Xometry Inc CFO James Rallo Sells 4,404 Shares

James Rallo, the Chief Financial Officer of Xometry Inc (NASDAQ:XMTR), executed a sale of 4,404 shares in the company on January 3, 2024, according to a recent SEC Filing.

Xometry Inc operates as a technology company that offers an online marketplace for on-demand manufacturing. The platform connects customers with a network of manufacturing facilities, providing a range of services, including 3D printing, CNC machining, injection molding, and sheet metal fabrication. The company aims to provide buyers with instant pricing, expected lead times, and manufacturability feedback, while manufacturers benefit from the platform by gaining access to additional customers, streamlining their operations, and increasing capacity utilization.

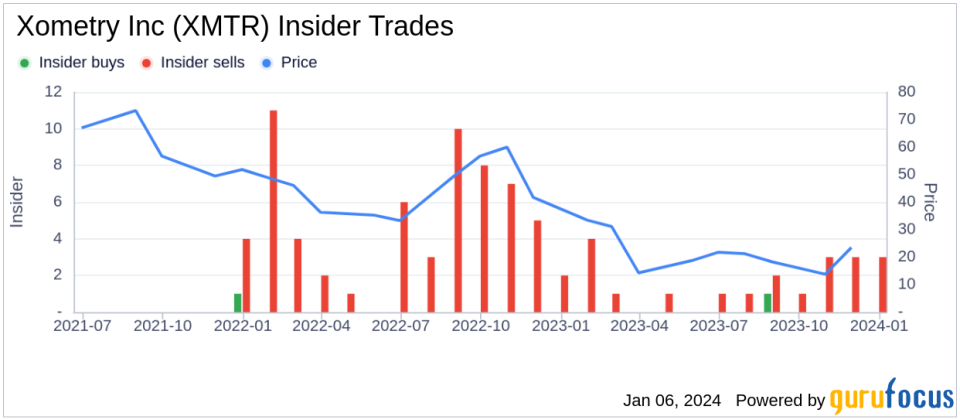

Over the past year, the insider has sold a total of 24,404 shares and has not made any purchases of the company's stock. The recent transaction by the insider was executed at a price of $33.76 per share, resulting in a total value of $148,646.24. Following this transaction, the market capitalization of Xometry Inc stands at $1.563 billion.

The insider transaction history at Xometry Inc over the past year indicates a trend of more insider selling than buying. There has been only 1 insider buy, contrasted with 20 insider sells during the same period.

Investors often monitor insider buying and selling as it can provide insights into a company's internal perspective. However, insider transactions are not necessarily indicative of future stock performance and may be influenced by various factors, including personal financial requirements or portfolio diversification strategies.

It is important for investors to consider the broader context and not rely solely on a single insider's transactions when making investment decisions. The information provided in this article is based on regulatory filings and does not constitute investment advice.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.