XOMA Corp (XOMA) Reports Mixed Financial Results for Q4 and Full Year 2023

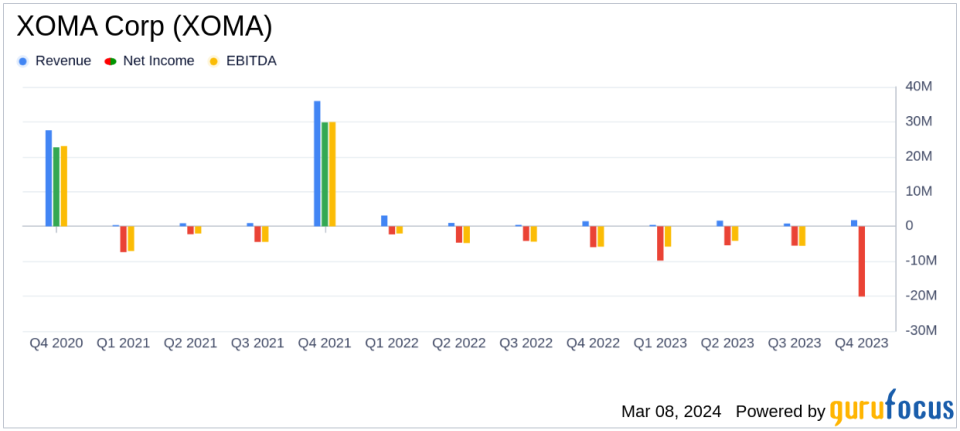

Revenue: XOMA recorded total revenues of $1.8 million for Q4 and $4.8 million for the full year of 2023.

Net Loss: The company reported a net loss of $20.1 million for Q4 and $40.8 million for the full year.

Cash Position: As of December 31, 2023, XOMA had cash and cash equivalents of $159.6 million.

Impairment Charges: XOMA recorded $15.8 million in impairment charges due to discontinued operations and terminated agreements.

Upcoming Events: Potential FDA action dates for tovorafenib and arimoclomol NDAs in 2024 could impact future revenues.

Stock Repurchase Program: XOMA announced a stock repurchase program of up to $50 million through January 2027.

Acquisitions: XOMA acquired economic interest in DSUVIA and announced the intention to acquire Kinnate Biopharma.

On March 8, 2024, XOMA Corp (NASDAQ:XOMA) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. XOMA, a biotechnology royalty aggregator, is known for acquiring future economic rights associated with pre-commercial therapeutic candidates, providing non-dilutive funding to biotech companies for their internal drug development or general corporate purposes.

Financial Performance and Challenges

XOMA's total revenues for the fourth quarter of 2023 were $1.8 million, with full-year revenues reaching $4.8 million. This represents a decrease from the $6.0 million reported in 2022, primarily due to lower milestone payments received from partners. The company's net loss widened significantly to $20.1 million for the fourth quarter and $40.8 million for the full year, compared to $6.0 million and $17.1 million, respectively, in the previous year. This increase in net loss was partly due to one-time arbitration settlement costs of $4.1 million and impairment charges totaling $15.8 million.

Despite these challenges, XOMA's financial achievements include raising up to $140 million through a royalty-backed loan related to VABYSMO sales and receiving $15.5 million in cash payments from royalties and milestone achievements in 2023. These achievements are crucial for XOMA as they provide the company with the necessary capital to fund operations and invest in new opportunities without diluting shareholder value.

Analysis of Financial Statements

General and administrative expenses for the full year of 2023 increased to $25.6 million from $23.2 million in the previous year, primarily due to a rise in stock-based compensation. XOMA's cash position is robust, with $159.6 million in cash and cash equivalents, including $6.3 million in restricted cash, as of December 31, 2023. This is a significant increase from the $57.8 million reported at the end of 2022.

The company's royalty interests generated cash payments of $7.3 million from Roche related to VABYSMO sales and $1.7 million from Medexus related to IXINITY sales. Additionally, XOMA received a $5.0 million milestone payment from Viracta related to the FDAs acceptance of Day One Pharmaceuticals NDA for tovorafenib.

"Over the course of 2023, we continued to build the foundation for future growth, spearheaded by the $140 million royalty-backed financing of VABYSMO in the fourth quarter," stated Owen Hughes, Chief Executive Officer of XOMA. "We entered 2024 with the strongest cash position in the Companys history, several key upcoming clinical and regulatory events, including the potential approvals of Day Ones tovorafenib and Zevra Therapeutics arimoclomol NDAs, and a growing pipeline of asset opportunities."

Looking Ahead

XOMA's outlook for 2024 includes several notable events that could drive shareholder value, such as the FDA action dates for tovorafenib and arimoclomol NDAs. The company's strategy of acquiring economic interests in commercial assets, like the recent acquisition of DSUVIA, and the intention to acquire Kinnate Biopharma, positions XOMA to potentially expand its revenue streams.

With a strong cash position and a focus on strategic acquisitions, XOMA is well-positioned to navigate the biotechnology industry's inherent risks and capitalize on upcoming opportunities. The company's management believes that the current cash reserves will be sufficient to fund operations for multiple years, providing a stable platform for future growth.

Investors and stakeholders will be closely monitoring XOMA's progress as it continues to leverage its unique business model in the dynamic biotech landscape.

Explore the complete 8-K earnings release (here) from XOMA Corp for further details.

This article first appeared on GuruFocus.