Xerox Holdings Corp (XRX) Navigates Market Challenges with Strategic Focus

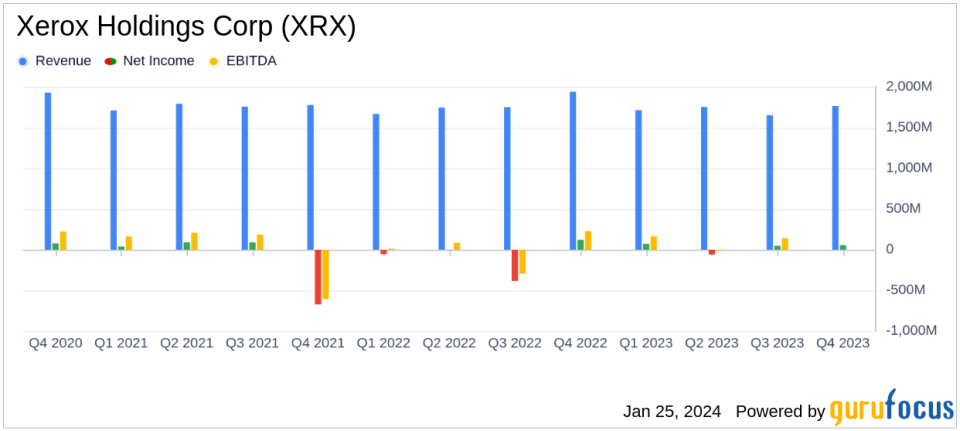

Revenue: FY 2023 revenue declined by 3.1% year-over-year to $6.89 billion.

Net Income: GAAP net income for FY 2023 stood at $1 million, a significant improvement from the previous year's net loss.

Adjusted Operating Margin: Increased by 170 basis points year-over-year to 5.6% for FY 2023.

Free Cash Flow: Demonstrated a robust increase, up $547 million year-over-year to $649 million for FY 2023.

Adjusted EPS: Grew to $1.82 per share in FY 2023, up from $1.12 per share in FY 2022.

2024 Guidance: Anticipates a revenue decline of 3% to 5% in constant currency, with a focus on improving adjusted operating margin and free cash flow.

On January 25, 2024, Xerox Holdings Corp (NASDAQ:XRX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. Despite a challenging year marked by a revenue decline, the company achieved significant growth in adjusted operating income and free cash flow, meeting its guidance for the year.

Xerox Holdings Corp, a leader in the printing technology and related solutions sector, operates primarily in one segment, focusing on large enterprise markets with a product range that includes multifunction printers (MFPs). The company garners 60% of its revenue from the U.S. and 40% internationally. Xerox also offers managed print services to enhance the efficiency of print and copy equipment usage. In a bid to diversify, Xerox is venturing into new markets such as digital print packaging solutions and printed electronics.

Financial Performance and Challenges

The company's revenue for the fourth quarter of 2023 was $1.77 billion, a decrease of 9.1% year-over-year, or 10.6% in constant currency. This decline was attributed to structural simplification efforts that impacted revenue but led to an expansion in adjusted operating margin by 170 basis points. The full-year revenue also saw a decrease of 3.1% to $6.89 billion. Despite the revenue challenges, Xerox's disciplined approach to cost management and operational efficiency resulted in a significant increase in free cash flow, which rose by $547 million to $649 million for the full year.

The GAAP net loss for Q4 2023 was $(58) million, or $(0.50) per share, which includes an after-tax restructuring and related costs, net charge of $78 million, or $0.62 per share, related to workforce reduction. However, for the full year, GAAP net income was $1 million, or $(0.09) per share, marking a substantial improvement from the prior year, primarily due to the absence of a goodwill impairment charge that affected 2022's results.

Strategic Focus and Outlook

CEO Steve Bandrowczak commented on the results, stating, "Last year, steps we took to structurally simplify our business impacted revenue but led to 170 basis points of adjusted operating margin expansion and laid the foundation for successful execution of our Reinvention." Looking ahead to 2024, Xerox is poised to stabilize and strengthen its core Print business, drive enterprise-wide efficiency, and capture opportunities in Digital and IT Services.

Last year, steps we took to structurally simplify our business impacted revenue but led to 170 basis points of adjusted operating margin expansion and laid the foundation for successful execution of our Reinvention.

The company's guidance for 2024 anticipates a revenue decline of 3% to 5% in constant currency, with an adjusted operating margin of at least 7.5% and free cash flow of at least $600 million. This guidance reflects expectations of stable Print demand, growth in Digital and IT Services, and neutral macroeconomic conditions.

Xerox's financial achievements in 2023, particularly the growth in adjusted operating income and free cash flow, underscore the company's resilience and strategic focus in a challenging market. These results are crucial for a technology company like Xerox, as they demonstrate the ability to adapt and maintain profitability amidst evolving industry dynamics.

Value investors and potential GuruFocus.com members may find Xerox's disciplined cost management and strategic initiatives promising, especially as the company continues to navigate market challenges with a clear focus on long-term growth and operational efficiency.

Explore the complete 8-K earnings release (here) from Xerox Holdings Corp for further details.

This article first appeared on GuruFocus.