New York Times Co Reports Robust Earnings Growth and Subscriber Expansion in Q4

Net Digital Subscribers: Added approximately 300,000 in Q4, reaching 9.7 million digital-only subscribers.

Digital Subscription Revenue: Increased by 7.2% year-over-year to $288.7 million.

Operating Profit: Grew by 38.7% year-over-year to $129.0 million.

Diluted Earnings Per Share (EPS): Rose to $0.66, a $0.23 increase from the previous year.

Free Cash Flow: Significantly improved to $337.9 million for the full year 2023.

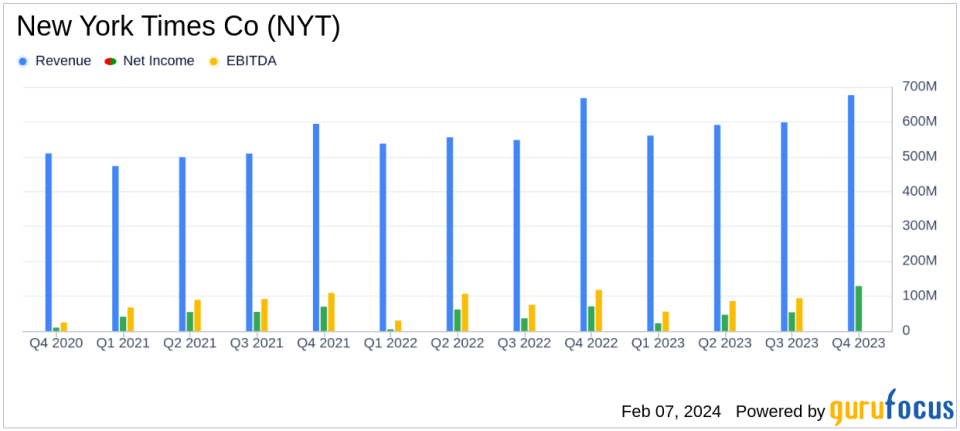

New York Times Co (NYSE:NYT) released its 8-K filing on February 7, 2024, revealing a substantial increase in operating profit and a significant addition to its digital subscriber base for the fourth quarter and full year of 2023. The company's strategic focus on digital transformation and multi-product offerings has yielded impressive results, with digital subscription revenues and free cash flow reaching new heights.

Company Overview

New York Times Co is a global media organization dedicated to creating a lasting impact through independent journalism. With a legacy of over a century, the company has transitioned from a traditional newspaper to a digital-first enterprise, offering a suite of products that cater to a diverse audience. Its digital subscription service, with over 1 million paid users, is a testament to its successful pivot in a rapidly evolving media landscape.

Financial Performance and Challenges

The company's financial achievements in the fourth quarter are noteworthy, with a 7.2% increase in digital-only subscription revenues and a 38.7% surge in operating profit. However, digital advertising revenues saw a 3.7% decline year-over-year, primarily due to fewer days in the quarter and a downturn in podcast and creative services revenue. Despite this, the overall revenue growth and cost management strategies have contributed to a robust bottom line.

Key Financial Metrics

Understanding the importance of key financial metrics, New York Times Co reported a total revenue increase of 1.3% year-over-year to $676.2 million for the fourth quarter. The adjusted operating profit margin improved by approximately 160 basis points to 22.8%. The company's ability to grow its digital subscriber base while effectively managing costs has been central to its financial success.

Meredith Kopit Levien, president and CEO, stated, "2023 was a strong year for The Times that showcased the power of our strategy to be the essential subscription for every curious person seeking to understand and engage with the world."

Analysis of Performance

The New York Times Co's strategic emphasis on digital subscription growth is evident in its latest earnings report. The addition of 300,000 net digital-only subscribers in the fourth quarter underscores the company's appeal and the effectiveness of its bundle and multi-product subscriber strategy. The increase in digital subscription revenue, coupled with disciplined cost management, has led to a substantial rise in operating profit and free cash flow, positioning the company well for continued investment in its digital transformation.

The company's financial health is further underscored by its strong liquidity position, with cash and marketable securities totaling $709.2 million as of December 31, 2023. This financial stability enables New York Times Co to navigate the competitive media landscape and invest in growth opportunities.

For value investors and those interested in the media industry's evolving dynamics, New York Times Co's latest earnings report provides a compelling narrative of resilience and strategic growth. The company's ability to adapt and thrive in the digital age serves as a case study for successful transformation in the sector.

For more detailed insights and analysis, visit GuruFocus.com to explore the full earnings report and the strategic implications for New York Times Co and the media industry at large.

Explore the complete 8-K earnings release (here) from New York Times Co for further details.

This article first appeared on GuruFocus.