature and the need for prudent risk management. WR Berkley Corp's record pre-tax underwriting income, which grew 8.2% to $315.9 million in the fourth quarter, and a record annual pre-tax underwriting income of $1.1 billion, underscore the company's effective underwriting discipline and operational efficiency. Additionally, the record net investment income, which increased by 35.1% to $1.1 billion for the year, reflects a well-managed investment portfolio that benefits from higher interest rates and contributes to the overall financial strength of the company.

Key Financial Metrics

WR Berkley Corp's income statement reveals a robust increase in net premiums earned, from $2.51 billion in Q4 2022 to $2.71 billion in Q4 2023, and from $9.56 billion in the full year 2022 to $10.40 billion in 2023. The balance sheet shows a solid financial position with net invested assets of $26.97 billion as of December 31, 2023, up from $24.55 billion the previous year. The company's cash flow from operations also increased to a record $2.93 billion for the year, indicating strong operational efficiency and financial health.

"Our Company completed another record-setting year in 2023, achieving a 23.6% annualized return on beginning equity in the fourth quarter. Our quarter and full year results were characterized by growth in net premiums written, along with record underwriting performance and net investment income," commented WR Berkley Corp.

Analysis of Company's Performance

The company's strategic focus on niche markets and its decentralized structure have allowed it to adapt quickly to changing market conditions and capitalize on growth opportunities. The increase in net premiums written and the company's disciplined underwriting approach have contributed to its strong performance. The substantial growth in net investment income is a testament to the company's effective asset management and the favorable interest rate environment. Looking ahead, WR Berkley Corp's management remains confident in delivering superior long-term risk-adjusted returns and increasing shareholder value.

WR Berkley Corp's solid financial results and strategic positioning bode well for its future prospects. Value investors and potential GuruFocus.com members interested in the insurance sector may find WR Berkley Corp's performance indicative of a company with strong fundamentals and a disciplined approach to growth and risk management.

Explore the complete 8-K earnings release (here) from WR Berkley Corp for further details.

This article first appeared on GuruFocus.