Yacktman Asset Management's Q3 2023 13F Filing: Booking Holdings Inc Sees Significant Reduction

An in-depth look at the investment moves of Yacktman Asset Management (Trades, Portfolio) in Q3 2023

Yacktman Asset Management (Trades, Portfolio), an Austin, Texas-based investment firm, recently submitted its 13F report for the third quarter of 2023. The firm, known for its value equity investing approach, is led by a team of seasoned investment professionals, including Chief Investment Officer Stephen Yacktman and Portfolio Managers Jason Subotky, Adam Sues, and Russell Wilkins. The firm's investment philosophy is rooted in patience, diligence, and a focus on achieving superior returns over a full market cycle.

New Stock Purchases

During Q3 2023, Yacktman Asset Management (Trades, Portfolio) added a total of five stocks to its portfolio. The most significant addition was Kenvue Inc (NYSE:KVUE), with 3,774,062 shares, accounting for 0.75% of the portfolio and a total value of $75.78 million. The second and third largest additions were Masco Corp (NYSE:MAS) and Verizon Communications Inc (NYSE:VZ), with total values of $19.54 million and $4.86 million, respectively.

Increased Positions

The firm also increased its stakes in 13 stocks. The most notable increase was in U-Haul Holding Co (NYSE:UHAL.B), with an additional 496,908 shares, bringing the total to 7,407,767 shares. This adjustment represents a significant 7.19% increase in share count and a total value of $388.09 million. The second largest increase was in eBay Inc (NASDAQ:EBAY), with an additional 59,007 shares, bringing the total to 2,949,190 shares and a total value of $130.03 million.

Complete Exits

Yacktman Asset Management (Trades, Portfolio) completely exited two holdings in Q3 2023: Univar Solutions Inc (UNVR) and MSC Industrial Direct Co Inc (NYSE:MSM), resulting in -0.68% and -0.26% impacts on the portfolio, respectively.

Reduced Positions

The firm also reduced its positions in 45 stocks. The most significant reduction was in Booking Holdings Inc (NASDAQ:BKNG), with a decrease of 60,403 shares, resulting in a -51.17% decrease in shares and a -1.55% impact on the portfolio. The stock traded at an average price of $3,027.95 during the quarter and has returned -5.15% over the past three months and 37.17% year-to-date.

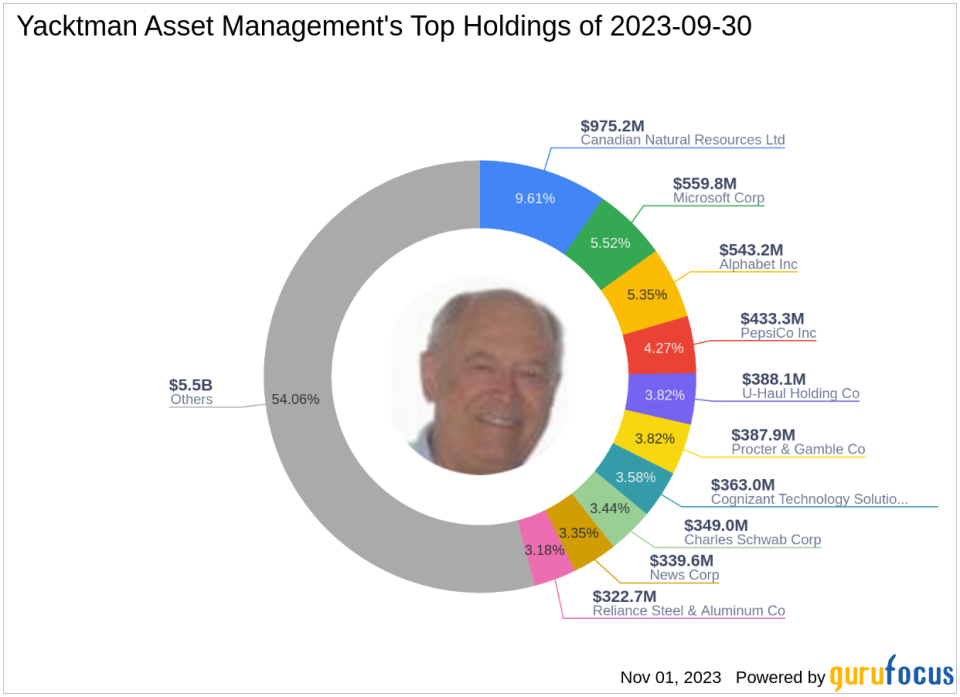

Portfolio Overview

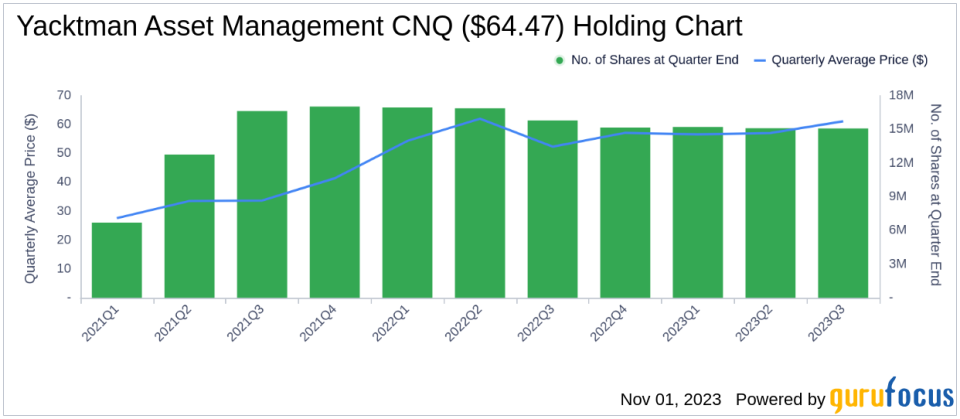

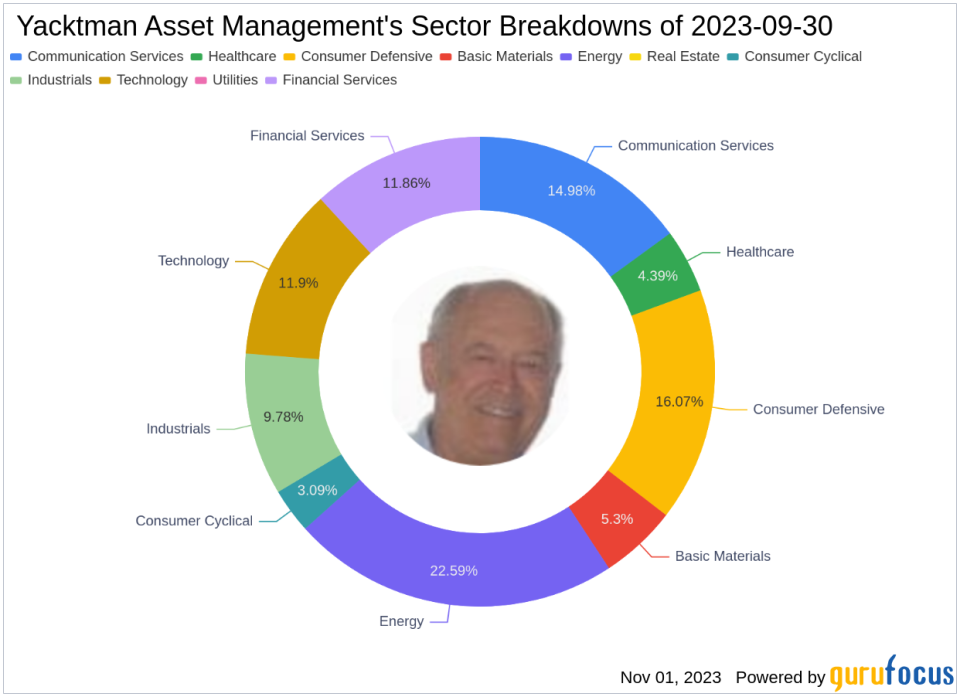

As of Q3 2023, Yacktman Asset Management (Trades, Portfolio)'s portfolio included 72 stocks, with top holdings in Canadian Natural Resources Ltd (NYSE:CNQ), Microsoft Corp (NASDAQ:MSFT), Alphabet Inc (NASDAQ:GOOG), PepsiCo Inc (NASDAQ:PEP), and Procter & Gamble Co (NYSE:PG). The holdings are mainly concentrated in nine of the 11 industries: Energy, Consumer Defensive, Communication Services, Technology, Financial Services, Industrials, Basic Materials, Healthcare, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.