Xerox's (XRX) Q1 Earnings Lag Estimates, Revenues Beat

Xerox Holdings Corporation XRX reported first-quarter 2020 earnings per share of 21 cents (on an adjusted basis) which miss the Zacks Consensus Estimate by 44 cents. Earnings declined year over year.

How Was the Estimate Revision Trend?

Investors should note that the Zacks Consensus Estimate for Xerox’s first-quarter 2020 earnings declined 34.3% over the past 30 days.

The company has an impressive earnings history having outperformed the Zacks Consensus Estimate in all of the last four quarters with an average beat of 16.2%.

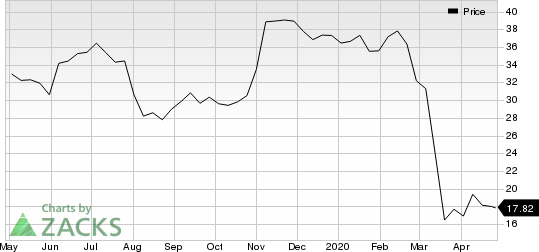

Xerox Corporation Price

Xerox Corporation price | Xerox Corporation Quote

Revenues higher Than Expected

Xerox recorded total revenues of $1,860 million which surpassed the Zacks Consensus Estimate of $1,754 million. However, revenues compared unfavorably with the year-ago figure.

Key Stats to Note: Operating cash flow of $173 million decreased $49 million year over year. Free cash flow of $150 million declined $57 million year over year.

Zacks Rank: Currently, Xerox has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Check back later for our full write up on this Xerox earnings report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xerox Corporation (XRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.