Xcel Energy (XEL) Gets Nod for Expanding Solar Energy Project

Xcel Energy Inc. XEL received approval from Minnesota officials for the expansion of a solar energy project under construction. The State Public Utilities Commission approved adding a 250-megawatt (MW) array to a 460-MW array, which is a part of the Sherco solar project. According to the company, the project will be completed by 2025.

Details of the Project

The new additions will require a fresh investment of $406 million, taking Xcel Energy’s total investment to over $1 billion. More than 150,000 houses will have access to the 710-MW project's yearly energy supply.

Once completed, the new power will replace the electricity produced by a coal-fired facility, which will be shut down later this year. By 2030, three coal-fired power units will be shut down by the company.

A proposal for Xcel Energy to purchase power from a projected 100-MW solar plant in northwest Wisconsin was also approved by the commission.

Focus on Emission Reduction

Xcel Energy aims to benefit from its investment to strengthen infrastructure and clean power generation. It is undertaking initiatives to produce and deliver clean energy to customers. In 2022, XEL received approval for both Minnesota and Colorado resource plans that will add nearly 10,000 MW of utility-scale renewables to the system and is expected to reduce carbon emissions by at least 80% by 2030. The addition of new clean energy projects will assist the company in achieving the net-zero emission target for 2050.

Xcel Energy aims to spend $29.5 billion during the 2023-2027 period. These investments are aimed to strengthen and expand the company’s transmission, distribution, electric generation and renewable projects.

Utilities Focus on Renewables

Utilities in the United States are gradually gaining strength from renewable sources of energy, with an increased focus on solar projects. Per the U.S. Energy Information Administration (EIA), sun and wind have been a dominant source of U.S. electricity generation in recent years. EIA expects an increase in utility-scale solar capacity of 26 gigawatt (GW) and 33 GW in 2023 and 2024, respectively. These would be the highest solar installations for any year on record.

According to Solar Energy Industries Association, the U.S. solar industry installed 5.6 GW-direct current of capacity in the second quarter of 2023, indicating a 20% increase from the year-ago quarter’s level.

Apart from Xcel Energy, other electric power utility companies like Dominion Energy Inc. D, Ameren Corp. AEE and Duke Energy Corp. DUK are also focused on enhancing their footprint in the U.S. solar market.

In August 2023, Dominion Energy unveiled a solar and energy storage project at the Dulles International Airport near Washington, DC, marking the largest renewable energy project ever developed at a U.S. airport. In partnership with the Metropolitan Washington Airports Authority (“MWAA”), D plans an 835-acre, 100-MW capacity solar energy on the southwestern edge of the airport, along with a 50-MW energy storage facility. The project will generate enough to power more than 37,000 Virginia households at its peak output.

D’s long-term (three to five years) earnings growth rate is 4%. It delivered an average earnings surprise of 4.3% in the last four quarters.

In June 2023, Ameren announced that its arm, Ameren Missouri, has planned to increase its renewable energy generation capability with 550 MW of solar projects. AEE aims to either acquire or construct four solar projects, which will be enough to power more than 95,000 average-sized residential homes.

AEE’s long-term earnings growth rate is 6.43%. It delivered an average earnings surprise of 8.9% in the last four quarters.

In March 2023, Duke Energy’s non-regulated commercial brand, Duke Energy Sustainable Solutions, announced that its 250-MW Pisgah Ridge Solar project in Texas attained commercial operations. This provided a boost to its Texas solar portfolio as it progresses toward its zero-carbon emission goal.

DUK’s long-term earnings growth rate is 6.09%. The Zacks Consensus Estimates for 2023 EPS indicates year-over-year growth of 6.5%.

Price Performance

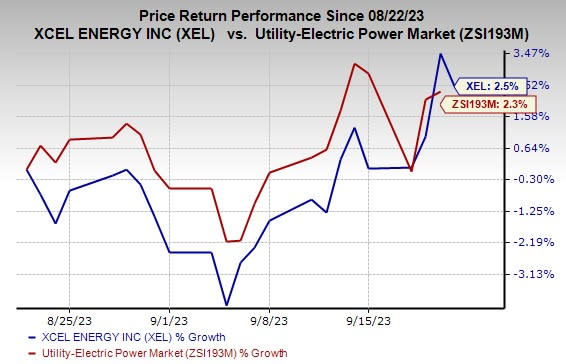

In the past month, shares of XEL have risen 2.5% compared with the industry’s 2.3% growth.

Image Source: Zacks Investment Research

Zacks Rank

Xcel Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report