Zendesk Acquires FutureSimple to Ease Salesforce Automation

Zendesk Inc. ZEN recently announced that it acquired FutureSimple Inc. — provider of the well-known customer relationship management and sales productivity platform called Base.

Base provides “sales force automation software” aimed at optimizing efficiency of the sales workforce. Being an easy to use mobile application, it is widely used by a large number of companies.

Last year, the duo, Base and Zendesk, had already partnered when they launched an integrated version of their products. Hence the old partners are expected to perform even better now, as they will operate under the same umbrella.

Presently, Base has offices located in San Francisco and Krakow, Poland and around 5000 customers worldwide. While the customers will continue enjoying services even after the acquisition, the talent pool of Base will be absorbed by Zendesk.

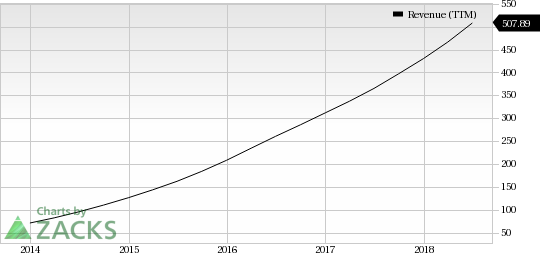

As a result, Zendesk’s top line is anticipated to witness a significant improvement moving ahead. In second-quarter 2018, the company’s revenues surged 39% from the year-ago quarter to $141.9 million better than the Zacks Consensus Estimate of $138 million.

Zendesk, Inc. Revenue (TTM)

Zendesk, Inc. Revenue (TTM) | Zendesk, Inc. Quote

Zendesk’s Overall Performance

Zendesk is gaining momentum backed by strong adoption of the company’s products. Increasing usage of its products by existing customers is also driving growth.

During the last reported quarter, the company launched the Zendesk Suite — its new omnichannel bundle — which brings together Support, Guide, Talk, and Chat products. It also launched Zendesk Connect that enables proactive customer engagement.

Zendesk continued to add features to its enterprise products as well. Moreover, the company launched new enterprise workflow and collaboration tools during the same period.

The company's customer base expanded in the quarter with new additions like Henry Schein, IDEX, Netflix NFLX and Yandex Taxi, among others.

However, the company’s margins were slightly under pressure due to the ongoing transition from co-located data centers to cloud infrastructure. Nevertheless, Zendesk expects to complete the transition by 2018 end, which might help the company post better financials in the long run.

Zacks Rank & Key Picks

Currently, Zendesk has a Zacks Rank #3 (Hold).

Five9, Inc. FIVN and Paycom Software, Inc. PAYC are stocks worth considering in the same sector as both sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term growth rate for Five9 and Paycom Software is pegged at 20% and 25.5%, respectively.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Zendesk, Inc. (ZEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research