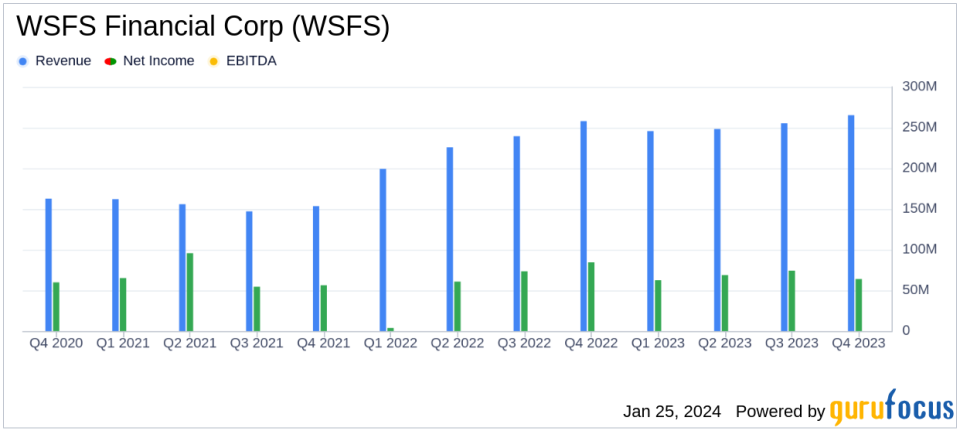

WSFS Financial Corp Reports Mixed Q4 Results Amidst Strong Deposit and Fee Revenue Growth

Net Interest Income: Q4 saw a decrease to $178.1 million from $193.9 million in the same quarter last year.

Fee Revenue: Increased to $87.2 million in Q4, marking a significant year-over-year growth from $64.9 million.

Net Income: Attributable to WSFS for Q4 was $63.9 million, down from $84.4 million in Q4 of the previous year.

Earnings Per Share (EPS): Diluted EPS for Q4 stood at $1.05, compared to $1.37 in the same period last year.

Return on Average Assets (ROA): Q4 ROA was 1.25%, a decrease from 1.69% in Q4 of the prior year.

Efficiency Ratio: Improved slightly to 55.6% in Q4 from 62.1% in the previous year.

Dividends and Share Repurchases: WSFS declared a quarterly cash dividend of $0.15 per share and repurchased 241,000 shares in Q4.

On January 25, 2024, WSFS Financial Corp (NASDAQ:WSFS) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. WSFS, a savings and loan holding company, operates through segments that include WSFS Bank, Cash Connect, and Wealth Management, offering a range of financial products and services.

WSFS reported a mixed set of financial results for the fourth quarter. While the company saw a strong growth in deposit and fee revenue, net interest income and net income attributable to WSFS showed a decline compared to the same quarter in the previous year. The company's earnings per share (EPS) and return on average assets (ROA) also decreased year-over-year.

Despite these challenges, the company's fee revenue as a percentage of total net revenue increased, and the efficiency ratio improved, indicating a more cost-effective operation compared to the previous year. These financial achievements are significant for WSFS and the banking industry, as they reflect the company's ability to grow its revenue streams and manage expenses effectively.

WSFS's performance in the fourth quarter is important as it demonstrates the company's resilience in a competitive banking environment. The challenges faced, such as the decrease in net interest income and net income, may lead to concerns about the company's interest income sensitivity and profitability in a changing economic landscape.

Financial Performance Analysis

The company's balance sheet showed an increase in gross loan and lease portfolio, driven by growth in commercial mortgage and consumer loans. Customer deposits also saw a significant increase, reflecting a strong deposit base. However, net interest income experienced a decrease, primarily due to rising deposit costs, which also led to a contraction in net interest margin.

Asset quality metrics remained stable, with a slight increase in nonperforming assets. The provision for credit losses rose, reflecting higher provision on certain loan portfolios. WSFS's capital ratios remained well above regulatory "well-capitalized" levels, indicating a strong capital position.

Rodger Levenson, Chairman, President, and CEO of WSFS, commented on the results: "Our fourth quarter operating results reflect the continued optimization of the significant franchise investments leveraging our unique competitive market positioning and diverse business mix. Core EPS of $1.15 and core ROA of 1.36% were driven by growth in deposits and loans as well as record core fee revenue."

The company's Wealth Management and Cash Connect segments showed robust performance, with increases in fee revenue and pre-tax income. WSFS's focus on expanding its fee-based businesses and managing expenses has contributed to its financial achievements.

In conclusion, WSFS Financial Corp's fourth quarter results present a picture of a company navigating a challenging interest rate environment while capitalizing on growth opportunities in its deposit and fee-based businesses. The company's strong capital management and strategic investments position it well for future growth.

For a detailed analysis of WSFS Financial Corp's financial results, including reconciliations of non-GAAP financial measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from WSFS Financial Corp for further details.

This article first appeared on GuruFocus.