Yelp Inc (YELP) Posts Record High Revenue and Net Income for 2023

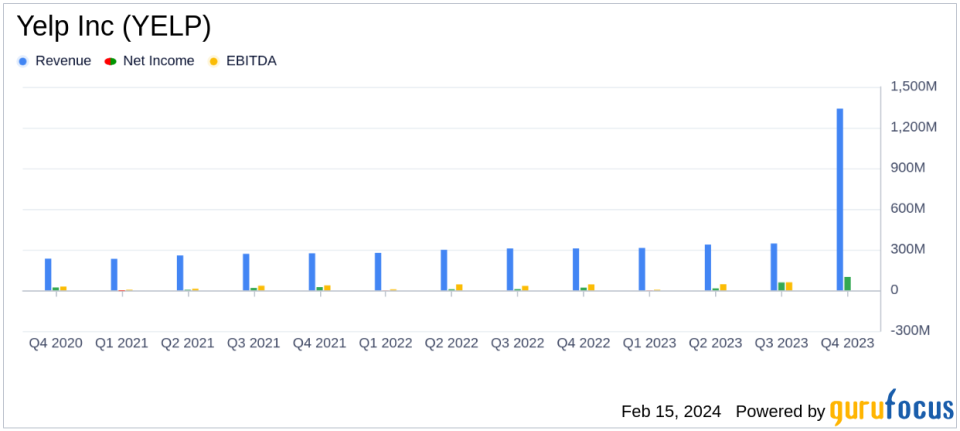

Net Revenue: Reached a record $1.34 billion, a 12% increase year over year.

Net Income: Surged by 173% to $99 million, with a net income margin of 7%.

Adjusted EBITDA: Grew by 23% to a record $330 million, representing a 25% adjusted EBITDA margin.

Advertising Revenue: Total advertising revenue climbed to a record $1.28 billion, a 13% increase year over year.

Services Category: Services businesses advertising revenue hit a record $793 million, up 14% from 2022.

Share Repurchase Program: Board authorized a $500 million increase to the share repurchase program.

2024 Outlook: Expects net revenue between $1.42 billion and $1.44 billion, and adjusted EBITDA between $315 million and $335 million.

On February 15, 2024, Yelp Inc (NYSE:YELP) released its 8-K filing, announcing a year of financial triumphs. The company, known for connecting consumers with local businesses through its web-based platform and mobile application, reported a record high in net revenue and net income for the fiscal year 2023.

Yelp Inc's strategic focus on product development has been instrumental in driving its financial success. The company introduced nearly 60 new product features and updates in the past year, which has significantly contributed to its robust financial performance. Yelp's CEO, Jeremy Stoppelman, emphasized the importance of the company's product-led strategy in achieving durable growth and expressed confidence in the opportunities ahead to enhance shareholder value.

Financial Performance and Challenges

Yelp Inc's financial achievements in 2023 are noteworthy, especially considering the challenges faced by the interactive media industry. The company's net revenue increased by 12% year over year to a record $1.34 billion, while net income saw a staggering 173% increase to $99 million. This performance is particularly significant as it demonstrates Yelp's ability to monetize its high-intent audience effectively, a crucial factor for companies in the online content market.

Despite these achievements, Yelp Inc faces the ongoing challenge of maintaining and expanding its advertiser base, particularly as competition in the digital advertising space intensifies. The company's focus on the Services categories, including Home Services, which saw a 20% annual revenue increase, is part of its strategy to address this challenge and sustain growth.

Financial Highlights and Importance

Yelp Inc's financial strength is further underscored by its adjusted EBITDA, which grew by 23% to $330 million, representing a 25% adjusted EBITDA margin. This metric is important as it indicates the company's operational efficiency and ability to generate profits from its core business activities.

The company's advertising revenue, which constitutes the bulk of its income, increased by 13% to a record $1.28 billion. This growth was driven by strong advertiser demand, with ad clicks increasing by 5% from the previous year and average cost per click (CPC) rising by 9%. The Services businesses, particularly the Home Services category, played a significant role in this growth, contributing $793 million in advertising revenue, up 14% from 2022.

Yelp Inc's financial tables reveal a solid balance sheet with $313.9 million in cash and cash equivalents and $127.5 million in short-term marketable securities. The company's ability to generate free cash flow, which amounted to $279.4 million for the year, is a testament to its financial health and capacity for strategic investments and shareholder returns.

"Investments in our long-term strategic initiatives have led to multiple records as local advertisers continued to see the value of Yelps high-intent audience in 2023," said David Schwarzbach, Yelps chief financial officer.

Analysis of Company's Performance

Yelp Inc's performance in 2023 reflects a successful execution of its product-led growth strategy, which has translated into significant financial gains. The company's ability to nearly triple its net income and achieve record levels of net revenue and adjusted EBITDA is indicative of its strong market position and effective monetization strategies.

The company's outlook for 2024 suggests a continued trajectory of growth, with net revenue expected to be in the range of $1.42 billion to $1.44 billion and adjusted EBITDA anticipated to be between $315 million and $335 million. This forward-looking perspective, combined with the $500 million increase to the share repurchase program, signals confidence in Yelp Inc's future performance and commitment to delivering value to its shareholders.

Overall, Yelp Inc's financial results for 2023 demonstrate the company's resilience and strategic acumen in a competitive digital marketplace. As Yelp continues to innovate and adapt to changing consumer and advertiser needs, it remains well-positioned for sustained growth and profitability.

Explore the complete 8-K earnings release (here) from Yelp Inc for further details.

This article first appeared on GuruFocus.