XPO beats Q2 expectations, July volumes pop

Less-than-truckload carrier XPO beat analysts’ expectations for the second quarter and volumes saw a big move in July as one competitor shut down.

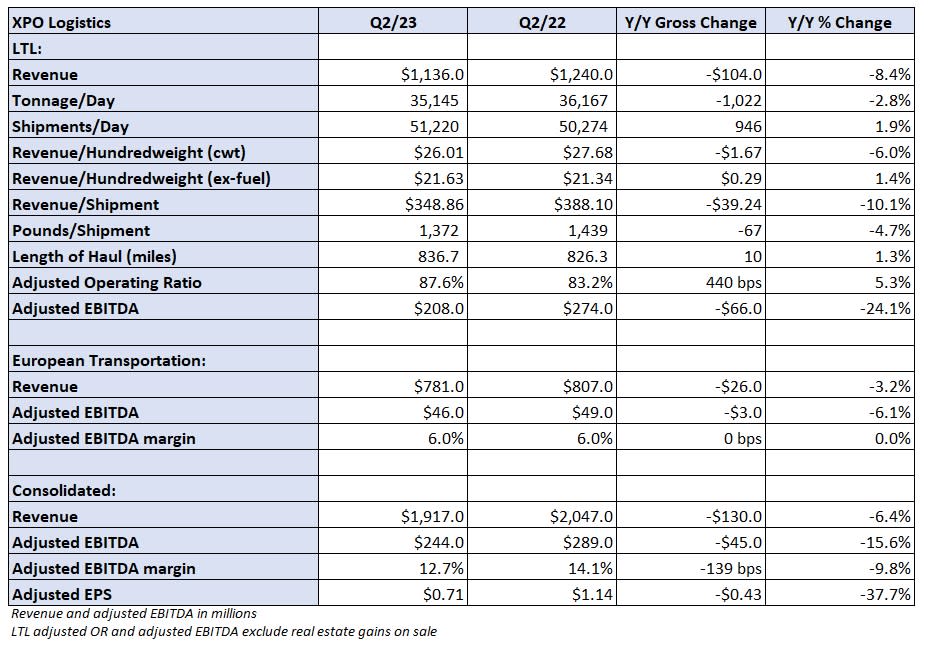

XPO (NYSE: XPO) reported second-quarter adjusted earnings per share of 71 cents, 10 cents better than the consensus estimate but 43 cents lower year over year (y/y). The result excluded transaction costs from the spinoff of a brokerage unit as well as restructuring costs.

Less-than-truckload revenue fell 8% y/y to $1.14 billion as tonnage per day was down 3%, which was partially offset by a 1% increase in yield (excluding fuel surcharges). The tonnage change was the result of a 2% increase in shipments offset by a 5% decline in weight per shipment.

Click for full report – “XPO to ramp up capacity to fill Yellow void”

The company did see a positive inflection in July as shippers began diverting freight from carrier Yellow Corp. (NASDAQ: YELL).

July shipments increased 9% y/y and tonnage was up 4%. Both were 700 basis-point swings from the change rates booked for all of the second quarter. Yield was up again in July.

The LTL adjusted operating ratio was 87.6%, 440 bps worse y/y but in line with management’s guidance — sequential improvement of 200 bps. (The unit posted an 89.6% adjusted OR in the first quarter).

“In North American LTL, we sequentially improved our adjusted operating ratio more than our forecast, and operated with greater labor efficiency,” said CEO Mario Harik. “Our shipments per day were higher than a year ago, driven by our quality of service, with yield growth getting stronger as the quarter progressed.”

Adjusted earnings before interest, taxes, depreciation and amortization of $208 million in the LTL segment was 24% lower y/y as fuel surcharges fell due to declining diesel prices (down approximately 30% y/y).

XPO’s European transportation segment recorded a 3% y/y revenue decline to $781 million and a 6% adjusted EBITDA margin, which was flat y/y.

The company will host a call with analysts to discuss results at 8:30 a.m. EDT.

Click for full report – “XPO to ramp up capacity to fill Yellow void”

More FreightWaves articles by Todd Maiden

The post XPO beats Q2 expectations, July volumes pop appeared first on FreightWaves.