Yacktman Focused Fund's Top 4 Buys in 4th Quarter

- By James Li

The Yacktman Focused Fund (Trades, Portfolio) disclosed this week its top four buys from fourth-quarter 2018 included two new holdings and two position boosts.

Warning! GuruFocus has detected 2 Warning Signs with RP. Click here to check it out.

The intrinsic value of STT

Managed by Stephen Yacktman and Jason Subotky, the Austin, Texas-based fund seeks companies that meet at least one of the following criteria: good business, shareholder-oriented management and low purchase price. The fund's two new holdings for the quarter were State Street Corp. (STT) and Goldman Sachs Group Inc. (GS), while its top two position boosts were Samsung Electronics Co. Ltd. (005935.KS) and Bollore SA (BOL.PA).

Fund updates investment strategy in a "challenging" 2019

Yacktman and Subotky said in a "Market View 2019" video that while the fund is more optimistic about the opportunities available in 2019, it still faces the challenge of staying fully invested during a time where market valuations remain high despite increasing volatility. Yacktman introduced the idea of a "snow globe": particles of snow scatter around when one shakes the globe. While each particle of snow represents an investing opportunity, some are overvalued while others are undervalued. Subotky said the firm seeks the undervalued opportunities using "significant navigation."

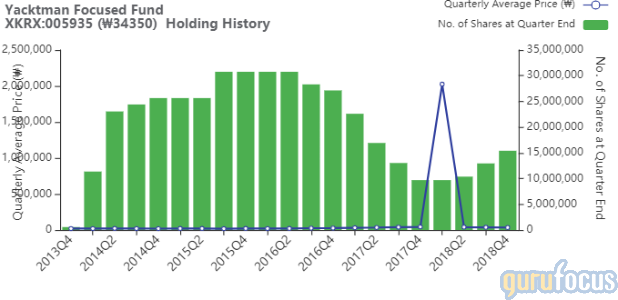

The fund managers also detailed several benefits of investing in family-run businesses like Samsung and Twenty-First Century Fox Inc. (FOX)(FOXA), including the potential for depressed current earnings and investments back to the company. During the quarter, the Focused Fund added 2,462,747 shares of Samsung for an average price of 34,591 won ($30.80) per share, boosting the position 19.02%. The transaction increased the equity portfolio 2.60%.

The South Korean diversified electronics conglomerate manufactures and sells a wide range of products, including smartphones, semiconductor chips, printers, home appliances, medical and telecom equipment. GuruFocus ranks the company's financial strength and profitability 8 out of 10 on several positive signs, which include a solid Altman Z-score of 4.46 and a strong Piotroski F-score of 8. Additionally, Samsung's profit margins have increased approximately 5.80% per year over the past five years and are outperforming over 96% of global competitors.

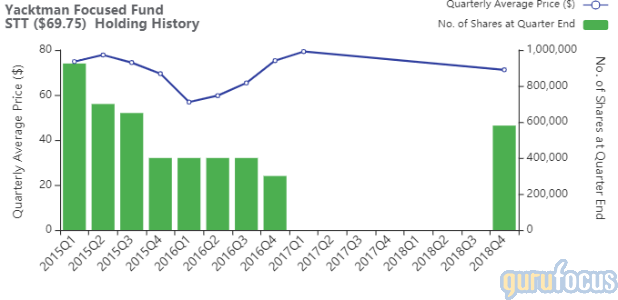

State Street

The fund managers invested in 580,000 shares of State Street for an average price of $71.19, dedicating 1.35% of the equity portfolio to the position.

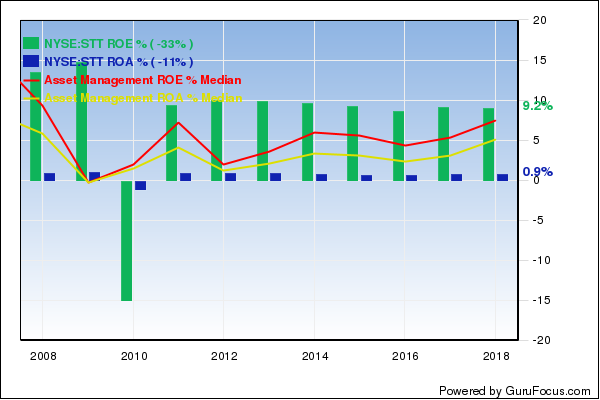

Boston-based State Street provides investment management services to various institutions like mutual funds, retirement plans and insurance companies. GuruFocus ranks the company's profitability 4 out of 10: while the company's return on equity of 10.26% outperforms 65% of global competitors, State Street's return on assets underperforms 65% of global asset management companies.

Other gurus with large holdings in State Street include Bill Nygren (Trades, Portfolio) and Hotchkis & Wiley.

Goldman Sachs

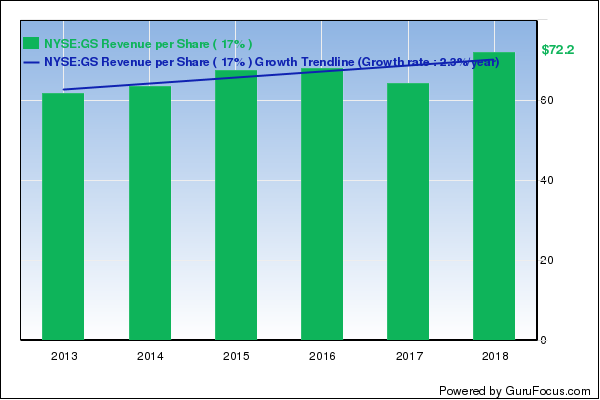

Yacktman and Subotky invested in 110,000 shares of Goldman Sachs for an average price of $200.26 per share, dedicating 0.68% of the equity portfolio to the position.

Shares of Goldman Sachs, a major Warren Buffett (Trades, Portfolio) bank holding, rose on Wednesday as the New York-based investment bank reported stronger-than-expected revenue across key segments like investment banking and institutional client services. Goldman Sachs' revenue increased approximately 12% over the past 12 months, contributing to a five-year compound annual growth rate of sales of approximately 2.30%.

Bollore

Yacktman and Subotky added 4,894,116 shares of Bollore for an average price of 3.70 euros ($4.21) per share. The fund managers increased their equity portfolio 0.73% with this transaction.

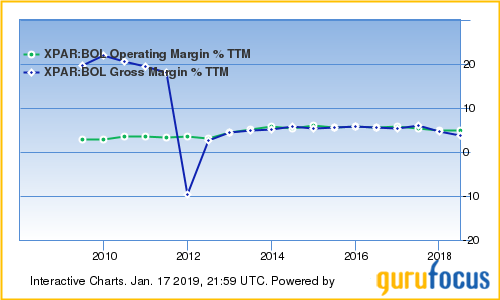

The French shipping and logistics company operates four business segments: transportation and logistics, oil logistics, communication and electricity storage and solutions. GuruFocus ranks Bollore's profitability 7 out of 10 on several good signs, which include expanding profit margins and a solid Piotroski F-score of 7.

Other funds riding Bollore's strong profitability include the Tweedy Browne (Trades, Portfolio) Global Value Fund and Charles de Vaulx ( Trades , Portfolio ) 's IVA Worldwide Fund.

Disclosure: No positions.

Read more here:

Yacktman Asset Management Buys 4 Companies in 3rd Quarter

Yacktman Focused Fund Dives Into South Korea in 3rd Quarter

Buffett's Goldman Sachs Boosts Dow's Gain on Wednesday

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with RP. Click here to check it out.

The intrinsic value of STT