Xponential Fitness Inc (XPOF) Reports Growth Amidst Increased Restructuring Costs

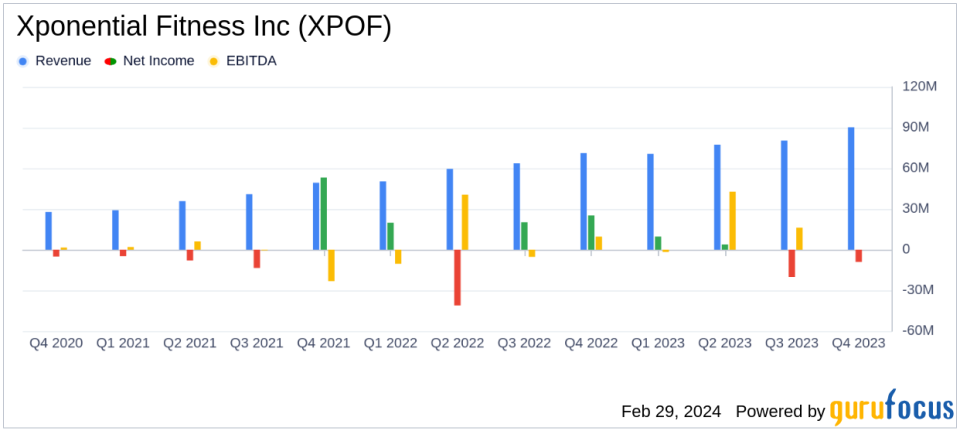

Revenue Growth: Q4 revenue increased by 27% to $90.2 million, and full-year revenue grew by 30% to $318.7 million.

Net Loss: Q4 net loss widened to $9.1 million from $0.4 million in the prior year, and full-year net loss totaled $1.7 million compared to a net income of $2.9 million in 2022.

Adjusted EBITDA: Q4 Adjusted EBITDA rose 38% to $30.7 million, and full-year Adjusted EBITDA increased by 42% to $105.3 million.

Same Store Sales: North America same store sales increased by 14% in Q4 and 16% for the full year.

Liquidity: As of December 31, 2023, XPOF had $37.1 million in cash and equivalents, with $328.5 million in long-term debt.

Xponential Fitness Inc (NYSE:XPOF), the largest global franchisor of boutique fitness brands, released its 8-K filing on February 29, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its diverse portfolio of fitness brands, has shown significant top-line growth, with revenue increases both quarterly and annually. However, this growth was offset by a widened net loss, primarily due to increased restructuring costs and impairment of goodwill and other assets.

Financial Performance and Challenges

For Q4 2023, XPOF reported a revenue increase to $90.2 million, up 27% from the previous year, driven by a 14% increase in North America same store sales. Despite this, the company faced a net loss of $9.1 million, a significant increase from a $0.4 million loss in the prior year. The loss was attributed to an $8.8 million rise in restructuring costs related to company-owned transition studios, a $6.6 million decrease in overall profitability, and a $4.9 million increase in impairment charges. However, these were partially offset by a $8.8 million decrease in non-cash contingent consideration and a $2.8 million reduction in non-cash equity-based compensation expense.

For the full year, XPOF's revenue climbed to $318.7 million, a 30% increase, with a corresponding 16% rise in North America same store sales. The net loss for the year was $1.7 million, compared to a net income of $2.9 million in 2022. The annual loss was impacted by similar factors as the quarterly loss, including a $15.5 million increase in restructuring costs and a $13.0 million rise in impairment charges, offset by a $20.4 million decrease in non-cash contingent consideration and an $11.0 million decrease in non-cash equity-based compensation expense.

Adjusted EBITDA and Net Income

Adjusted EBITDA for Q4 increased by 38% to $30.7 million, and for the full year, it rose by 42% to $105.3 million. Adjusted net income for Q4 was $4.2 million, or $0.05 per basic share, and for the full year, it was $15.7 million, or $0.17 per basic share. These figures exclude various non-cash and one-time items, providing a view of the company's operational performance.

Liquidity and Capital Resources

As of the end of 2023, XPOF had $37.1 million in cash and equivalents, with a total long-term debt of $328.5 million. Net cash provided by operating activities for the year was $35.4 million.

2024 Outlook

XPOF is optimistic about 2024, expecting to build on the momentum from 2023. However, the company has not provided a quantitative reconciliation of its full-year Adjusted EBITDA for 2024 due to the unpredictability of certain items.

Conclusion

While XPOF has demonstrated strong revenue growth and same store sales performance, the company's profitability has been challenged by increased restructuring costs and asset impairments. The company's focus on streamlining operations and leveraging its brand portfolio is expected to drive future margin expansion and operational cash flows. Investors should consider both the growth potential and the operational challenges faced by XPOF when evaluating the company's financial health and prospects.

For more detailed financial tables and a full reconciliation of GAAP to non-GAAP measures, please refer to the original 8-K filing.

Explore the complete 8-K earnings release (here) from Xponential Fitness Inc for further details.

This article first appeared on GuruFocus.