XPO holds volume gains in August

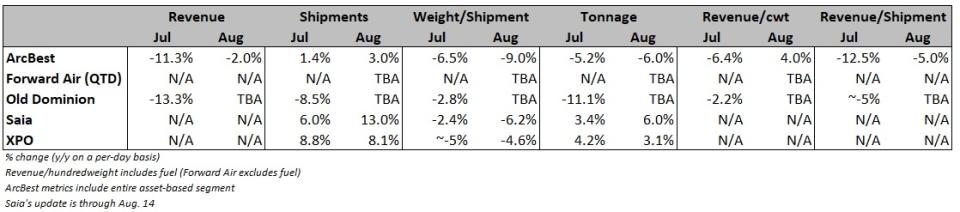

Less-than-truckload carrier XPO saw recent volume wins from Yellow’s departure stick in August. Tonnage was up 3.1% year over year (y/y) during the month following a 4.2% increase in July. The increases were the combination of high-single-digit growth in shipments partially offset by mid-single-digit declines in weight per shipment.

Most carriers have seen lighter shipment weights throughout the softer demand environment.

XPO (NYSE: XPO) has been taking market share within its local accounts, which are often smaller and more impacted by macroeconomic changes than its larger shippers. As the economy softens, the group tends to keep shipment counts level but fewer pallets get shipped in each load. However, on a two-year stacked comparison, XPO’s tonnage appeared to increase from July to August.

XPO’s tonnage was down nearly 3% y/y in the third quarter last year but improved as the quarter progressed, turning positive by September. The turnaround was tied to market share wins, notably in areas where the company had added or expanded terminals, as well as an increase to its sales force.

Every major carrier has seen shipments improve following the shutdown of Yellow Corp.

Saia (NASDAQ: SAIA) recently noted a 13% y/y jump in shipments in the first two weeks of August, and ArcBest (NASDAQ: ARCB) said shipments at its core accounts have improved roughly 20% since June (but were up just 3% in total during August).

Freight began fleeing Yellow’s network in mid-July when the company said it wouldn’t be able to make required benefits payments. Its union workforce threatened to strike and customers quickly sought other options for capacity.

XPO said on its second-quarter call a month ago that shipments per day increased between 3,000 and 4,000 (on a 50,000 per-day run rate) from the beginning to the end of July. It appears the new daily run rate held steady through August.

Even with the increase in volumes, the carrier noted an improvement in its damage claims ratio in the first two months of the third quarter when compared to the second quarter.

XPO does not provide yield metrics in its intraquarter updates. It guided to a 3% y/y increase in yields (excluding fuel) on its second-quarter call.

The company continues to add capacity to the network.

XPO also announced Tuesday the completion of an expansion project that added 58 new doors to a terminal near Dallas. The project is part of a two-year growth plan that will add 900 new doors on a net basis to its network by the first quarter of next year. It opened six new service centers last year and has expanded capacity at three other terminals so far this year.

On the second-quarter call, the company said that excess capacity in the network had been reduced to a midteen percentage, lower than a desired level of roughly 20% prior to Yellow’s exit. At the time, it said it may need to add terminals and equipment to meet the increased need but that any new freight it onboarded would have to be accretive to margins.

Most growth-oriented carriers are proactive, adding incremental infrastructure ahead of demand. XPO has completed roughly half of its growth plan.

More FreightWaves articles by Todd Maiden

The post XPO holds volume gains in August appeared first on FreightWaves.