The New York Times Co. (NYT) Flourishes on Subscriber Growth

Despite operational challenges, The New York Times Company NYT has achieved success, propelled by growth in its subscriber base and a strategic transformation. The company's unwavering focus on diversifying revenue streams, optimizing costs and streamlining operations has been instrumental in its thriving performance. To bolster revenues further, The New York Times Company is actively promoting a more strategic bundled subscription offering.

This New York-based company has embraced technological advancements to forge strong connections with its target audience. The strategic acquisitions of Wirecutter, a product review website, and The Athletic, a digital subscription-based sports media business, have significantly widened its reach and unlocked new opportunities in the market. As The New York Times Company continues to adapt and innovate, its prospects remain promising in the dynamic media landscape.

Let’s Dig

The sustained expansion of The New York Times Company's subscriber base is undeniably pivotal. As the subscriber base increases, so does the company's influence and market standing, making it an appealing platform for advertisers eager to connect with a wider and more engaged audience.

The New York Times Company ended the third quarter of 2023 with roughly 10.08 million subscribers across its print and digital products, including roughly 9.41 million digital-only subscribers. Of the 9.41 million subscribers, about 3.79 million were bundle and multiproduct subscribers. There was a net increase of 210,000 and 820,000 in digital-only subscribers compared with the second quarter of 2023 and the third quarter of 2022, respectively.

Image Source: Zacks Investment Research

Subscription revenues of $418.6 million grew 9.4% year over year. Subscription revenues from digital-only products jumped 15.7% to $282.2 million. This reflects an increase in bundle and multiproduct revenues of $44.1 million and a rise in other single-product subscription revenues of $2.2 million.

The company achieved consistent growth in its digital-only average revenue per user (ARPU) for the fifth consecutive quarter. The ARPU increased from $8.87 in the year-ago period to an impressive $9.28. This increase in ARPU can be attributed to subscribers transitioning from promotional pricing to higher rate plans and the introduction of price hikes for tenured non-bundle subscribers.

Projections for the final quarter of 2023 also point to a decent increase in total subscription revenues, with digital-only subscription revenues expected to climb even higher. Management envisions fourth-quarter total subscription revenues to increase about 2-5%, with digital-only subscription revenues anticipated to rise approximately 6-9% on a reported basis.

Wrapping Up

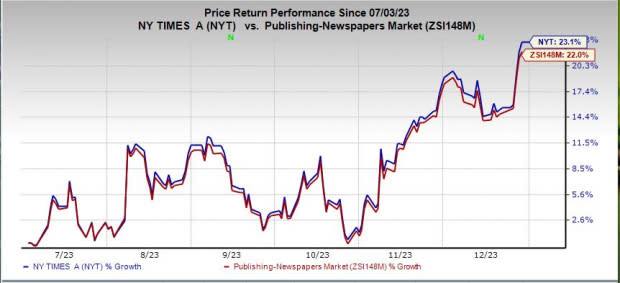

Rooted in New York, this Zacks Rank #3 (Hold) company has undergone a remarkable transformation, experiencing a notable surge of 23.1% in its stock price over the past six months compared with the industry’s growth of 22%. This surge not only underscores the company's solid fundamentals but also positions NYT as an attractive choice for investors seeking growth and resilience in the dynamic media landscape. The company's ability to evolve and innovate in response to changing consumer preferences has positioned it as a formidable player.

3 Stocks Worth Looking

Some better-ranked stocks are Aspen Technology, Inc. AZPN, NETGEAR, Inc. NTGR and RADCOM Ltd. RDCM.

Aspen Technology, a global leader in industrial software, carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Aspen Technology’s current financial-year revenues and EPS calls for growth of 7.5% and 15.9%, respectively, from the year-ago period.

NETGEAR, the leading provider of networking products that power businesses, currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 127.5%, on average.

The Zacks Consensus Estimate for NETGEAR’s current financial-year bottom line implies growth of 69% from the year-ago reported figure.

RADCOM, the leading expert in 5G-ready cloud-native network intelligence solutions for telecom operators, carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 131.1%, on average.

The Zacks Consensus Estimate for RADCOM’s current financial-year revenues suggests growth of 11%, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The New York Times Company (NYT) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Radcom Ltd. (RDCM) : Free Stock Analysis Report