Xometry Inc (XMTR) Reports Strong Revenue Growth Amid Marketplace Expansion

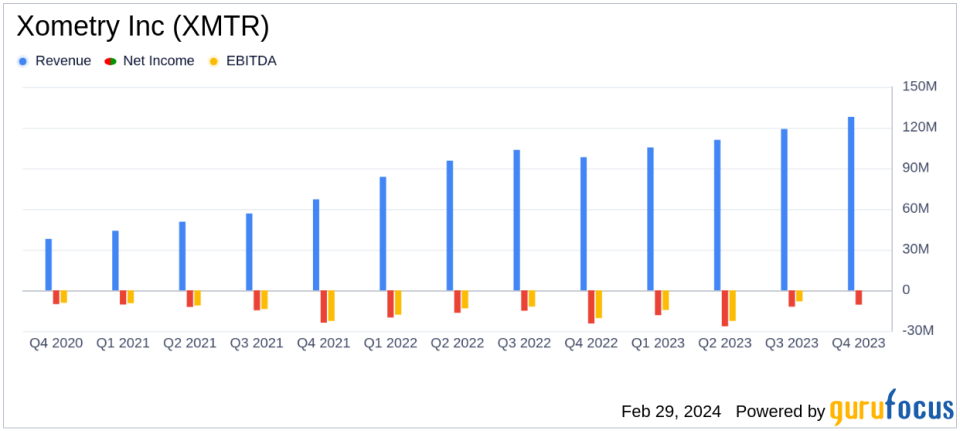

Revenue Growth: Q4 revenue surged by 31% year-over-year to $128 million, with full-year revenue up 22%.

Gross Profit Increase: Q4 gross profit rose by 39% year-over-year, driven by a significant 68% increase in marketplace gross profit.

Marketplace Expansion: Marketplace revenue for Q4 grew by 42% year-over-year, with active buyers increasing by 36%.

Net Loss Reduction: Q4 net loss to common stockholders decreased by $15.3 million year-over-year, showing a 59% improvement.

Adjusted EBITDA: Q4 Adjusted EBITDA loss improved by $12.8 million year-over-year, indicating better operating leverage.

On February 29, 2024, Xometry Inc (NASDAQ:XMTR), a leader in AI-enabled manufacturing equipment, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, which serves a diverse customer base including engineers, product designers, and procurement professionals, operates primarily in the U.S. but also has a growing international segment.

Financial Performance and Challenges

Xometry's Q4 revenue growth to $128 million, a 31% increase year-over-year, was primarily driven by a 42% increase in marketplace revenue, which reached $112 million. This growth reflects the company's successful expansion of its buyer and supplier networks, as well as its marketplace offerings. However, supplier services revenue saw a 15% decline, largely due to the strategic discontinuation of the sale of tools and materials, which impacted revenue by approximately $2 million year-over-year.

The company's gross profit also saw a notable increase, with Q4 gross profit up 39% year-over-year, and marketplace gross margin expanding by 500 basis points to 31.3%. Despite these achievements, Xometry faced a net loss attributable to common stockholders of $10.6 million for the quarter, though this was a significant improvement from the previous year's loss of $25.8 million. The net loss included $5.9 million of stock-based compensation and $2.8 million of depreciation and amortization expense.

Financial Achievements and Importance

Xometry's financial achievements, particularly the growth in marketplace revenue and the expansion of gross margins, are critical for the company's long-term profitability and market competitiveness. The increase in active buyers and accounts with significant spend underscores the platform's growing adoption and the value it provides to its users. These metrics are vital for Xometry as they indicate the company's ability to scale effectively while managing costs.

Income Statement and Balance Sheet Highlights

For the full year 2023, Xometry reported total revenue of $463 million, a 22% increase from the previous year. The marketplace segment was the primary growth driver, with revenue increasing by 30% to $395 million. The company's focus on operational efficiency and cost management resulted in a $17.3 million improvement in Adjusted EBITDA for the year. As of December 31, 2023, Xometry's cash, cash equivalents, and marketable securities stood at $268.8 million, providing a solid financial foundation for future growth initiatives.

Analysis and Outlook

Xometry's performance in Q4 and the full year 2023 reflects a company successfully executing on its growth strategy, despite facing challenges such as the discontinuation of certain services. The company's marketplace continues to gain traction, which is evident from the increase in active buyers and accounts with significant spend. Looking ahead, Xometry expects Q1 2024 revenue to grow by 12%-14% year-over-year and aims to achieve Adjusted EBITDA profitability in the third quarter of 2024. The company's growth initiatives for 2024 include expanding its buyer and supplier networks, driving deeper enterprise engagement, and growing internationally.

Xometry's appointment of James Miln as Chief Financial Officer is expected to further strengthen the company's focus on long-term growth and profitability. CEO Randy Altschuler commented on the results, stating, "Xometry's strong 31% revenue growth was driven by accelerated 42% marketplace growth. We improved operating leverage, reducing Q4 Adjusted EBITDA loss by 32% quarter-over-quarter. Powered by AI, our marketplace continues to gain significant market share as buyers and suppliers realize the value, convenience, and resiliency of our platform."

In Q4 2023, we delivered record financial results including our highest revenue and gross profit in Xometry history," said Randy Altschuler, Xometrys CEO.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Value investors and potential GuruFocus.com members interested in Xometry Inc (NASDAQ:XMTR) can find more in-depth analysis and up-to-date information on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Xometry Inc for further details.

This article first appeared on GuruFocus.