Yorktown Energy Partners IX, L.P. Reduces Stake in Ramaco Resources Inc

On November 15, 2023, Yorktown Energy Partners IX, L.P. (Trades, Portfolio), an investment firm with a focus on energy and basic materials, executed a significant reduction in its holdings of Ramaco Resources Inc (NASDAQ:METC). The transaction involved the sale of 4,499,956 shares, which resulted in a substantial decrease in the firm's exposure to the stock. This move by Yorktown Energy Partners IX, L.P. (Trades, Portfolio) has caught the attention of investors and market analysts, as it may signal a shift in the firm's investment strategy regarding Ramaco Resources Inc.

Investment Firm's Profile

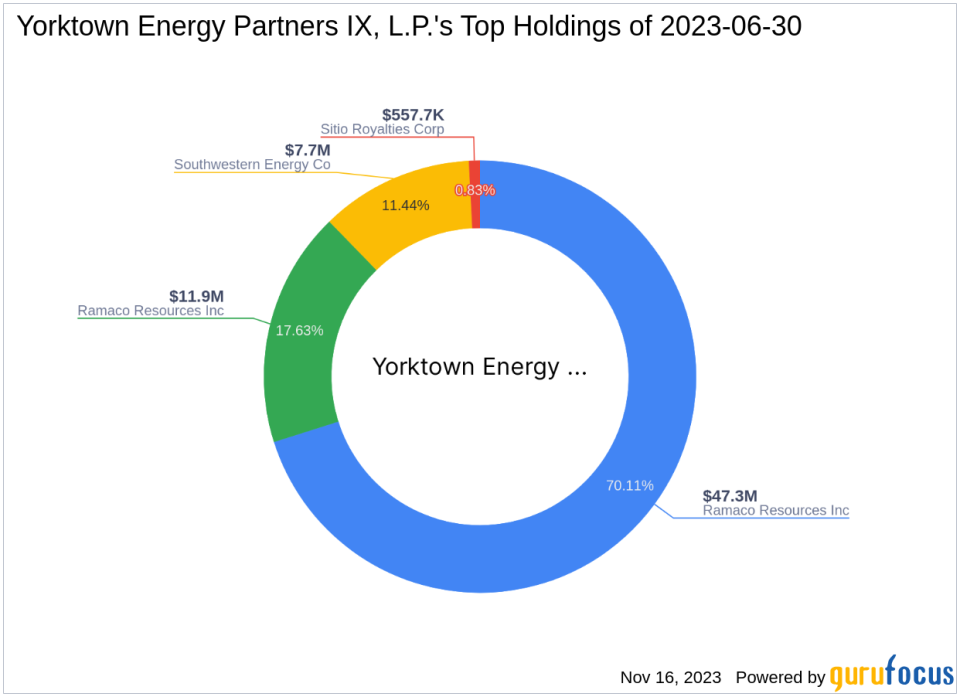

Yorktown Energy Partners IX, L.P. (Trades, Portfolio), headquartered at 410 Park Avenue, New York, NY, is known for its strategic investments in the energy sector. With a portfolio that includes only four stocks, the firm has a concentrated approach to investing, with a particular emphasis on the Basic Materials and Energy sectors. Ramaco Resources Inc was one of the firm's top holdings, alongside Southwestern Energy Co (NYSE:SWN), Sitio Royalties Corp (NYSE:STR), and Ramaco Resources Inc's Class B shares (NASDAQ:METCB). As of the latest data, Yorktown Energy Partners IX, L.P. (Trades, Portfolio) manages an equity portfolio valued at approximately $68 million.

Overview of Ramaco Resources Inc

Ramaco Resources Inc, with the stock symbol METC, operates within the United States steel industry. Since its IPO on February 3, 2017, the company has been engaged in the production and development of metallurgical coal, a critical component in steel-making. With a market capitalization of $913.388 million and a PE ratio of 12.33, Ramaco Resources Inc has established itself as a notable player in its sector. The company's stock is currently considered modestly overvalued with a GF Value of $14.27 and a Price to GF Value ratio of 1.26.

Transaction Specifics

The recent transaction by Yorktown Energy Partners IX, L.P. (Trades, Portfolio) saw a reduction of 4,499,956 shares in Ramaco Resources Inc, with a trade price of $18.23 per share. This trade has had a significant impact on the firm's portfolio, with a -121.48% trade impact and reducing the firm's position in Ramaco Resources Inc to 2.11%. The remaining holding of 1,109,484 shares indicates a strategic shift by the firm, as the position now accounts for a -139.45% ratio in the firm's overall portfolio.

Market Impact and Stock Valuation

Since its IPO, Ramaco Resources Inc's stock has seen a price change increase of 23.71%, with a remarkable year-to-date gain of 113.52%. However, since the transaction date, the stock has experienced a slight decline of -1.26%. The company's GF Score stands at 74/100, indicating a potential for average performance in the future.

Financial Health and Performance Rankings

Ramaco Resources Inc's financial health is reflected in its balance sheet rank of 7/10 and a profitability rank of 6/10. The company's growth rank is also strong at 7/10. However, its GF Value Rank is low at 1/10, suggesting that the stock may be overvalued at its current price. The firm's cash to debt ratio of 0.37, along with an interest coverage of 8.67, indicates a stable financial position. The company's ROE and ROA are impressive at 20.39% and 10.73%, respectively.

Comparative Sector Analysis

Yorktown Energy Partners IX, L.P. (Trades, Portfolio)'s top sector holdings are in Basic Materials and Energy, with Ramaco Resources Inc fitting well within this investment strategy. When compared to the overall sector, Ramaco Resources Inc has shown strong performance, particularly in terms of year-to-date stock price growth.

Future Outlook and Performance Potential

Looking ahead, Ramaco Resources Inc's future performance potential is supported by a solid GF Score of 74/100. The stock's momentum and RSI indicators suggest a positive short-term trajectory, with RSI values of 86.71, 85.21, and 82.96 for the 5-day, 9-day, and 14-day periods, respectively. These metrics, combined with the company's growth in operating margin and EBITDA, paint a promising picture for Ramaco Resources Inc's performance potential.

Transaction Analysis

The reduction in Yorktown Energy Partners IX, L.P. (Trades, Portfolio)'s stake in Ramaco Resources Inc is a significant move that may influence the stock's market perception. The firm's decision to decrease its position could be based on a variety of factors, including valuation concerns or a strategic reallocation of resources. Investors and market watchers will be keen to see how this transaction affects Ramaco Resources Inc's stock performance and Yorktown Energy Partners IX, L.P. (Trades, Portfolio)'s portfolio dynamics in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.