XPO’s shares jump 18% on big Q4

XPO was “firing on all cylinders” during the fourth quarter. The better-than-expected report sent shares sharply higher on Wednesday.

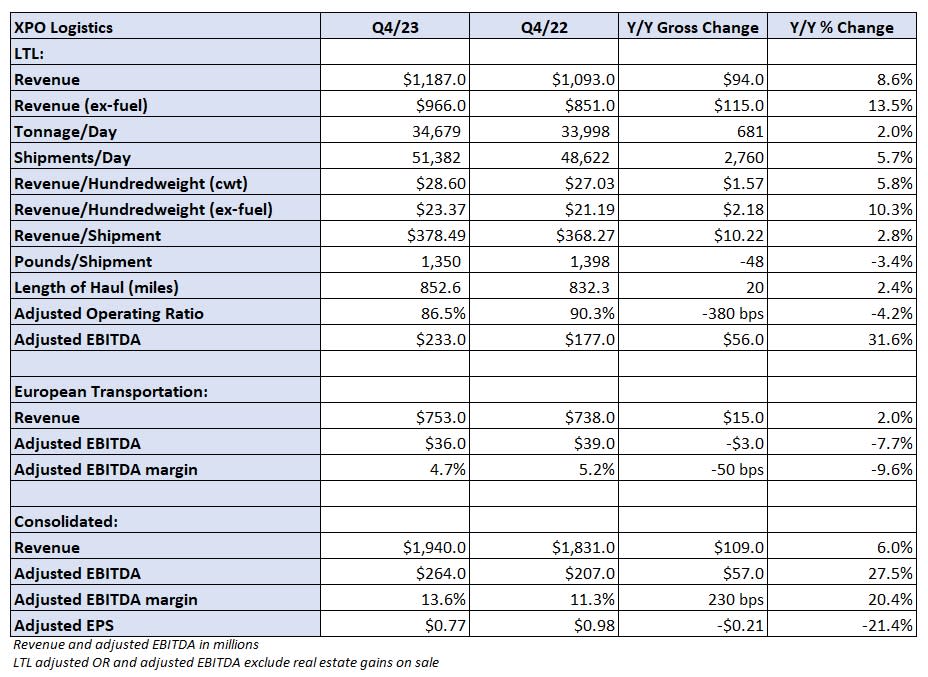

The less-than-truckload carrier reported fourth-quarter adjusted earnings per share of 77 cents, which was 15 cents better than the consensus estimate but 21 cents lower year over year (y/y). The adjusted number excluded transaction, litigation and restructuring costs.

XPO’s (NYSE: XPO) LTL segment reported a 9% y/y increase in revenue to $1.19 billion. Tonnage per day was up 2% and revenue per hundredweight, or yield, increased more than 10% excluding fuel surcharges. Looking forward to full-year 2024, management said it expects tonnage to continue to increase by a low-single-digit percentage, with yields growing by mid- to high-single digits, and possibly higher.

Indications from XPO’s customers suggest demand will be flat to up in the first half of 2024, with “even more optimism for the back half,” CEO Mario Harik said on a Wednesday call with analysts. He also noted a robust pricing opportunity in front of them.

XPO believes it can increase pricing by a midteens percentage over time given the success of recent service improvements as well as future initiatives. The company reported a record-low claims ratio of 0.3% in the fourth quarter and said its on-time performance was 300 basis points better y/y. XPO had a claims ratio of 1.2% just two years ago.

Improved service is expected to produce 700 bps to 800 bps of the overall price improvement. An increase in accessorials and premium services revenue, from roughly 10% of total revenue currently to more than 15%, is expected to yield 500 bps of price improvement. Harik said the company is still in the “early innings” of a service overhaul.

XPO is also expanding its local sales channel, which serves small shippers with fewer shipments per week, but those shipments produce higher yields and margins. The sales force serving that market grew by 20% last year and will be 30% larger in total by the middle of the year. The effort is expected to account for 200 bps to 300 bps of the growth plan.

Shipment growth with local customers was 12% higher y/y during 2023.

During the fourth quarter, tonnage was up 2.5% y/y in October, down 0.5% in November and 3.6% higher in December. The growth in tonnage was the combination of a 6% increase in shipments partially offset by a 3% decline in weight per shipment. The lower shipment weights positively impacted yields.

Pricing on contract renewals was 9% higher y/y for a second straight quarter.

Tonnage in January was off 1.1% y/y with inclement weather being a detractor. However, tonnage and shipments increased from December to January by an undisclosed amount, outperforming normal seasonality.

The LTL segment recorded an 86.5% adjusted operating ratio, which was 380 bps better y/y. The OR was 30 bps worse than the third quarter but better than management’s guidance of roughly 210 bps of deterioration.

Purchased transportation expenses as a percentage of revenue were down 270 bps y/y. The company is now outsourcing less than 20% of its linehaul miles compared to roughly 25% two years ago. It plans to execute more linehaul miles internally going forward.

Also, head count was up just 1.7% y/y compared to a 5.7% increase in shipment counts.

The OR is expected to outperform the average change rate of 40 bps of deterioration from the fourth to the first quarter. For the full year, the OR is expected to improve 150 bps to 250 bps.

XPO recently acquired 28 terminals valued at $870 million from bankrupt Yellow’s estate. It’s a total of 3,000 new doors, roughly 1,000 of which will replace existing doors in XPO’s network.

Roughly half of the new sites won’t require hiring as they will be used for relocating existing operations into larger facilities. In other markets, XPO will be adding a second or third terminal. However, it plans to split head count in those areas initially, layering in incremental staff as needed over time.

Improved terminal efficiencies from the expansions are expected to outweigh incremental costs. The acquired locations are expected to have little impact on the unit’s OR this year even with higher depreciation and amortization expense. The sites are forecast to be accretive to EPS in 2025, offsetting a 45-cent drag from higher interest expense.

Management said recently opened service centers were accretive within 30 to 60 days.

XPO’s European transportation segment recorded a 2% y/y revenue increase to $753 million and an adjusted earnings before interest, taxes, depreciation and amortization margin of 4.7%, which was 50 bps lower y/y.

Shares of XPO were up 17.7% at 12:30 p.m. EST on Wednesday compared to the S&P 500, which was up 0.7%.

More FreightWaves articles by Todd Maiden

The post XPO’s shares jump 18% on big Q4 appeared first on FreightWaves.