Yorktown Energy Partners XI, L.P. Reduces Stake in Ramaco Resources Inc

Overview of Yorktown Energy Partners XI, L.P. (Trades, Portfolio)'s Recent Transaction

Yorktown Energy Partners XI, L.P. (Trades, Portfolio), a notable investment firm, has recently adjusted its investment portfolio by reducing its stake in Ramaco Resources Inc (NASDAQ:METC). On November 15, 2023, the firm sold 4,482,058 shares of Ramaco Resources, which resulted in an 80.22% decrease in their holding. This transaction has had a significant impact on the firm's investment in Ramaco, altering the landscape of its portfolio.

Investment Firm Profile

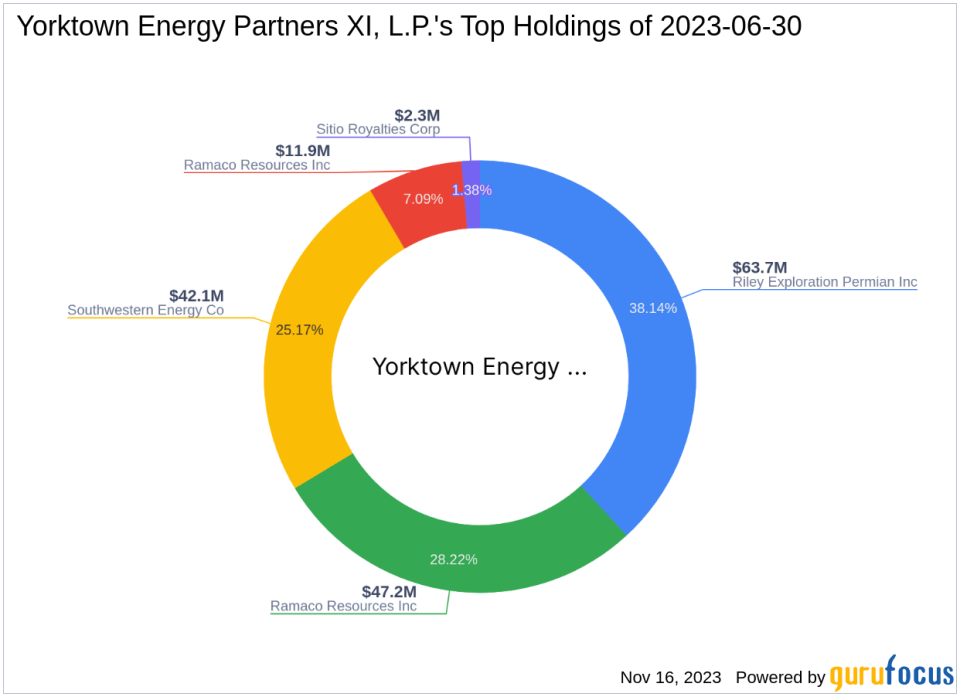

Yorktown Energy Partners XI, L.P. (Trades, Portfolio), based at 410 Park Avenue in New York, is known for its strategic investment decisions in the energy and basic materials sectors. With a focused investment philosophy, the firm has maintained a portfolio that includes top holdings such as Riley Exploration Permian Inc (REPX), Southwestern Energy Co (NYSE:SWN), and Sitio Royalties Corp (NYSE:STR). After the recent transaction, Ramaco Resources Inc remains a key component of their investment strategy, albeit at a reduced capacity. The firm's equity stands at $167 million, with energy and basic materials as its top sectors.

About Ramaco Resources Inc

Ramaco Resources Inc, operating in the steel industry, is a U.S.-based company that specializes in the production of metallurgical coal, essential for steel-making processes. Since its IPO on February 3, 2017, the company has focused on mining operations across West Virginia, Virginia, and Pennsylvania. Ramaco's business model revolves around serving both domestic and international markets, with a single-segment focus on metallurgical coal.

Transaction Specifics

The trade executed by Yorktown Energy Partners XI, L.P. (Trades, Portfolio) on November 15 saw the firm's share count in Ramaco Resources decrease by 4,482,058 shares, priced at $18.23 per share. This reduction has brought their total shareholding to 1,105,070, which now represents 2.10% of the company's stock and 23.59% of the firm's portfolio. The trade has had a substantial impact of -48.9% on the firm's investment in Ramaco.

Ramaco Resources Inc Stock Analysis

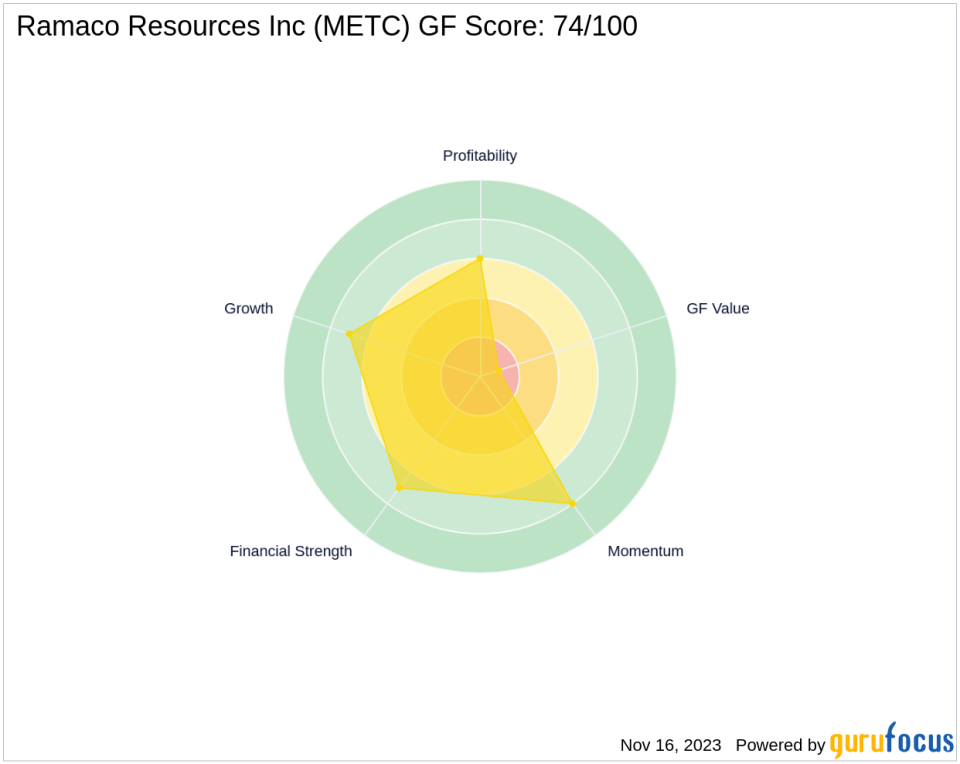

Currently, Ramaco Resources Inc has a market capitalization of approximately $913.388 million, with a stock price hovering around $18. The company's PE ratio stands at 12.33, indicating profitability. However, GuruFocus deems the stock as modestly overvalued with a GF Value of $14.27 and a price to GF Value ratio of 1.26. The stock has experienced a slight decline of 1.26% since the transaction, yet it has seen a significant increase of 113.52% year-to-date and 23.71% since its IPO.

Financial Health and Performance Metrics

Ramaco Resources Inc boasts a strong ROE of 20.39% and an ROA of 10.73%, reflecting efficient management and profitability. The company's cash to debt ratio is 0.37, indicating a moderate level of financial stability. Over the past three years, Ramaco has seen revenue growth of 30.90%, EBITDA growth of 51.70%, and earnings growth of 62.10%, showcasing a strong trajectory in financial performance.

Market Performance and Momentum Indicators

Since its IPO, Ramaco Resources Inc's stock has shown resilience and growth. The stock's momentum is further evidenced by its RSI 14-day figure of 82.96 and a Momentum Index ranking of 290 for the 6-month period. These indicators suggest that the stock has been performing well in the market, maintaining a strong upward trend.

Sector and Market Context

Yorktown Energy Partners XI, L.P. (Trades, Portfolio)'s portfolio is heavily influenced by the energy and basic materials sectors, with Ramaco Resources Inc playing a significant role. The steel industry, where Ramaco operates, is currently facing various market dynamics, but the firm's strategic reduction in Ramaco's shares indicates a calculated approach to these trends and their potential impact on the company's future performance.

Transaction Analysis

The recent reduction in Yorktown Energy Partners XI, L.P. (Trades, Portfolio)'s stake in Ramaco Resources Inc reflects a significant portfolio adjustment for the firm. While the transaction has decreased the firm's exposure to Ramaco, it also suggests a rebalancing of investments in line with the firm's broader market strategy. Investors and market watchers will be keen to observe how this move influences both the firm's portfolio and Ramaco's stock performance in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.