Zebra Technologies Corp (ZBRA) Faces Sharp Decline in Q4 Sales and Earnings

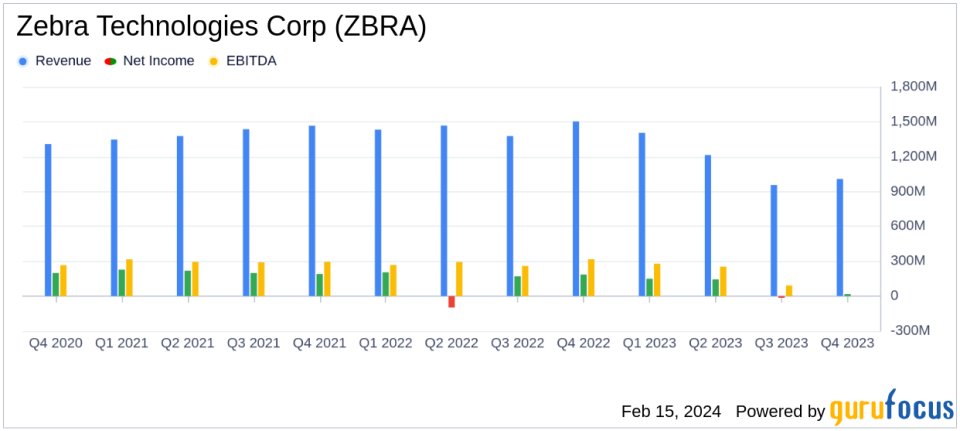

Net Sales: Q4 net sales plummeted by 32.9% year-over-year to $1,009 million.

Net Income: Q4 net income saw a drastic drop of 90.9% to $17 million.

Adjusted EBITDA: Experienced a 54.1% decrease year-over-year to $155 million in Q4.

Cost Reduction Plans: Expanded to drive $120 million annualized net expense savings.

Free Cash Flow: Negative free cash flow of $91 million reported for the full year 2023.

Outlook: Q1 2024 net sales expected to decline by 17-20%; full-year 2024 net sales projected to range from a 1% decline to 3% growth.

On February 15, 2024, Zebra Technologies Corp (NASDAQ:ZBRA) released its 8-K filing, detailing a significant downturn in its fourth-quarter and full-year 2023 financial performance. The company, a leader in automatic identification and data capture technology, faced a challenging quarter with net sales dropping to $1,009 million, a 32.9% decrease from the previous year. Net income also fell sharply to $17 million, marking a 90.9% decline, with net income per diluted share down by 91.3% to $0.31.

Zebra Technologies, known for its barcode printers, scanners, mobile computers, and workflow optimization software, serves key industries such as retail, transportation logistics, manufacturing, and healthcare. Despite its strong market presence, the company has not been immune to the broader economic headwinds affecting global markets.

The company's adjusted EBITDA for Q4 stood at $155 million, a 54.1% decrease from the prior year, reflecting the impact of lower gross profit and higher operating expenses as a percentage of revenue. Zebra Technologies also expanded its cost reduction plans, now expected to drive $120 million in annualized net expense savings, up from the previously announced $100 million.

From the balance sheet perspective, as of December 31, 2023, Zebra Technologies had $137 million in cash and cash equivalents, with total debt standing at $2,226 million. The full-year 2023 saw the company grappling with negative free cash flow of $91 million, after accounting for capital expenditures of $87 million and net cash used in operating activities of $4 million.

CEO Bill Burns commented on the results, stating, "As expected, our fourth quarter results continued to be impacted by broad-based softness across our end markets and distributor destocking." He also noted that while some improvement in order activity was observed, a broad market recovery had yet to materialize.

"Entering 2024, distributor inventories are aligned with the current demand environment. Although we are seeing some improvement in order activity, we are not yet seeing signs of a broad market recovery. We continue to be well positioned to address our customers biggest challenges and return to growth in 2024," said Bill Burns, Chief Executive Officer of Zebra Technologies.

Looking ahead, Zebra Technologies expects net sales for the first quarter of 2024 to decline between 17% and 20% compared to the first quarter of 2023. For the full year 2024, the company anticipates net sales to range from a 1% decline to 3% growth. Adjusted EBITDA margin for the first quarter is projected at approximately 18%, with non-GAAP diluted earnings per share expected to be between $2.30 and $2.60.

The company's performance reflects the challenges faced by the hardware industry, where supply chain disruptions, market softness, and evolving customer requirements have put pressure on sales and profitability. Zebra Technologies' efforts to streamline operations and reduce costs are critical steps in navigating the current economic landscape and positioning the company for future growth.

Investors and stakeholders will be closely monitoring Zebra Technologies' progress as it implements its cost-saving measures and adapts to the shifting market dynamics. The company's resilience and strategic initiatives will be key to its recovery and long-term success.

Explore the complete 8-K earnings release (here) from Zebra Technologies Corp for further details.

This article first appeared on GuruFocus.