Yum! Brands (NYSE:YUM) Reports Sales Below Analyst Estimates In Q4 Earnings

Fast-food company Yum! Brands (NYSE:YUM) fell short of analysts' expectations in Q4 FY2023, with revenue flat year on year at $2.04 billion. It made a non-GAAP profit of $1.26 per share, down from its profit of $1.31 per share in the same quarter last year.

Is now the time to buy Yum! Brands? Find out by accessing our full research report, it's free.

Yum! Brands (YUM) Q4 FY2023 Highlights:

Revenue: $2.04 billion vs analyst estimates of $2.10 billion (3.3% miss)

EPS (non-GAAP): $1.26 vs analyst expectations of $1.40 (10.1% miss)

Free Cash Flow of $342 million, down 19.5% from the previous quarter

Gross Margin (GAAP): 47.8%, up from 46.8% in the same quarter last year

Same-Store Sales were up 1% year on year

Store Locations: 58,330 at quarter end, increasing by 2,969 over the last 12 months

Market Capitalization: $35.67 billion

Spun off as an independent company from PepsiCo, Yum! Brands (NYSE:YUM) is a multinational corporation that owns KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Yum! Brands is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

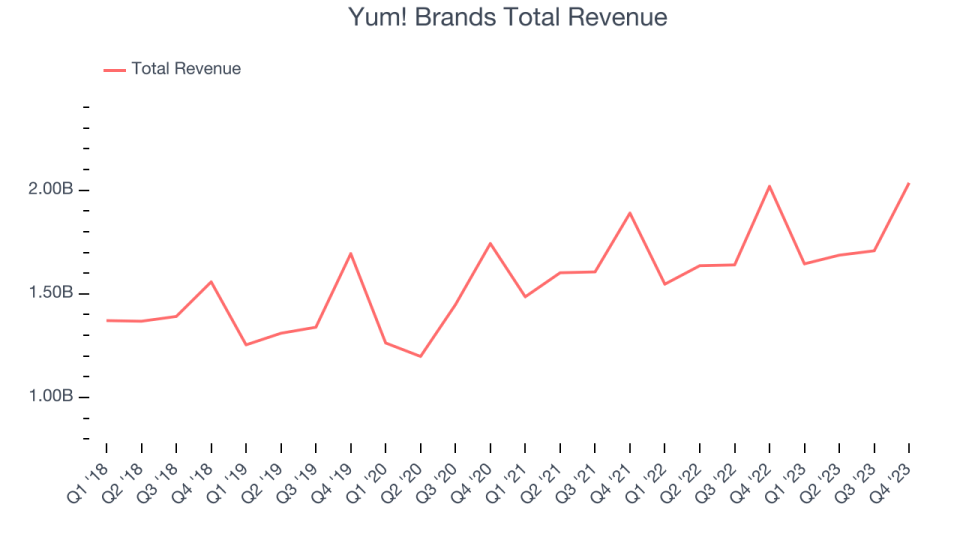

As you can see below, the company's annualized revenue growth rate of 6% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Yum! Brands's revenue grew 0.8% year on year to $2.04 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 9.2% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Number of Stores

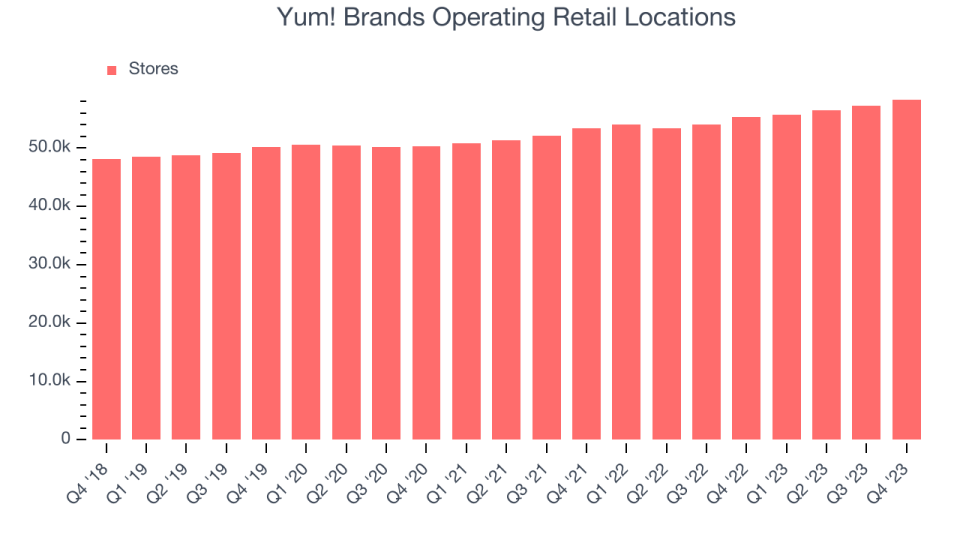

A restaurant chain's total number of dining locations often determines how much revenue it can generate.

When a chain like Yum! Brands is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Yum! Brands's restaurant count increased by 2,969, or 5.4%, over the last 12 months to 58,330 locations in the most recently reported quarter.

Over the last two years, Yum! Brands has rapidly opened new restaurants, averaging 4.7% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Yum! Brands has more opportunities to feed customers and generate sales.

Same-Store Sales

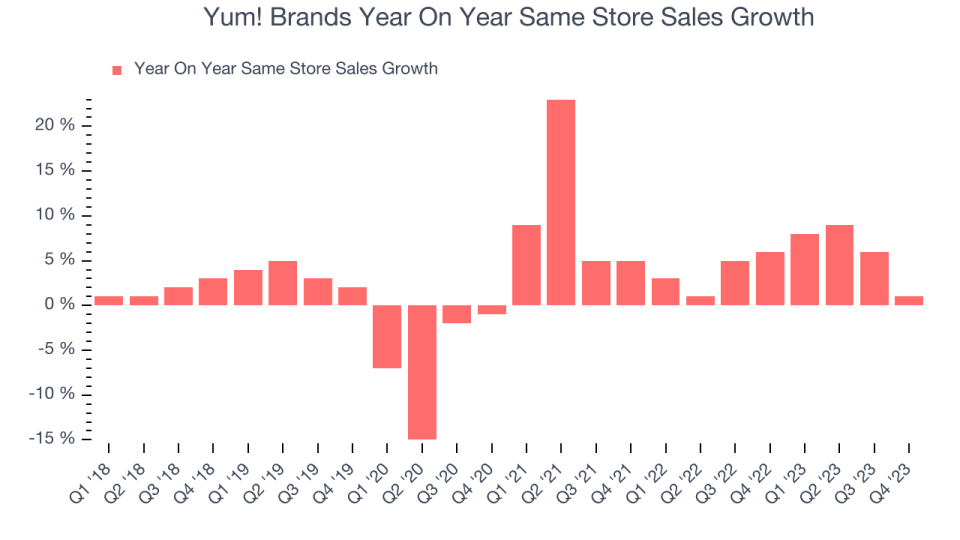

Yum! Brands's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 4.9% year on year. With positive same-store sales growth amid an increasing number of restaurants, Yum! Brands is reaching more diners and growing sales.

In the latest quarter, Yum! Brands's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 6% year-on-year increase it posted 12 months ago. We'll be watching Yum! Brands closely to see if it can reaccelerate growth.

Key Takeaways from Yum! Brands's Q4 Results

Revenue missed on same-store sales and total locations below expectations. EPS also missed despite better-than-expected gross margins. The company didn't give guidance in the earnings release. Overall, the results could have been better. The company is down 1.9% on the results and currently trades at $124.85 per share.

Yum! Brands may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.