Yong Rong (HK) Asset Management Ltd Acquires New Stake in Applied Optoelectronics Inc

Yong Rong (HK) Asset Management Ltd, a prominent investment firm, recently acquired a significant stake in Applied Optoelectronics Inc (NASDAQ:AAOI). This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications for value investors.

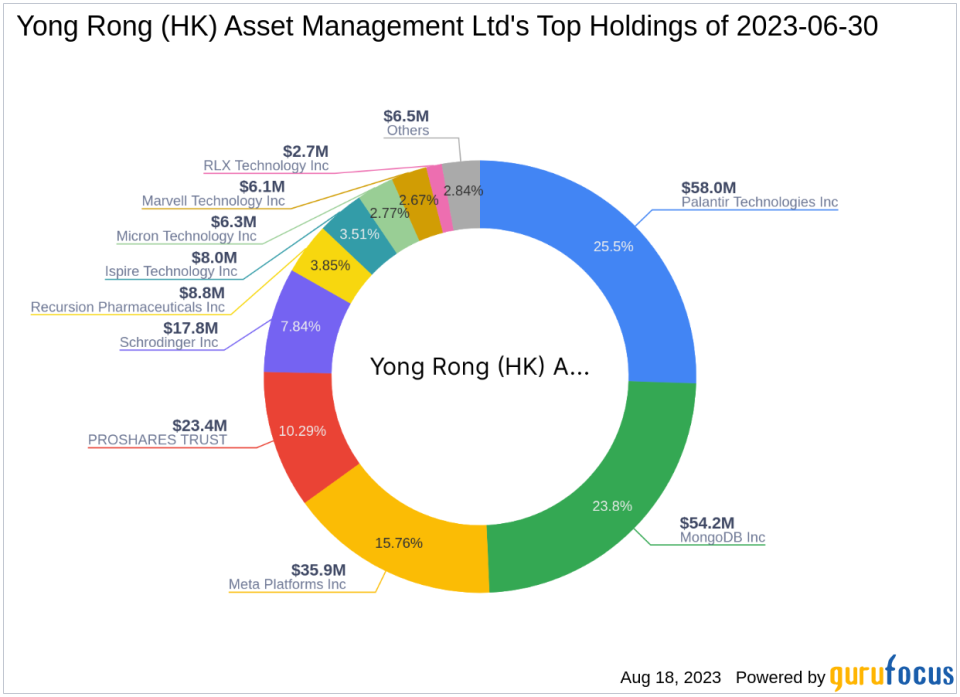

Profile of Yong Rong (HK) Asset Management Ltd

Yong Rong (HK) Asset Management Ltd is a renowned investment firm based in Sheung Wan, K3. The firm manages a diverse portfolio of 20 stocks, with a total equity of $228 million. Its top holdings include Meta Platforms Inc(NASDAQ:META), PROSHARES TRUST(NASDAQ:TQQQ), MongoDB Inc(NASDAQ:MDB), Schrodinger Inc(NASDAQ:SDGR), and Palantir Technologies Inc(NYSE:PLTR). The firm's portfolio is heavily concentrated in the Technology and Communication Services sectors.

Details of the Transaction

On August 15, 2023, Yong Rong (HK) Asset Management Ltd purchased 1,828,638 shares of Applied Optoelectronics Inc at a price of $14.79 per share. This new holding represents 10.62% of the firm's portfolio and 5.69% of the total shares of Applied Optoelectronics Inc. The transaction significantly impacts the firm's portfolio, demonstrating its confidence in the traded company's potential.

Profile of Applied Optoelectronics Inc

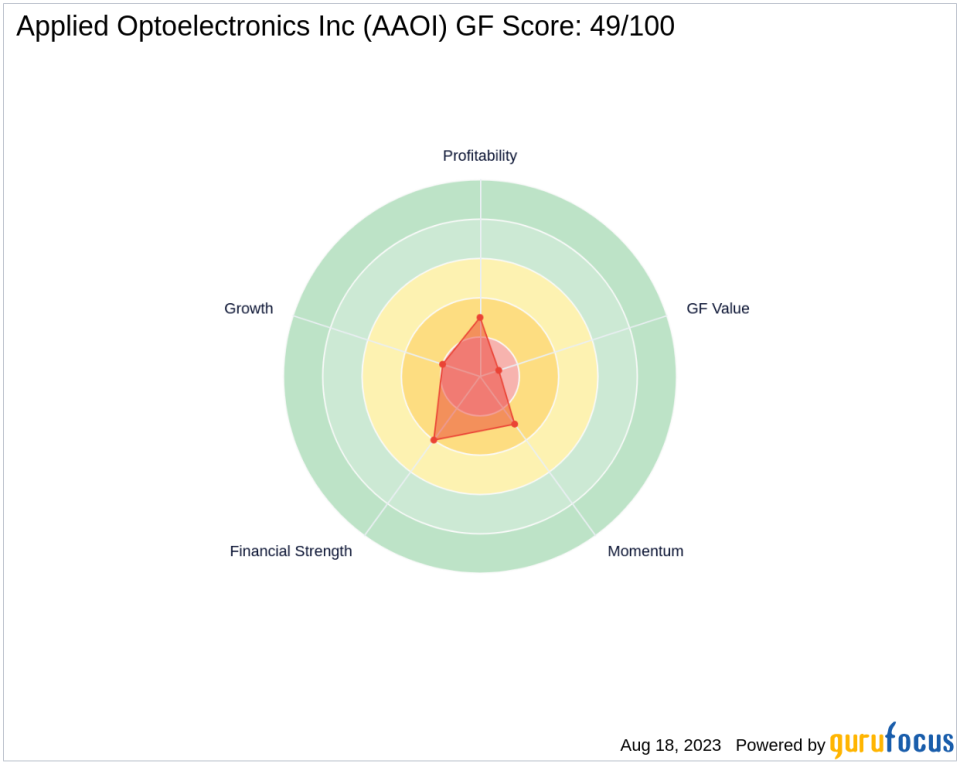

Applied Optoelectronics Inc, a US-based company, is a leading provider of fiber-optic networking products for various end markets, including Internet data centers, cable television, telecommunications, and fiber-to-the-home. The company, which went public on September 26, 2013, focuses on designing and manufacturing a range of optical communication products. Despite its current market capitalization of $400.484 million, the company's financial performance has been less than stellar, with a GF Score of 49/100, indicating poor future performance potential.

Stock Performance and Analysis

Since its IPO, Applied Optoelectronics Inc has seen a price change ratio of 24.65%. However, the stock's price has declined by 15.72% since the transaction. Despite a year-to-date price change ratio of 563.03%, the company's financial strength and profitability rank are low, with scores of 4/10 and 3/10, respectively. The company's growth rank is also low at 2/10, indicating a lack of substantial growth in recent years.

GAMCO Investors: The Largest Guru Holder of Applied Optoelectronics Inc

GAMCO Investors is currently the largest guru holder of Applied Optoelectronics Inc. The position of GAMCO Investors in the traded company could potentially influence the stock's performance and should be closely monitored by value investors.

Conclusion

In conclusion, the recent acquisition of Applied Optoelectronics Inc by Yong Rong (HK) Asset Management Ltd represents a significant addition to the firm's portfolio. Despite the traded company's underwhelming financial performance, the transaction demonstrates the firm's confidence in its potential. Value investors should closely monitor the developments and consider the implications of this transaction for their investment strategies.

This article first appeared on GuruFocus.