Wyndham (NYSE:WH) Misses Q4 Revenue Estimates

Hotel franchising company Wyndham (NYSE:WH) fell short of analysts' expectations in Q4 FY2023, with revenue down 3.9% year on year to $321 million. It made a non-GAAP profit of $0.91 per share, improving from its profit of $0.72 per share in the same quarter last year.

Is now the time to buy Wyndham? Find out by accessing our full research report, it's free.

Wyndham (WH) Q4 FY2023 Highlights:

Revenue: $321 million vs analyst estimates of $323.8 million (0.9% miss)

EPS (non-GAAP): $0.91 vs analyst estimates of $0.90 (1.1% beat)

Gross Margin (GAAP): 61.4%, down from 95.2% in the same quarter last year

Market Capitalization: $6.40 billion

"We are tremendously proud to report fourth quarter results that demonstrate the continued success of our global strategy and our accelerating momentum," said Geoff Ballotti, president and chief executive officer.

Established in 1981, Wyndham (NYSE:WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

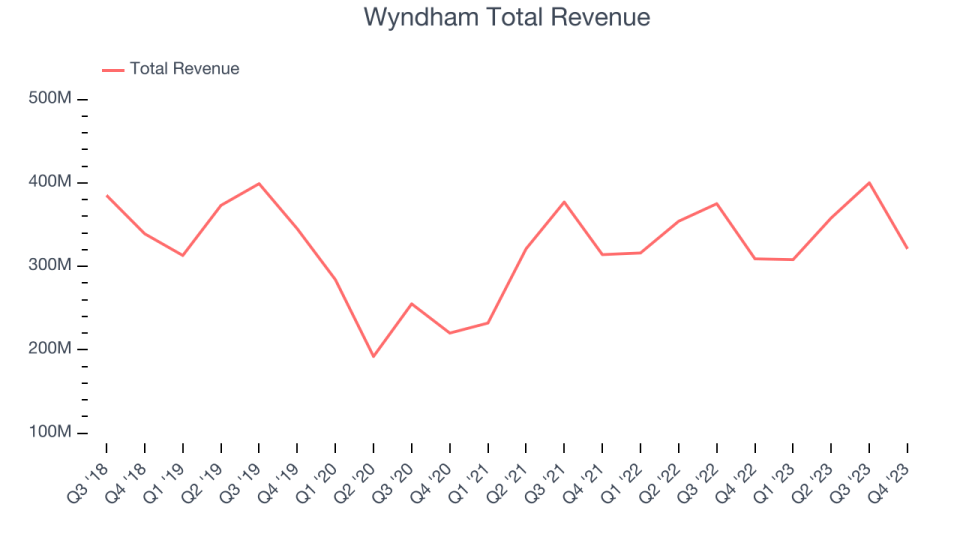

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Wyndham's revenue declined over the last five years, dropping 5.6% annually.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Wyndham's 2-year annualized revenue declines of 5.5% are in line with its five-year revenue declines, suggesting its demand is consistently shrinking.

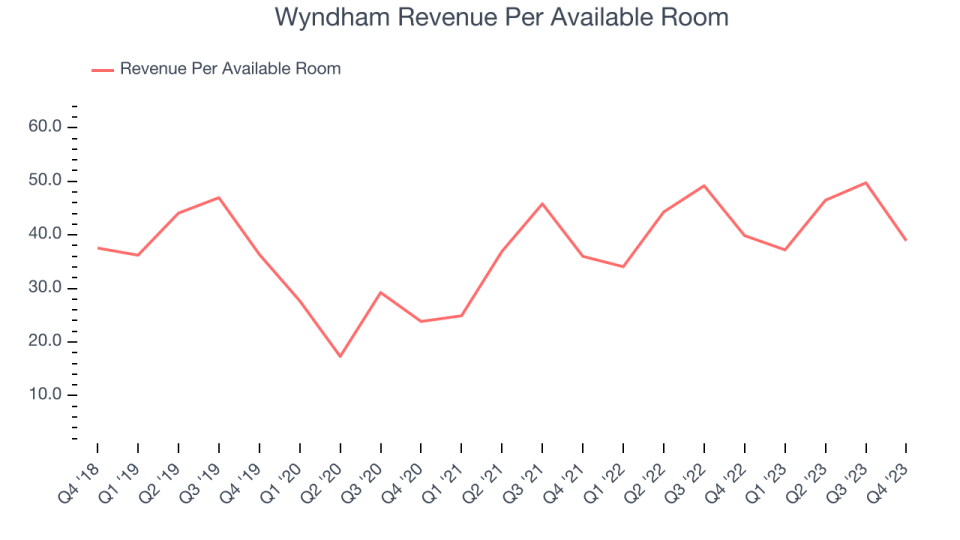

We can better understand the company's revenue dynamics by analyzing its revenue per available room, which clocked in at $38.90 this quarter and is a key metric accounting for average daily rates and occupancy levels. Over the last two years, Wyndham's revenue per room averaged 11% year-on-year growth. Because this number is higher than its revenue growth, we can see its room bookings outperformed its sales from other areas like restaurants, bars, and amenities.

This quarter, Wyndham missed Wall Street's estimates and reported a rather uninspiring 3.9% year-on-year revenue decline, generating $321 million of revenue. Looking ahead, Wall Street expects sales to grow 4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Wyndham has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 36.4%.

In Q4, Wyndham generated an operating profit margin of 32.4%, up 4.6 percentage points year on year.

Over the next 12 months, Wall Street expects Wyndham to become more profitable. Analysts are expecting the company’s LTM operating margin of 36% to rise to 38.1%.

Key Takeaways from Wyndham's Q4 Results

We struggled to find many strong positives in these results. Its revenue per room and operating margin missed analysts' expectations. In terms of full-year 2024 guidance, its EBITDA beat while its EPS fell short. Overall, this was a mediocre quarter for Wyndham. The stock is up 1.6% after reporting and currently trades at $79.43 per share.

So should you invest in Wyndham right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.