YETI Holdings (YETI) Q2 Earnings Beat Estimates, Stock up

YETI Holdings, Inc. YETI reported mixed second-quarter fiscal 2023 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. The top and the bottom line declined on a year-over-year basis.

Following the results, shares of the company rose 17.3% during trading hours on Aug 10. Positive investor sentiments were witnessed as YETI provided a better-than-expected outlook for fiscal 2023. Management is optimistic about growing consumer demand trends (for hydration solutions), broadening colorways and innovation pipeline.

Earnings & Revenues Details

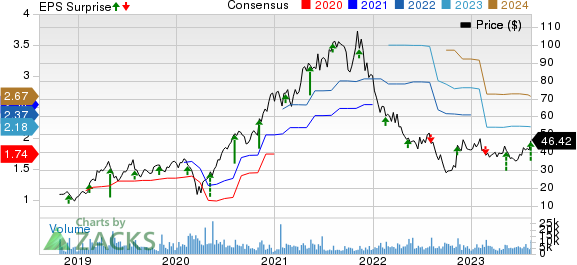

During the fiscal second quarter, the company reported adjusted earnings per share (EPS) of 57 cents, beating the Zacks Consensus Estimate of 47 cents. In the prior-year quarter, YETI reported an EPS of 63 cents.

YETI Holdings, Inc. Price, Consensus and EPS Surprise

YETI Holdings, Inc. price-consensus-eps-surprise-chart | YETI Holdings, Inc. Quote

Quarterly revenues of $402.6 million missed the Zacks Consensus Estimate of $411 million by 2 Also, the top line fell 4.2% on a year-over-year basis.

During the quarter, Direct-to-consumer channel sales came in at $226.4 million, compared with $224.8 million reported in the prior-year quarter. The upside was primarily backed by strength in the Drinkware business.

Wholesale channel sales came in at $176.2 million, compared to $195.2 million reported in the prior-year quarter. This downside was caused by a decline in Coolers & Equipment owing to the stop sale of the products affected by the recalls.

Operating Highlights

During the fiscal second quarter, Adjusted selling, general, and administrative expenses came in at $167.2 million compared with $145.3 million reported in the prior-year quarter.

Adjusted gross margin during the quarter came in at 54.9% compared with 52.2% reported in the prior-year quarter.

Adjusted operating income in the fiscal second quarter came in at $67.1 million compared with $73.8 million reported in the prior-year quarter.

Balance Sheet

Cash as of Jul 1, 2023, totaled $223.1 million compared with $234.7 million on Dec 31, 2022.

Inventory during the quarter came in at $322 million compared with $490 million reported in the prior-year period.

As of Jul 1, 2023, Long-term debt, net of the current portion, was $81.1 million compared with $71.7 million at the end of Dec 31, 2022.

2023 Outlook

For fiscal 2023, the company expects Adjusted net sales to be between $1,699 and $1,715.3 million compared with the previous expectation of $1,682.6-$1,715.3 million. Adjusted operating income is anticipated in the range of $263.3-$274.5 million compared with the previous expectation of $252.4-$265.9 million.

The company expects 2023 Adjusted net income to be in the range of $194.5 and $202.8 million compared with the previous expectation of $184.7-$194.8 million. Adjusted EPS during the year is anticipated in the range of $2.23-$2.32 compared with the previous expectation of $2.12-$2.23.

Zacks Rank

YETI Holdings currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Recent Consumer Discretionary Releases

American Public Education, Inc. APEI reported better-than-expected second-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. However, both metrics declined on a year-over-year basis.

The company’s results benefited from the solid contributions of the American Public University System and Hondros College of Nursing segment as well as Graduate School USA revenues included in Corporate and Other and cost-saving initiatives. However, the dismal performance of the Rasmussen University segment ailed the other segments’ tailwind to some extent.

Hasbro, Inc. HAS reported mixed second-quarter fiscal 2023 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The metrics declined on a year-over-year basis. The dismal performances of Franchise Brands, Partner Brands and Portfolio Brands affected the top line.

The company announced the sale of its eOne Film and TV business to Lionsgate for approximately $500 million. The company anticipates the deal to strengthen its financial flexibility and retire its floating rate debt (by approximately $400 million). HAS expects to close the deal by 2023 end.

MGM Resorts International MGM reported impressive second-quarter 2023 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Both metrics surpassed the consensus estimate for the third consecutive quarter. Moreover, the top and the bottom line increased on a year-over-year basis.

MGM’s upside was primarily driven by growth in business volume and travel activity, primarily at MGM China and Las Vegas Strip Resorts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

YETI Holdings, Inc. (YETI) : Free Stock Analysis Report