Yelp Inc's CTO Sam Eaton Sells 57,071 Shares: An Insider Sell Analysis

Yelp Inc (NYSE:YELP), the company that connects people with great local businesses, has recently witnessed a significant insider sell by its Chief Technology Officer, Sam Eaton. On November 22, 2023, Sam Eaton sold a total of 57,071 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction is part of a series of sales by the insider over the past year, with no recorded purchases in the same period.

Before delving into the implications of this insider activity, it's important to understand who Sam Eaton is within Yelp Inc. As the Chief Technology Officer, Eaton is responsible for overseeing the company's technological advancements and maintaining the integrity of the platforms that serve millions of users and businesses. His role is crucial in ensuring that Yelp stays at the forefront of innovation and continues to provide value to its users.

Yelp Inc's business model revolves around its vast database of user-generated reviews and ratings for local businesses. The platform allows consumers to discover, rate, and review businesses in their area, ranging from restaurants and bars to home services and medical professionals. Yelp's revenue primarily comes from advertising sales to businesses that want to promote their services on the platform.

Now, let's analyze the insider sell activity and its relationship with the stock price. Over the past year, Sam Eaton has sold a total of 111,409 shares, with no recorded purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider. However, without additional context, it's challenging to determine the exact motivation behind these sales.

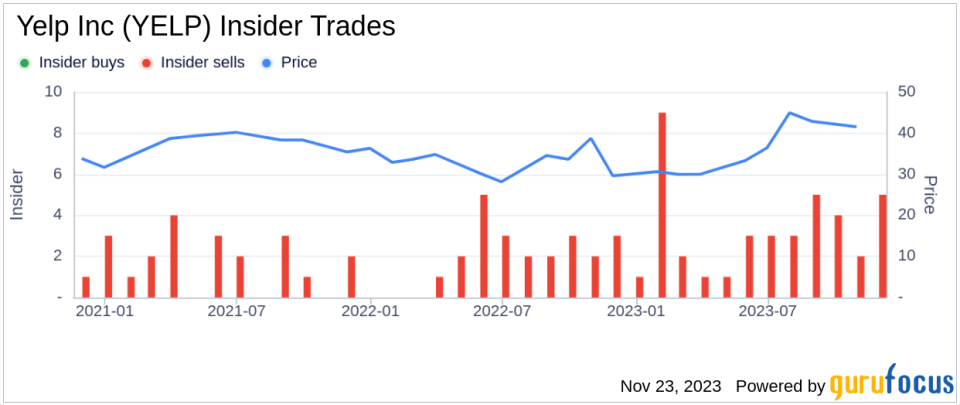

The insider transaction history for Yelp Inc shows a trend of more insider sells than buys over the past year, with 40 insider sells and no insider buys. This could be indicative of insiders taking profits or reallocating their investments, but it's not necessarily a sign of fundamental issues within the company.

On the valuation front, shares of Yelp Inc were trading at $45.72 on the day of Sam Eaton's recent sell, giving the company a market cap of $3.131 billion. The price-earnings ratio stands at 36.30, which is higher than the industry median of 21.2 but lower than the company's historical median price-earnings ratio. This suggests that while Yelp's shares are trading at a premium compared to the industry, they are not excessively valued based on the company's own historical standards.

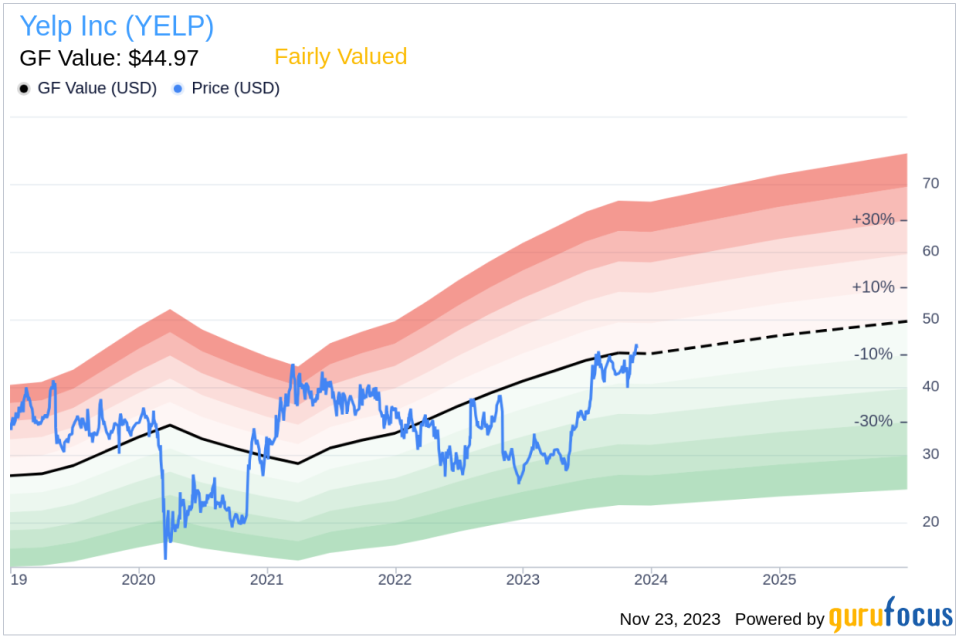

According to the GuruFocus Value, which is an intrinsic value estimate, Yelp Inc has a price-to-GF-Value ratio of 1.02, indicating that the stock is Fairly Valued. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This assessment suggests that the stock is priced appropriately given its current and expected performance.

When considering the insider sell activity in conjunction with the stock's valuation, it's important to note that insider sells alone do not necessarily predict a decline in stock price. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their portfolio, tax planning, or personal financial needs.

However, consistent insider selling over time, especially when not accompanied by insider buys, can raise questions about the insiders' long-term confidence in the company's growth potential. Investors should consider this information as part of a broader analysis that includes financial performance, market conditions, and other relevant factors.

Here is the insider trend image reflecting the recent insider transactions:

And here is the GF Value image, providing a visual representation of Yelp Inc's valuation:

In conclusion, while the insider sell activity by Yelp Inc's CTO Sam Eaton is noteworthy, it should be evaluated in the context of the company's overall financial health and market valuation. The stock appears to be fairly valued based on the GF Value, and the price-earnings ratio is within a reasonable range. Investors should continue to monitor insider transactions as part of their due diligence but should also consider a wide array of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.