Young & Co.’s Brewery, P.L.C. (LON:YNGA): Commentary On Fundamentals

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Young & Co.’s Brewery, P.L.C. (LON:YNGA) is a stock with outstanding fundamental characteristics. When we build an investment case, we need to look at the stock with a holistic perspective. In the case of YNGA, it is a notable dividend payer that has been able to sustain great financial health over the past. Below is a brief commentary on these key aspects. For those interested in digger a bit deeper into my commentary, read the full report on Young’s Brewery here.

Adequate balance sheet average dividend payer

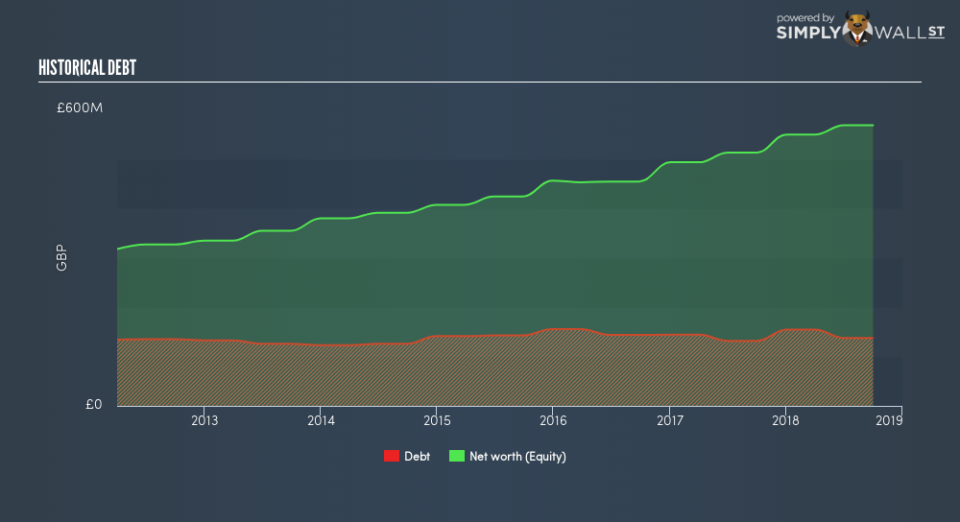

YNGA’s debt-to-equity ratio stands at 24%, which means its debt level is acceptable. This means that YNGA’s capital structure strikes a good balance between low-cost debt funding and maintaining financial flexibility without overly restrictive terms of debt. YNGA appears to have made good use of debt, producing operating cash levels of 0.42x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

YNGA is also a dividend company, with ample net income to cover its dividend payout, which has been consistently growing over the past decade, keeping income investors happy.

Next Steps:

For Young’s Brewery, I’ve put together three important factors you should look at:

Future Outlook: What are well-informed industry analysts predicting for YNGA’s future growth? Take a look at our free research report of analyst consensus for YNGA’s outlook.

Historical Performance: What has YNGA’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of YNGA? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.