Zevra Therapeutics Inc (ZVRA) Earnings: A Mixed Bag Against Analyst Estimates with Significant ...

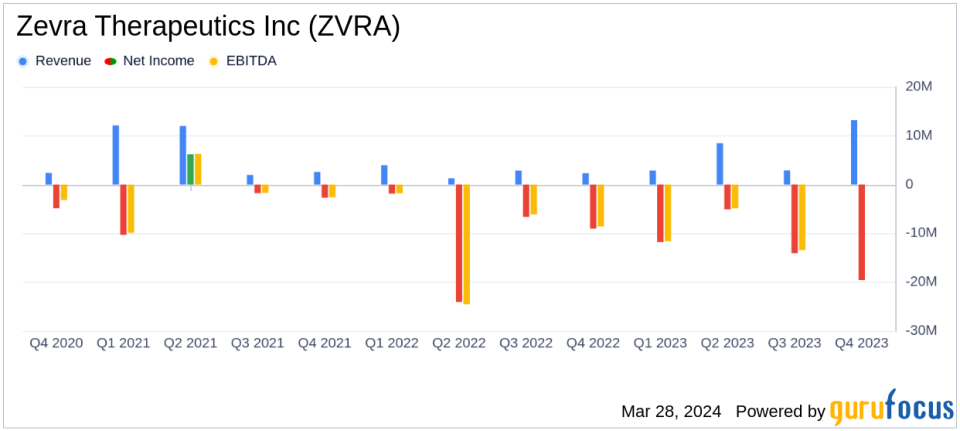

Revenue: Q4 2023 net revenue reached $13.2 million, significantly surpassing analyst estimates of $4.1006 million.

Net Loss: Q4 net loss was ($19.6) million, or ($0.51) per share, exceeding the estimated loss per share of ($0.402).

Full-Year Performance: FY 2023 net revenue totaled $27.5 million, with a net loss of ($46.0) million, or ($1.30) per share.

Operational Highlights: Positive Phase 2 study results for KP1077 and the launch of OLPRUVA for urea cycle disorders.

Financial Position: Cash and cash equivalents stood at $67.7 million by year-end, with a cash runway extending into 2026.

Zevra Therapeutics Inc (NASDAQ:ZVRA) released its 8-K filing on March 28, 2024, reporting its financial results for the fourth quarter and the full year of 2023. The company, a rare disease therapeutics firm, has shown significant revenue growth but also faces challenges, including a wider net loss and the need to restate prior financial statements.

Zevra Therapeutics Inc is dedicated to developing transformative therapies for rare diseases with limited treatment options. The company's approach combines science, data, and patient needs. Its lead products include Arimoclomol for Niemann-Pick type C (NPC) and KP1077 for idiopathic hypersomnia (IH) and narcolepsy.

The fourth quarter saw a substantial increase in revenue, mainly due to royalties from AZSTARYS, reimbursements for arimoclomol, and initial sales of OLPRUVA. However, the company's net loss for the quarter deepened to ($19.6) million, or ($0.51) per share, compared to a net loss of ($3.0) million, or ($0.09) per share in the same period last year.

For the full year, Zevra's revenue climbed to $27.5 million, a significant rise from the previous year's $10.2 million. This growth reflects the company's strategic initiatives and the successful launch of OLPRUVA. However, the annual net loss also expanded to ($46.0) million, or ($1.30) per share, influenced by increased R&D and G&A expenses associated with the company's commercial and business development activities.

Investors should note that Zevra completed the acquisition of Acer, adding OLPRUVA to its product portfolio and enhancing its pipeline with other investigational product candidates. The company also reported that it would restate its previously issued financial statements for 2022 and 2021 due to errors in accounting for certain common stock warrants as liabilities.

Despite the challenges, Zevra's financial achievements in 2023 are significant for a biotechnology company, particularly one focused on rare diseases. The substantial revenue growth and the promising clinical trial results for KP1077 underscore the company's potential in a market that highly values innovation and unmet medical needs.

Zevra's financial position remains robust, with a cash runway that is expected to extend into 2026, providing the company with a solid foundation to advance its clinical programs and prepare for product launches. This financial stability is crucial for sustaining the company's operations and continuing its mission to deliver life-changing therapeutics to people living with rare diseases.

As Zevra Therapeutics Inc (NASDAQ:ZVRA) navigates the complexities of the biotech industry, it remains a company to watch for investors interested in the rare disease sector. The company's progress and challenges reflect the dynamic nature of drug development and commercialization, with the potential for significant rewards balanced against the inherent risks of the industry.

Explore the complete 8-K earnings release (here) from Zevra Therapeutics Inc for further details.

This article first appeared on GuruFocus.