Yext's (NYSE:YEXT) Q4 Earnings Results: Revenue In Line With Expectations, Stock Jumps 15.4%

Online reputation and search platform Yext (NYSE:YEXT) reported results in line with analysts' expectations in Q4 FY2024, with revenue flat year on year at $101.1 million. On the other hand, next quarter's revenue guidance of $96.25 million was less impressive, coming in 3.1% below analysts' estimates. It made a non-GAAP profit of $0.10 per share, improving from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Yext? Find out by accessing our full research report, it's free.

Yext (YEXT) Q4 FY2024 Highlights:

Revenue: $101.1 million vs analyst estimates of $100.6 million (small beat)

EPS (non-GAAP): $0.10 vs analyst estimates of $0.07 (47.1% beat)

Revenue Guidance for Q1 2025 is $96.25 million at the midpoint, below analyst estimates of $99.32 million

Management's revenue guidance for the upcoming financial year 2025 is $401 million at the midpoint, missing analyst estimates by 1.7% and implying -0.8% growth (vs 0.9% in FY2024)

Free Cash Flow of $27.61 million is up from -$2.33 million in the previous quarter

Gross Margin (GAAP): 78.6%, up from 74% in the same quarter last year

Market Capitalization: $713.4 million

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Listing Management Software

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

Sales Growth

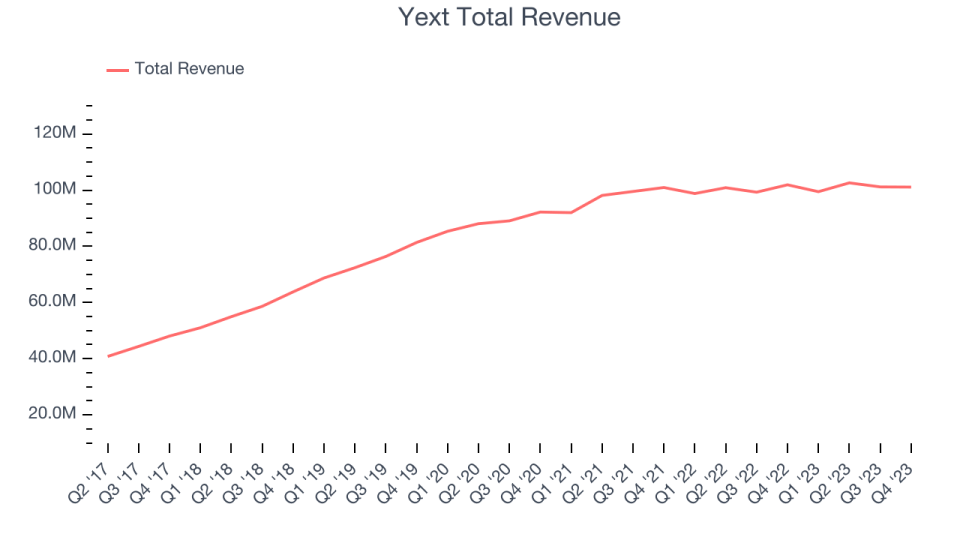

As you can see below, Yext's revenue growth has been unimpressive over the last two years, growing from $100.9 million in Q4 FY2022 to $101.1 million this quarter.

This quarter, Yext's revenue was down 0.8% year on year, which might disappointment some shareholders.

Next quarter, Yext is guiding for a 3.2% year-on-year revenue decline to $96.25 million, a further deceleration from the 0.7% year-on-year decrease it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $401 million at the midpoint, declining 0.8% year on year compared to the 0.9% increase in FY2024.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

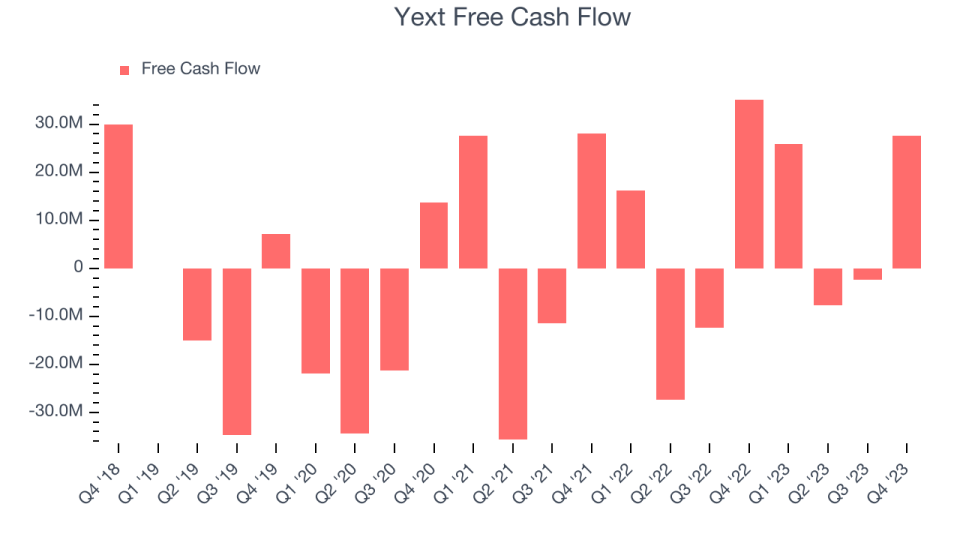

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Yext's free cash flow came in at $27.61 million in Q4, down 21.4% year on year.

Yext has generated $43.43 million in free cash flow over the last 12 months, or 10.7% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Yext's Q4 Results

Although Yext's revenue missed analysts' estimates, its profitability was better than expected. It produced $14.8 million of adjusted EBITDA (vs estimates of $12.6 million), partly thanks to a huge year-on-year increase in its gross margin, which expanded from 74% to 78.6% thanks to the company's shift to a professional services strategy. This encouraging gross margin expansion trumped its underwhelming full-year revenue guidance, which was below expectations. A reason for the lower revenue guidance was the loss of a large customer during the quarter, but the market doesn't seem to care. The stock is up 16.6% after reporting and currently trades at $6.95 per share.

So should you invest in Yext right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.