Xponential (XPOF) Enters Into a Partnership With KINRGY

Xponential Fitness, Inc. XPOF collaborated with KINRGY, a dance and fitness platform, for the debut of brick-and-mortar KINRGY studio locations.

Per the agreement, Xponential will acquire certain intellectual property of KINRGY along with the opportunity to rebrand three studio locations of its dance-cardio brand, AKT, and operate it as KINRGY Studios.

Xponential is optimistic about the new partnership with Julianne Hough’s KINRGY as it believes that by leveraging its platform and proven success in operating fitness studios, its team can create and deliver a top-tier in-studio experience.

Xponential’s Expansion Initiatives

Xponential is one of the largest global franchisors of boutique fitness brands and is witnessing robust demand for its brands outside of North America. The company’s growth durability is primarily backed by new studios opened by its franchisees, collaborations and other additional business in the existing locations.

As of Sep 30, 2023, Xponential operated about 2,980 studios globally with a total of 6,088 licenses sold across its 10 leading fitness brands. As of the third quarter of 2023, the company has franchise, master franchise and international expansion agreements in 23 countries globally. In the same quarter, the franchise revenues of the company grew 21% to $36.4 million year over year.

The company’s persistent expansion initiatives into new markets have reflected in 1,000 studios obligated to open under its master franchise agreements.

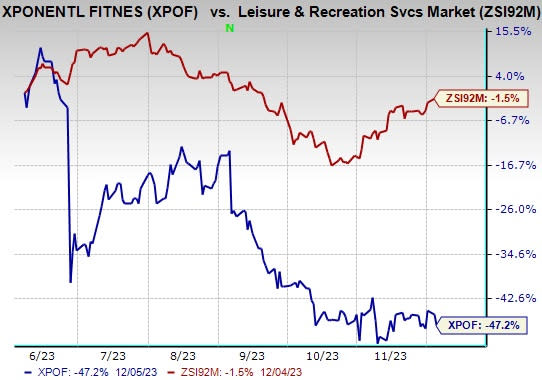

Image Source: Zacks Investment Research

Shares of XPOF have lost 47.2% in the past six months compared with the Zacks Leisure and Recreation Services industry’s 1.5% decline. Although the shares of the company have underperformed the industry, its accretive expansion strategies will help it gain traction in this high-cost environment in the upcoming period.

Zacks Rank & Key Picks

Xponential currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

It has a trailing four-quarter earnings surprise of 28.3%, on average. The stock has rallied 102.1% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates an improvement of 57.7% and 187.9%, respectively, from the year-ago period’s level.

Live Nation Entertainment, Inc. LYV currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 37.5%, on average. The stock has risen 14.4% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates growth of 28.6% and 132.8%, respectively, from the year-ago period’s level.

Grand Canyon Education, Inc. LOPE currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 9.9%, on average. The stock has risen 29.8% in the past year.

The Zacks Consensus Estimate for LOPE’s 2023 sales and EPS indicates an improvement of 7.1% and 17.1%, respectively, from the year-ago period’s level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE) : Free Stock Analysis Report

Xponential Fitness, Inc. (XPOF) : Free Stock Analysis Report