Xponential Fitness (NYSE:XPOF) Surprises With Q4 Sales

Boutique fitness studio franchisor Xponential Fitness (NYSE:XPOF) announced better-than-expected results in Q4 FY2023, with revenue up 26.6% year on year to $90.2 million. The company expects the full year's revenue to be around $345 million, in line with analysts' estimates. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.11 per share in the same quarter last year.

Is now the time to buy Xponential Fitness? Find out by accessing our full research report, it's free.

Xponential Fitness (XPOF) Q4 FY2023 Highlights:

Revenue: $90.2 million vs analyst estimates of $81.84 million (10.2% beat)

EPS (non-GAAP): $0.08 vs analyst estimates of $0.17 (-$0.09 miss)

Management's revenue guidance for the upcoming financial year 2024 is $345 million at the midpoint, in line with analyst expectations and implying 8.3% growth (vs 30.7% in FY2023)

Free Cash Flow was -$4.05 million, down from $5.83 million in the previous quarter

Gross Margin (GAAP): 76%, in line with the same quarter last year

Market Capitalization: $300.9 million

“In 2023, we experienced substantial growth on both the top and bottom lines as members continued to demonstrate that they prioritize their health and wellness routines. We further streamlined our business and are operating from a position of strength as we leverage our operations,” said Anthony Geisler, CEO of Xponential Fitness.

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE:XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

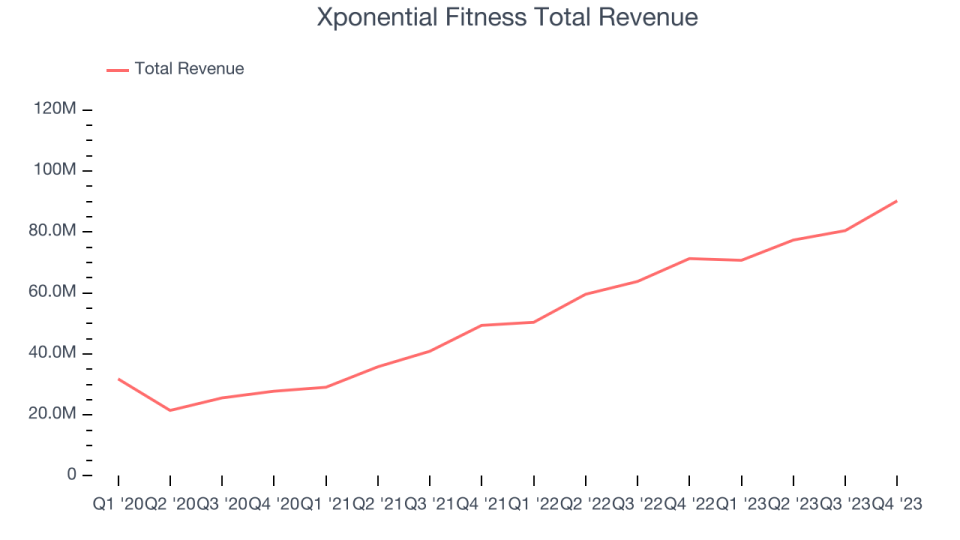

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Xponential Fitness's annualized revenue growth rate of 44.1% over the last three years was incredible for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Xponential Fitness's annualized revenue growth of 43.3% over the last two years aligns with its three-year revenue growth, suggesting the company's demand has been stable.

We can better understand the company's revenue dynamics by analyzing its most important segment, Franchise. Over the last two years, Xponential Fitness's Franchise revenue (royalty fees) averaged 41.3% year-on-year growth.

This quarter, Xponential Fitness reported remarkable year-on-year revenue growth of 26.6%, and its $90.2 million of revenue topped Wall Street estimates by 10.2%. Looking ahead, Wall Street expects sales to grow 8.9% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

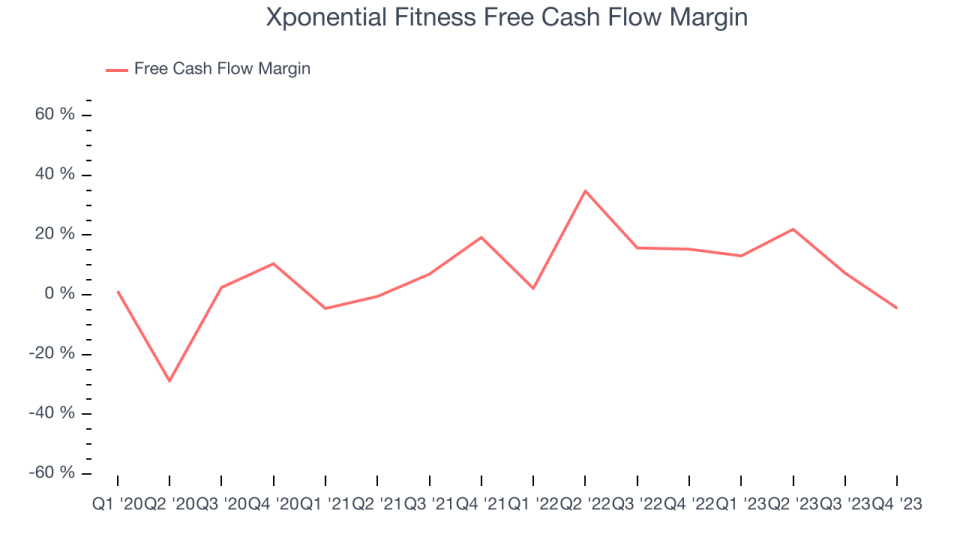

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Xponential Fitness has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 12.5%, slightly better than the broader consumer discretionary sector.

Xponential Fitness burned through $4.05 million of cash in Q4, equivalent to a negative 4.5% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter. Over the next year, analysts predict Xponential Fitness's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 8.8% will increase to 21.8%.

Key Takeaways from Xponential Fitness's Q4 Results

We were impressed by how significantly Xponential Fitness blew past analysts' revenue estimates this quarter, driven by better-than-expected equipment and merchandise sales to its franchisees. On the other hand, its operating margin and EPS fell short of Wall Street's projections as it produced less high-margin franchise revenue than expected.

Looking ahead, its full-year 2024 revenue guidance was in line with estimates while its EBITDA outlook of $138 million fell short. One weird aspect of the earnings was that the company didn't provide a reconciliation of its operating profit to EBITDA, making us skeptical.

Overall, this was a mediocre quarter for Xponential Fitness. The stock is up 1.2% after reporting and currently trades at $10.2 per share.

So should you invest in Xponential Fitness right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.