New York Mortgage Trust Inc (NYMT) Reports Mixed Results for Q4 and Full Year 2023

Net Income: Reported Q4 net income of $31.5 million, but a full-year net loss of $90 million.

Book Value: Ended the year with a book value per common share of $11.31 and an adjusted book value of $12.66.

Dividends: Declared dividends of $0.20 per common share for Q4 and $1.20 for the full year.

Interest Income: Generated $78.8 million in Q4 and $258.7 million for the full year.

Investment Activities: Purchased approximately $2.0 billion of Agency RMBS and $620.3 million in residential loans throughout the year.

Leverage Ratios: Company recourse leverage ratio at 1.6x; portfolio recourse leverage ratio at 1.5x.

Stock Repurchase: Repurchased shares of common and preferred stock under the repurchase program.

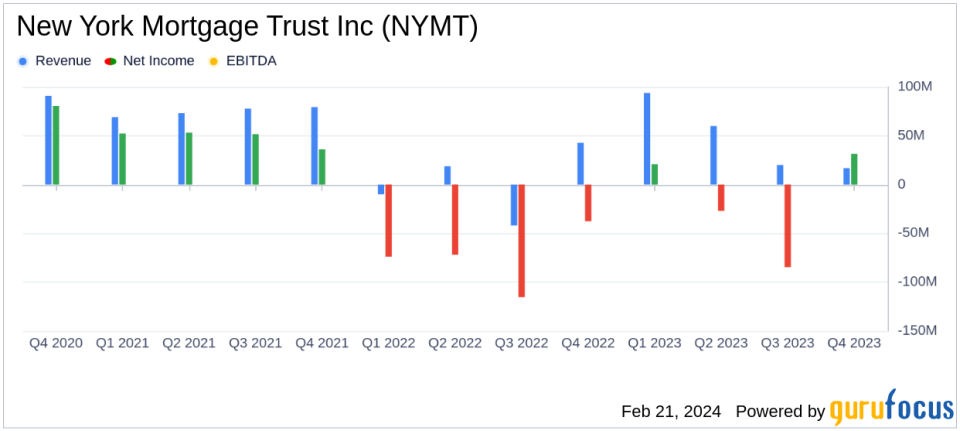

On February 21, 2024, New York Mortgage Trust Inc (NASDAQ:NYMT) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a real estate investment trust (REIT) specializing in mortgage-related and residential housing-related assets, navigated a challenging economic landscape marked by volatility and interest rate fluctuations.

Q4 and Full Year 2023 Performance

For the fourth quarter, NYMT reported a net income of $31.5 million, or $0.35 per share, a positive shift from the full-year net loss of $90 million, or $0.99 per share. This performance reflects the company's resilience in the face of economic headwinds. The book value per common share stood at $11.31 at year-end, with an adjusted book value per common share of $12.66, indicating a measure of stability in the company's intrinsic value.

The company's net interest income for the fourth quarter was $16.8 million, contributing to the full-year total of $66.5 million. The yield on average interest-earning assets was 6.21% for Q4 and 6.14% for the full year, demonstrating the company's ability to generate earnings from its asset base. However, the net interest spread for the year was lower at 0.74%, compared to 1.02% for the quarter, reflecting tighter margins over the longer period.

Investment and Financing Activities

Throughout 2023, NYMT actively managed its investment portfolio, purchasing approximately $2.0 billion of Agency RMBS and $620.3 million in residential loans. The company also sold investment securities for proceeds of about $64.7 million and residential loans for approximately $25.1 million. These transactions are part of NYMT's strategy to optimize its asset mix in response to market conditions.

On the financing side, NYMT obtained approximately $84.9 million of financing for residential loans through a repurchase agreement with a new counterparty and about $74.3 million for single-family rental properties through an existing counterparty. The company also upsized its common stock repurchase program to $246.0 million and authorized a preferred stock repurchase program of up to $100.0 million, showcasing a commitment to shareholder value.

Challenges and Management Commentary

Jason Serrano, NYMT's Chief Executive Officer, acknowledged the heightened macroeconomic volatility and the challenges posed by U.S. government deficit spending and a dislocated commercial real estate market. He noted that the company's decision to reduce portfolio risk and increase liquidity in 2023 was premature, impacting earnings. However, Serrano expressed confidence that this conservative approach would yield improved results in the future as the market adjusts to the maturing commercial real estate debt.

The end of an economic cycle often generates heightened macroeconomic volatility as we approach inflection points in the market... we believe this approach will yield improved results not only this year but has the potential to enhance results in the years ahead as trillions of dollars of maturing commercial real estate debt is sorted out."

Looking Ahead

NYMT's strategic activities, including the suspension of marketing for nine multi-family properties and the redemption of a Mezzanine Lending investment, reflect a cautious yet proactive approach to asset management. The company's capital allocation and leverage ratios indicate a solid financial structure designed to withstand market fluctuations.

Investors and stakeholders can expect NYMT to continue navigating the complex REIT landscape with a focus on value preservation and strategic growth. The company's full-year 2023 financial and operating data will be available in its Annual Report on Form 10-K, to be filed with the SEC on or about February 23, 2024.

For further insights and detailed financial analysis, readers are encouraged to visit GuruFocus.com, where they can find comprehensive investment tools and resources tailored to value investors.

Explore the complete 8-K earnings release (here) from New York Mortgage Trust Inc for further details.

This article first appeared on GuruFocus.