Yacktman Asset Management Adjusts Portfolio, Weatherford International PLC Sees Significant ...

Insights from Yacktman Asset Management (Trades, Portfolio)'s Latest 13F Filing for Q4 2023

Yacktman Asset Management (Trades, Portfolio), known for its disciplined value investing approach, has revealed its 13F holdings for the fourth quarter of 2023. The Austin, Texas-based firm, led by a team of seasoned investment professionals, focuses on acquiring high-quality companies at reasonable prices. With a philosophy centered on long-term returns and risk management, Yacktman Asset Management (Trades, Portfolio)'s latest portfolio adjustments offer a glimpse into their strategic decisions during a dynamic market period.

Key Position Increases

Yacktman Asset Management (Trades, Portfolio) has bolstered its positions in 11 stocks. Noteworthy increases include:

Kenvue Inc (NYSE:KVUE), where an additional 1,635,395 shares were acquired, bringing the total to 5,409,457 shares. This represents a substantial 43.33% increase in share count and a 0.33% impact on the current portfolio, with a total value of $116,465,610.

The S&P 500 ETF TRUST ETF (SPY) saw an addition of 49,663 shares, resulting in a total of 57,814 shares. This adjustment marks a significant 609.29% increase in share count, with a total value of $27,479,570.

Key Position Reductions

Conversely, Yacktman Asset Management (Trades, Portfolio) reduced its stake in 46 stocks. The most significant reductions include:

Weatherford International PLC (NASDAQ:WFRD) saw a reduction of 842,500 shares, leading to a 37.83% decrease in shares and a 0.75% impact on the portfolio. The stock traded at an average price of $92.97 during the quarter and has seen a -12.05% return over the past three months and -10.90% year-to-date.

Microsoft Corp (NASDAQ:MSFT) was reduced by 136,340 shares, equating to a 7.69% reduction in shares and a 0.42% impact on the portfolio. The stock's average trading price was $355.93 during the quarter, with a return of 17.25% over the past three months and 8.38% year-to-date.

Portfolio Overview

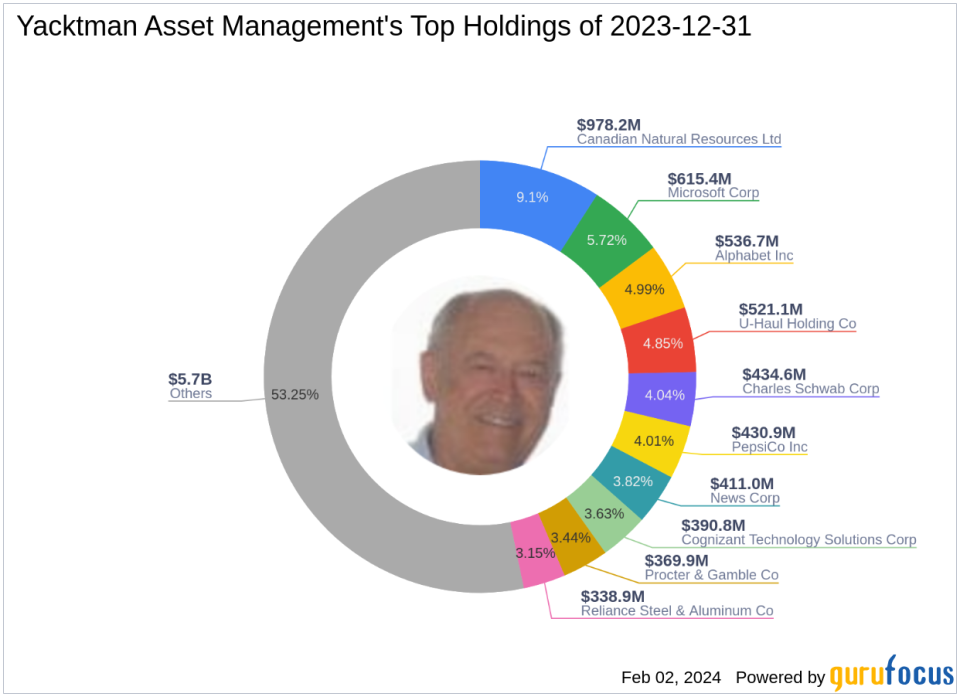

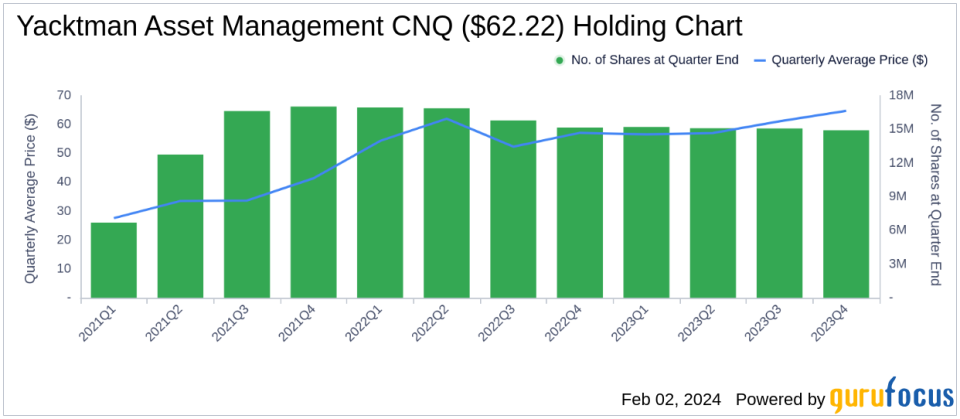

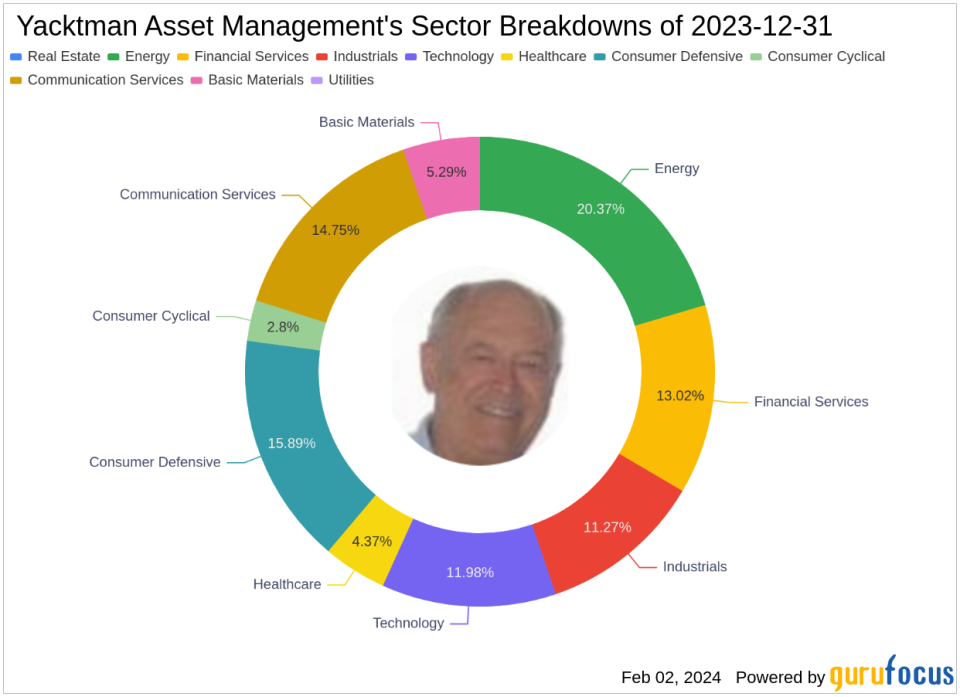

As of the fourth quarter of 2023, Yacktman Asset Management (Trades, Portfolio)'s portfolio comprised 70 stocks. The top holdings included 9.1% in Canadian Natural Resources Ltd (NYSE:CNQ), 5.72% in Microsoft Corp (NASDAQ:MSFT), 4.99% in Alphabet Inc (NASDAQ:GOOG), 4.85% in U-Haul Holding Co (NYSE:UHAL.B), and 4.04% in Charles Schwab Corp (NYSE:SCHW). The firm's investments are primarily concentrated across nine industries: Energy, Consumer Defensive, Communication Services, Financial Services, Technology, Industrials, Basic Materials, Healthcare, and Consumer Cyclical.

The strategic moves by Yacktman Asset Management (Trades, Portfolio), particularly the significant reduction in Weatherford International PLC, reflect the firm's ongoing commitment to value investing and portfolio optimization. Investors and potential members of GuruFocus.com can gain valuable insights from these adjustments, which are indicative of the firm's market outlook and investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.