XPEL Inc (XPEL) Posts Strong Revenue and Net Income Growth in Q4 and Year-End 2023 Results

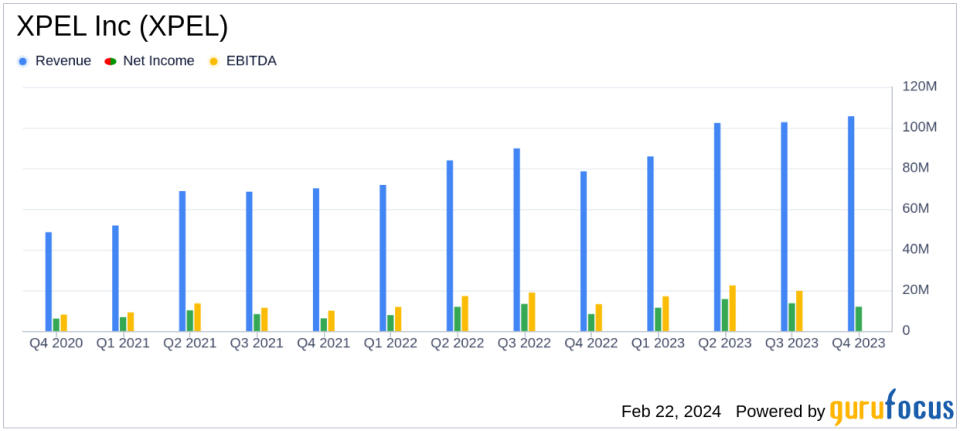

Revenue Growth: Q4 revenue surged by 34.5% YoY to $105.5 million; annual revenue up by 22.3% to $396.3 million.

Net Income: Q4 net income climbed by 43.2% YoY to $12.0 million; annual net income increased by 27.6% to $52.8 million.

Earnings Per Share (EPS): EPS for Q4 stood at $0.43, a significant increase from $0.30 in Q4 2022; annual EPS rose to $1.91 from $1.50.

EBITDA: Q4 EBITDA grew by 33.6% YoY to $17.7 million; annual EBITDA up by 25.6% to $76.9 million.

Geographical Expansion: Notable revenue growth in China (166.6%) and Middle East/Africa (100.4%) regions.

Product and Service Revenue: Product revenue increased by 35.8% YoY; service revenue up by 30.0% YoY.

On February 22, 2024, XPEL Inc (NASDAQ:XPEL), a global leader in protective films and coatings, released its 8-K filing, disclosing its financial results for the fourth quarter and the full year ended December 31, 2023. The company reported a significant increase in both quarterly and annual revenue and net income, reflecting strong demand across its product lines and strategic market expansions.

XPEL Inc is renowned for its automotive paint protection film, surface protection film, and window films, as well as ceramic coatings. With a network of trained installers and proprietary DAP software, XPEL is committed to exceeding customer expectations through superior products and services.

Financial Performance and Challenges

The company's performance in the fourth quarter was marked by a 34.5% increase in revenue to $105.5 million compared to the same period in 2022. Net income for the quarter rose by 43.2% to $12.0 million, or $0.43 per basic and diluted share. The year-end results were equally impressive, with a 22.3% increase in annual revenue to $396.3 million and a 27.6% rise in net income to $52.8 million, or $1.91 per basic and diluted share.

Despite these achievements, XPEL faced challenges, including a slight decline in gross margin percentage from 39.6% to 38.8% in the fourth quarter, primarily due to increased revenue from lower-margin regions like China and the Middle East/Africa. Additionally, operating expenses grew by 32.2% year-over-year, reflecting investments in personnel and infrastructure to support growth.

Key Financial Metrics and Importance

EBITDA, a critical measure of profitability, grew by 33.6% to $17.7 million in the fourth quarter, representing 16.7% of revenue. This growth signifies the company's ability to increase earnings while managing expenses effectively. The geographical revenue summary highlights the company's successful expansion, with the China region growing by 166.6% and representing 15.7% of total revenue. This expansion is crucial for diversifying the company's revenue streams and reducing reliance on any single market.

Product and service revenue also saw substantial growth, with total product revenue increasing by 35.8% year-over-year, driven by heightened demand for film products. Service revenue, which includes installation labor revenue, grew by 30.0% year-over-year, indicating the company's effective scaling of its service offerings.

"We are pleased with our full year 2023 performance and closed out the year with solid growth in the fourth quarter. We delivered strong performance across our end markets and product offerings driving improved profitability for the year," said Ryan Pape, President and Chief Executive Officer of XPEL.

The company's balance sheet remains robust, with a year-end cash and cash equivalents balance of $11.6 million. The total assets increased to $252.0 million as of December 31, 2023, from $193.4 million the previous year, indicating healthy growth and investment in the company's future.

Analysis of Company's Performance

XPEL's performance in 2023 underscores its resilience and adaptability in a dynamic market. The company's strategic focus on new car dealerships, improved market strategies in key regions, and the launch of its next-generation software platform, DAPNext, have contributed to its success. Looking ahead, XPEL anticipates approximately 15% annual revenue growth, reflecting confidence in its business model and market opportunities.

For investors, XPEL's strong financial results, coupled with its strategic initiatives, present a compelling case for the company's continued growth and market leadership in the protective films and coatings industry.

For more detailed information on XPEL's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from XPEL Inc for further details.

This article first appeared on GuruFocus.