Xcel Brands (XELB) Stock Gains Despite Q3 Loss, Y/Y Revenue Dip

Xcel Brands Inc. XELB delivered the third-quarter 2023 results, with the bottom line improving year over year but lagging the Zacks Consensus Estimate. The company saw a year over year decline in revenues.

Despite the setback, Xcel Brands anticipates sequential growth in overall licensing revenues for fourth-quarter 2023 and beyond. The company’s recently inked agreements with G-III Apparel for the Halston Brand and JTV for the Judith Ripka Brand are expected to contribute positively. Shares of the company rose 3.1% in the after-market trading session on Nov 20.

Xcel Brands, Inc Price, Consensus and EPS Surprise

Xcel Brands, Inc price-consensus-eps-surprise-chart | Xcel Brands, Inc Quote

Important Developments

In November 2023, Xcel Brands completed its restructuring, finalizing licensing agreements for the Longaberger business. This transformation has turned Xcel Brands into a profitable, working capital-light company, with a strategic focus on high-touch licensing, livestream shopping and social commerce growth.

Xcel Brands is also set to launch its livestream and social commerce platform in the fourth quarter of 2023, presenting a promising opportunity for significant growth.

The company's adaptability to digital trends and consumer engagement signifies a forward-looking approach in the retail sector. Xcel Brands appears well-poised for continued success as it capitalizes on innovative strategies and remains responsive to evolving market dynamics.

Q3 in Detail

Xcel Brands posted an adjusted loss of 15 cents per share in the third quarter of 2023, narrower than the adjusted loss of 17 cents reported in the year-ago period. The metric was wider than the Zacks Consensus Estimate of an adjusted loss of 14 cents.

Net revenues of this Zacks Rank #4 (Sell) company slumped 42.2% year over year to $2.6 million. Notably, the Zacks Consensus Estimate was pegged at $3 million. This decline resulted from a $2.1-million reduction in net sales, attributed to the discontinuation of wholesale apparel and fine jewelry sales earlier in the year as a component of the company’s restructuring initiative.

Gross profit declined 20% year over year to $2.4 million. The gross margin expanded 2560 basis points (bps) to 92.3% from the prior-year period.

Selling, general and administrative expenses decreased 2.8% year over year to $3.5 million. As a percentage of net revenues, selling, general and administrative expenses expanded from 80% in the third quarter of 2022 to 134.6% in the third quarter of 2023.

The adjusted EBITDA loss was $1.4 million, narrower than the loss of $2.9 million in the year-ago period. This improvement is largely attributed to the successful restructuring of its business and the initiation of long-term license agreements for the Halston, Judith Ripka and C Wonder brands.

Image Source: Zacks Investment Research

Other Financial Updates

Xcel Brands concluded the quarter with cash and cash equivalents of $2.2 million, and stockholders' equity of $55.3 million.

Notably, there was no recorded short-term or long-term debt for the company as of Sep 30, indicating a favorable financial position, with positive equity and no outstanding debt obligations.

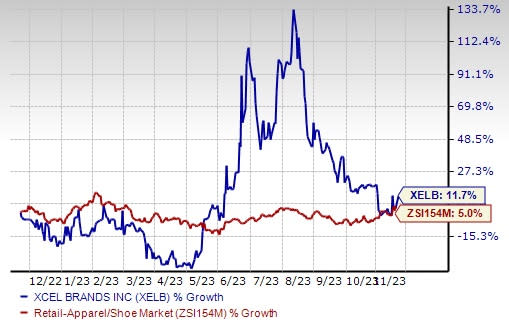

Shares of XELB have increased 11.7% in the past one year as compared to the industry’s 5% growth.

Stocks to Consider

A few better-ranked stocks in the same space are The Gap, Inc. GPS, Skechers U.S.A., Inc. SKX and Deckers Outdoor Corporation DECK.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company currently sports a Zacks Rank #1 (Strong Buy). GPS delivered a significant earnings surprise in the last reported quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings implies growth of 280% from the previous year’s reported number. GPS has a trailing four-quarter average earnings surprise of 137.9%.

Skechers U.S.A. designs, develops, markets and distributes footwear for men, women and children. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Skechers’ current financial-year earnings and sales indicates growth of 44.1% and 8.2%, respectively, from the previous year’s reported figures. SKX has a trailing four-quarter average earnings surprise of 50.3%.

Deckers Outdoor is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 20.9% and 11.3%, respectively, from the previous year’s reported figures. DECK has a trailing four-quarter average earnings surprise of 26.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Xcel Brands, Inc (XELB) : Free Stock Analysis Report