Zeta Global Holdings Corp (ZETA) Sustains Strong Revenue Growth, Despite Net Losses

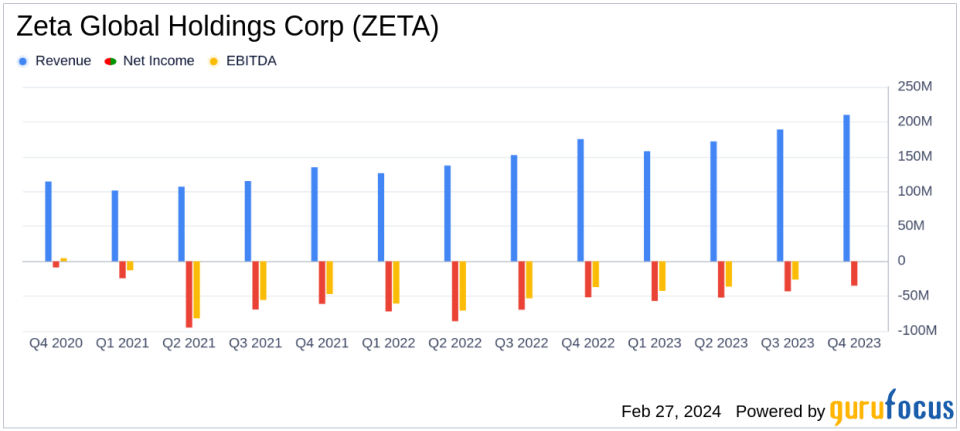

Revenue Growth: Zeta Global Holdings Corp (NYSE:ZETA) reported a 20% year-over-year increase in Q423 revenue, reaching $210M, and a 23% increase for the full year, totaling $729M.

Customer Growth: Scaled Customer count rose by 12% and Super-Scaled Customer count by 27% year-over-year.

ARPU Increase: Scaled Customer ARPU grew by 10% year-over-year to $1.57M in 2023.

Operating Cash Flow: Generated $27M in cash flow from operating activities in Q423 and $91M for the full year.

Net Loss: GAAP net loss was $35M in Q423, primarily due to $63M in stock-based compensation, improving from a $52M net loss in Q422.

Adjusted EBITDA: Adjusted EBITDA increased by 38% year-over-year to $44.8M in Q423, with a margin of 21.3%.

Guidance: Zeta guides to a fifth consecutive year of 20%+ revenue growth for 2024.

Zeta Global Holdings Corp (NYSE:ZETA), an AI-Powered Marketing Cloud, announced its financial results for the fourth quarter and full year ended December 31, 2023, on February 27, 2024, through its 8-K filing. The company, which provides consumer intelligence and marketing automation software across various industries, delivered its fourth consecutive year of over 20% revenue growth, demonstrating robust performance in a changing marketing ecosystem.

Financial Performance and Challenges

Zeta's revenue growth is a testament to its strong market position and the increasing demand for AI-driven marketing solutions. The company's focus on scaling its customer base and improving average revenue per user (ARPU) has paid off, with significant year-over-year growth in both metrics. However, despite these achievements, Zeta reported a GAAP net loss of $35 million for the fourth quarter, primarily driven by substantial stock-based compensation expenses. This loss represents an improvement over the previous year's $52 million net loss in the same quarter.

The company's financial health is also reflected in its operating cash flow, which stood at $27 million for the quarter and $91 million for the full year. This indicates Zeta's ability to generate cash from its core operations, an essential aspect for sustaining growth and investment in innovation.

Income Statement and Balance Sheet Highlights

Zeta's income statement reveals a mixed picture. While revenue and adjusted EBITDA have shown impressive growth, the cost of revenue as a percentage of total revenue has increased both quarterly and yearly, indicating rising costs associated with revenue generation. The balance sheet shows a healthy cash and cash equivalents position of $131.7 million as of December 31, 2023, providing the company with a solid liquidity position to support its operations and strategic initiatives.

Analysis and Outlook

Looking ahead, Zeta is guiding towards another year of 20%+ revenue growth for 2024, with an emphasis on continued adjusted EBITDA margin expansion and acceleration in free cash flow conversion. The company's long-term plan, Zeta 2025, aims to generate in excess of $1 billion in annual revenue with at least 20% adjusted EBITDA margins by 2025, indicating confidence in its business model and market opportunities.

Zeta's performance in a competitive and evolving market landscape underscores the company's ability to leverage AI and consumer data to deliver marketing solutions that resonate with enterprises. While the net losses are a concern, the underlying growth metrics and strategic focus on profitability and cash flow generation provide a positive outlook for value investors.

For a detailed understanding of Zeta Global Holdings Corp (NYSE:ZETA)'s financials and strategic direction, investors are encouraged to review the full earnings report and consider the company's potential in the broader context of the AI-driven marketing industry.

Explore the complete 8-K earnings release (here) from Zeta Global Holdings Corp for further details.

This article first appeared on GuruFocus.