Is YUM! Brands (NYSE:YUM) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, YUM! Brands, Inc. (NYSE:YUM) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for YUM! Brands

What Is YUM! Brands's Net Debt?

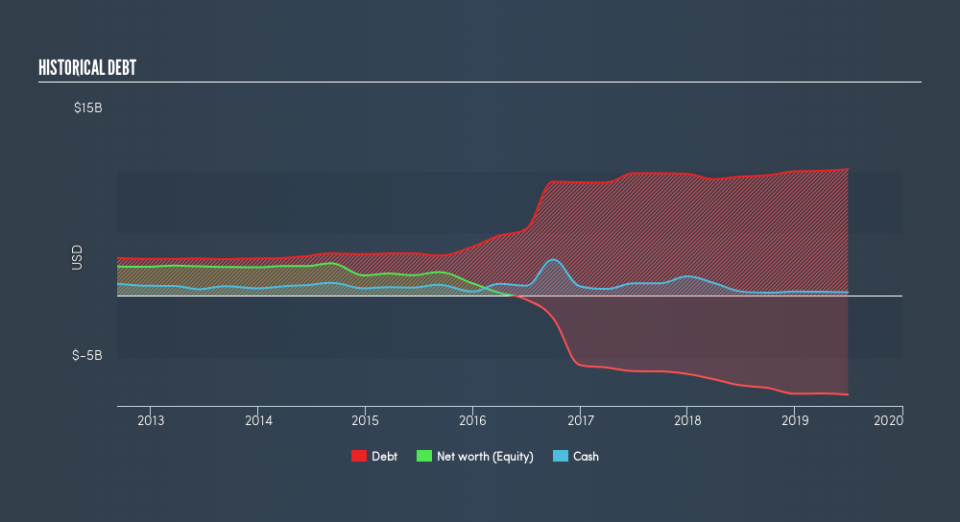

As you can see below, at the end of June 2019, YUM! Brands had US$10.2b of debt, up from US$9.67b a year ago. Click the image for more detail. However, it also had US$262.0m in cash, and so its net debt is US$9.93b.

How Strong Is YUM! Brands's Balance Sheet?

The latest balance sheet data shows that YUM! Brands had liabilities of US$1.19b due within a year, and liabilities of US$11.5b falling due after that. Offsetting this, it had US$262.0m in cash and US$535.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$11.9b.

While this might seem like a lot, it is not so bad since YUM! Brands has a huge market capitalization of US$35.2b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 5.0, it's fair to say YUM! Brands does have a significant amount of debt. However, its interest coverage of 3.5 is reasonably strong, which is a good sign. The good news is that YUM! Brands improved its EBIT by 7.0% over the last twelve years, thus gradually reducing its debt levels relative to its earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if YUM! Brands can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, YUM! Brands recorded free cash flow of 46% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

YUM! Brands's struggle handle its debt, based on its EBITDA, had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its EBIT growth rate is relatively strong. We think that YUM! Brands's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.