Old Xi Speech on China’s Monetary Tools Catches Trader Eyes

(Bloomberg) -- A line from a 172-page book citing President Xi Jinping’s comments on the nation’s monetary tools became a hot talking point among stock and bond traders Thursday.

Most Read from Bloomberg

London Insurers Face Baltimore Bridge Payouts Worth Billions

Biden Gains Ground Against Trump in Six Key States, Poll Shows

UBS Banker’s Frustration Exposes Cracks in World of Climate Finance

China should enrich its toolbox of monetary policies and the central bank should gradually increase the buying and selling of government bonds in its open-market operations, Xi was cited as saying in a book published this month. The snippet was taken from his speech — which was previously not fully released — during a twice-a-decade financial policy meeting in October.

The remarks, though vague and dated, were first highlighted in a South China Morning Post article which caught traders’ attention. A small group of market participants argued this may mean Beijing is considering quantitative easing, which involves a monetary authority buying a country’s government bonds, and that speculation helped to fuel gains in local stocks on Thursday.

However, most commentators said it wasn’t a green light for QE and focused their debate on whether the People’s Bank of China should go as far as buying bonds directly from the market. That’s a move that could boost the supply of cash in the financial system and support an economy challenged by weak demand and a property downturn, though not without consequences.

“More trades by the PBOC in the secondary bond market would add to rate market volatility given the PBOC’s huge trading sizes,” said Serena Zhou, economist at Mizuho Securities. “I’m not sure if this is what Xi suggested. I don’t think this is an implication of QE.”

For Morgan Stanley economists including Robin Xing, the comments were just about improving the open-market operations, a tool Beijing uses to smooth liquidity imbalances in the financial system. The standard approach among global central banks is increasing the use of government bond trading to control financial conditions, they wrote in a note Thursday.

“In fact, in the same speech, Beijing made hawkish comments that the deleveraging process requires a tighter grip on money and credit supply, which we believe indicates continued preference for austerity to prevent misallocations,” the economists said.

QE Opposition

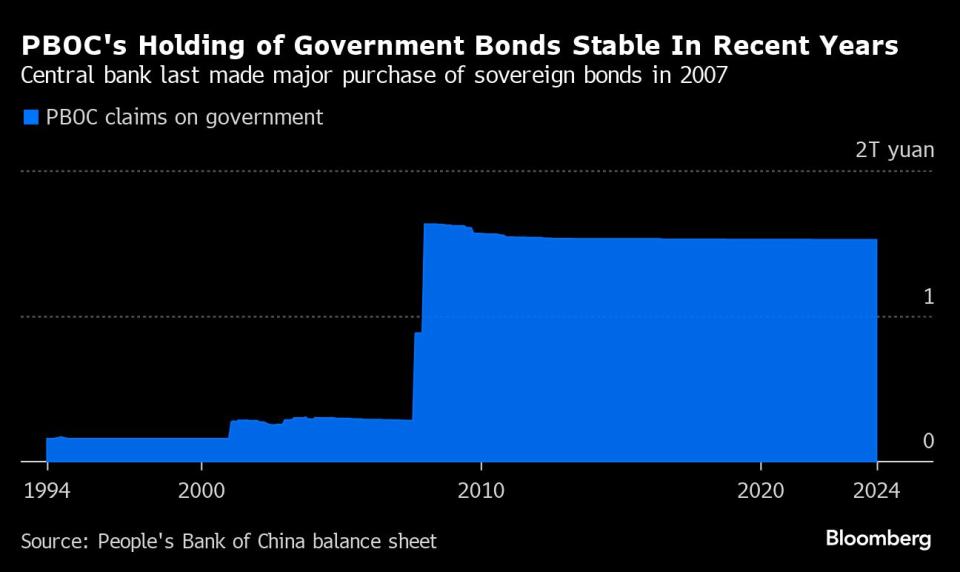

The People’s Bank of China has long opposed an aggressive stimulus policy and has pledged to keep a “normal” monetary stance for as long as possible. In recent history, Beijing has never used QE like its global peers such as Bank of Japan and Federal Reserve and its holding of sovereign bonds has been largely stable over the past decade.

On the same page in the book where PBOC bond trading was mentioned, Xi also said the nation needs to keep money supply in check, otherwise all efforts to reduce debt in the economy will be futile. He stressed that China should always maintain a prudent monetary policy.

Former Governor Yi Gang, whose tenure ended in July, said central banks should try their best to avoid asset purchases because in the long run they’ll “damage market functions, monetize fiscal deficits, harm central banks’ reputation, blur the boundary of monetary policy and create moral hazard.” His predecessor, Zhou Xiaochuan, warned in 2010 that QE in the US could spur negative effects for the world.

Stimulus Speculation

Despite the PBOC’s reluctance, speculation about additional monetary easing has climbed of late, with the nation planning to sell ultra-long special government bonds, starting with sales of 1 trillion yuan ($138 billion) this year.

On Thursday, the Hang Seng China Enterprises Index gained the most in two weeks, while a gauge tracking Chinese tech shares rose as much as 4.4%. The yield on China’s 10-year government bonds was little changed at 2.29%.

Chinese Stocks Gain as Report Spurs Policy Easing Speculation

Zhaopeng Xing, senior strategist at Australia & New Zealand Banking Group, said it was possible for the PBOC to buy sovereign notes and officials need to explore different forms of monetary stimulus.

“We expect the PBOC to try trading Chinese government bonds in open-market operations soon,” he said. “The PBOC lacks policy tools to drain excess liquidity. Selling government bonds will be a good option.”

(Updates throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.