XPO beats Q4 estimates

Less-than-truckload carrier XPO reported an earnings beat ahead of the market open on Wednesday.

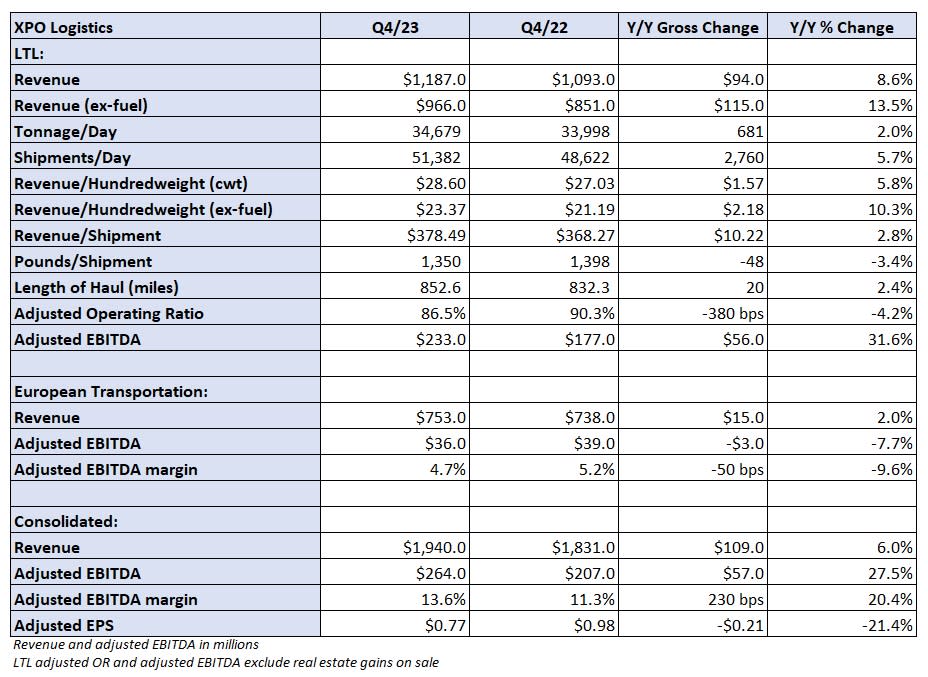

XPO (NYSE: XPO) reported fourth-quarter adjusted earnings per share of 77 cents, 15 cents better than the consensus estimate but 21 cents lower year over year (y/y). The adjusted number excludes transaction, litigation and restructuring costs.

Revenue in the LTL segment increased 9% y/y to $1.19 billion as tonnage per day was up 2% and revenue per hundredweight, or yield, increased 6% (10% higher excluding fuel surcharges). The tonnage increase was the combination of a 6% increase in shipments, partially offset by a 3% decline in weight per shipment. The lower shipment weights positively impacted yields.

Click for full report – “XPO’s shares jump 18% on big Q4”

A 270-basis-point reduction in purchased transportation expense as a percentage of revenue pushed the unit’s adjusted operating ratio to 86.5%, 380 bps better y/y. The OR was just 30 bps worse than the third-quarter result and better than management’s guidance, which called for roughly 210 bps of deterioration.

“We delivered fourth quarter results that were solidly above expectations, reflecting substantial momentum in service quality, pricing and productivity,” said XPO CEO Mario Harik in a news release.

XPO’s European transportation segment recorded a 2% y/y revenue increase to $753 million and an adjusted earnings before interest, taxes, depreciation and amortization margin of 4.7%, which was 50 bps lower y/y.

The company will host a call to discuss fourth-quarter results with analysts on Wednesday at 8:30 a.m. EST.

Click for full report – “XPO’s shares jump 18% on big Q4”

The post XPO beats Q4 estimates appeared first on FreightWaves.