Xylem (XYL) Beats on Q3 Earnings, Improves 2022 Guidance

Xylem Inc.’s XYL third-quarter 2022 adjusted earnings (excluding 72 cents from non-recurring items) of 79 cents per share, surpassed the Zacks Consensus Estimate of 66 cents. The bottom line increased 25.4% year over year.

Xylem’s revenues of $1,380 million also outperformed the Zacks Consensus Estimate of $1,330 million and inched up approximately 9.1% year over year. Organic sales in the quarter rose 16%.

Orders in the reported quarter decreased 7% year over year to $1,419 million. Organically, orders decreased by 1% owing to currency differences.

Segmental Details

Revenues in the Water Infrastructure segment were $574 million, up 5% year over year. Organic sales in the reported quarter grew 13% year over year, buoyed by effective price realization, healthy activity in the utility business in the U.S. and Western Europe and dewatering demand in the US and Emerging Markets.

The Applied Water segment generated revenues of $458 million in the third quarter, up 15% year over year. Organic sales increased 20% on a year-over-year basis. The segmental performance benefited from strong price realization and backlog execution in all end markets.

Quarterly revenues at the Measurement & Control Solutions segment were $348 million, up 9% year over year. Organic sales were up 15% year over year due to strength in the water quality test applications.

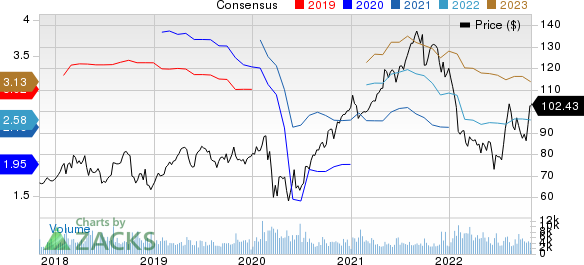

Xylem Inc. Price and Consensus

Xylem Inc. price-consensus-chart | Xylem Inc. Quote

Margin Profile

In the reported quarter, Xylem’s adjusted EBITDA was $252 million, up 11.5% from the year-ago quarter’s level. The margin in the quarter improved 170 basis points (bps) year over year to 18.3%.

Operating income was $168 million in the quarter under review, up 10.5% year over year. The operating margin increased to 12.2% in the third quarter of 2022 from 12% in the year-ago quarter. Interest expenses in the reported quarter totaled $12 million, down from $21 million in the year-ago quarter.

In the third quarter, Xylem’s cost of sales increased 7.9% year over year to $856 million. Selling, general and administrative expenses increased 7.7% to $294 million. Research and development expenses decreased 4.1% year over year to $47 million.

Balance Sheet and Cash Flow

Exiting the third quarter, Xylem had cash and cash equivalents of $1,186 million compared with $1,349 million at the end of December 2021. Long-term debt was $1,880 million at the end of the third quarter of 2022 compared with $2,440 million at the end of December 2021.

In the first nine months of 2022, Xylem generated net cash of $234 million compared with $318 million in the year-ago period. Capital expenditure was $148 million, up 16.5% year over year. Free cash flow was $86 million in the first nine months of 2022 compared with $86 million in the year-ago quarter.

Shareholder-Friendly Policies

In the first nine months of 2022, Xylem paid out dividends worth $163 million, reflecting an increase of 7.2% year over year. The company also bought back shares worth $52 million in the same period, down 23.5% year over year.

Outlook

Owing to strong demand, price realization and gradual easing of supply-chain constraints, Xylem raised its adjusted earnings per share guidance for the full year. The company now expects the metric to be in the range of $2.65 to $2.75 compared with $2.50 to $2.70 anticipated earlier. The mid-point of the guided range — $2.70 — lies above the Zacks Consensus Estimate of $2.58.

Xylem now anticipates full-year revenues to increase 4% on a reported basis and 9-10% on an organic basis compared with organic revenue growth and reported revenue increase of 8-10% and 3-5% estimated earlier.

For 2022, the adjusted EBITDA margin is now expected to be approximately 17% compared with 16.5-17% anticipated earlier. However, the company expects its full-year performance to be hurt by cost inflation and foreign currency headwinds.

Zacks Rank & Stocks to Consider

Xylem currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies from the Industrial Products sector are discussed below:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

EPAC’s earnings estimates have increased 9.1% for fiscal 2023 (ending August 2023) in the past 60 days. The company’s shares have gained 25.2% in the past six months.

iRobot Corp. IRBT presently has a Zacks Rank of 2 (Buy). IRBT’s earnings surprise in the last four quarters was 59.1%, on average.

In the past 60 days, iRobot’s earnings estimates have increased 0.1% for 2022. The stock has rallied 6.8% in the past six months.

Reliance Steel & Aluminum Co. RS presently carries a Zacks Rank of 2. Its earnings surprise in the last four quarters was 13.6%, on average.

In the past 60 days, RS’s earnings estimates have increased 0.1% for 2022. The stock has popped up 1.9% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research