Xylem Inc (XYL) Reports Robust Revenue Growth and Solid Earnings in Full-Year 2023 Results

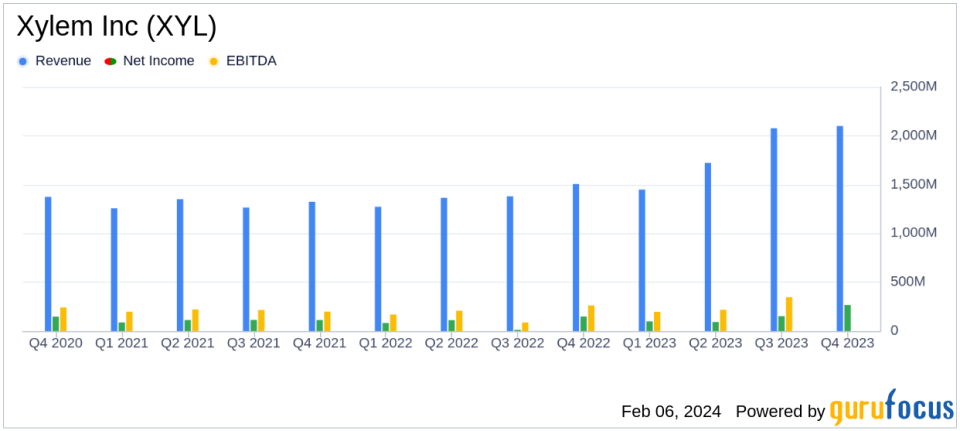

Revenue Growth: Xylem Inc (NYSE:XYL) reported a 33% increase in annual revenue, reaching $7.4 billion.

Earnings Per Share (EPS): Full-year EPS grew by 42% to $2.79, with adjusted EPS up 20% to $3.78.

Organic Growth: The company achieved a 12% organic growth in revenue for the full year.

Adjusted EBITDA Margin: Xylem saw a 90 basis point increase in adjusted EBITDA margin to 19.6% in Q4.

Dividend Increase: The Board declared a first-quarter dividend of $0.36 per share, marking a 9% increase.

2024 Outlook: Xylem provides 2024 revenue guidance of $8.4 to $8.5 billion, with 3% to 5% organic growth.

Free Cash Flow Conversion: The company expects a full-year free cash flow conversion to net income of approximately 115%.

On February 6, 2024, Xylem Inc (NYSE:XYL), a global leader in water technology, released its 8-K filing, announcing its fourth-quarter and full-year 2023 results. The company, known for its comprehensive solutions in the transport, treatment, testing, and efficient use of water, has reported a significant increase in revenue and earnings per share for the full year, surpassing its prior guidance.

Xylem's performance reflects robust demand across its business segments, with a notable 42% increase in full-year EPS to $2.79 and a 20% increase in adjusted EPS to $3.78. The company's revenue of $7.4 billion represents a 33% increase on a reported basis and a 12% organic growth, highlighting the company's strong execution and market demand. Xylem's adjusted EBITDA margin for the fourth quarter expanded by 90 basis points to 19.6%, driven by productivity savings, strong price realization, and higher volume.

Matthew Pine, Xylem's president and CEO, commented on the results:

The team delivered an outstanding fourth quarter, fueling momentum as we enter 2024,"

and further expressed confidence in the company's growth and margin expansion for the upcoming year. The integration of Evoqua is also progressing ahead of schedule, enhancing Xylem's offerings and customer solutions.

The company's net income for the fourth quarter stood at $266 million, or $1.10 per share, with a net income margin increase of 270 basis points to 12.6%. Adjusted net income was $239 million, or $0.99 per share, after excluding special charges and other costs. Xylem's Board of Directors has declared a first-quarter dividend of $0.36 per share, a 9% increase, payable on March 20, 2024, to shareholders of record as of February 21, 2024.

Looking ahead, Xylem forecasts full-year 2024 revenue of approximately $8.4 to $8.5 billion, with an expected increase of 14 to 15 percent on a reported basis and 3 to 5 percent on an organic basis. The adjusted EBITDA margin for 2024 is projected to be between 19.4 to 19.9 percent, representing a 50 to 100 basis point increase from the adjusted results of 2023. The company also anticipates a full-year free cash flow conversion to net income of approximately 115 percent.

Xylem's financial achievements, particularly in revenue growth and margin expansion, are significant for a company in the Industrial Products sector, where efficient operation and innovation are key to staying competitive. The company's focus on solving water challenges and its strategic investments have positioned it well for continued success in a critical global industry.

Investors and stakeholders can find further details and supplemental information on Xylems fourth-quarter 2023 earnings and reconciliations for certain non-GAAP items on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Xylem Inc for further details.

This article first appeared on GuruFocus.